Understanding the Agency GST Report

Overview

In REST the Agency GST report shows the GST collected by the Agency on the fees charged to owners for the selected month.

The amount on the agency GST report should match the GST amount in the Management Revenue Report.

This document will cover:

- Step to Produce the Report

- Trouble Shooting - Differences in GST amounts collected

- Example of troubleshooting the difference in GST collected and estimated

Steps to Produce the Report

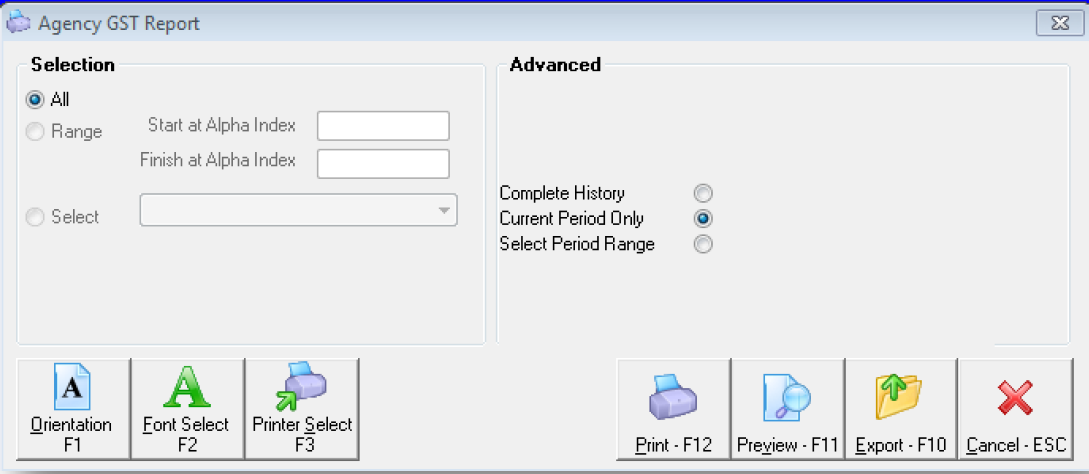

- Go to Reports > Other > Agency GST Report

- Select the criteria and click Preview-F11

- This will generate the report which gives 4 columns as follows:-

- Total fees – this reflect the total amount collect in each fee for the month

- Estimated GST – this calculated 10% of the total fee amount

- GST Collected – this shows the actual amount collected for GST for the month

- Difference – this is the difference between the estimated and actual GST collected

Trouble Shooting - Differences in GST amounts collected

Small differences between the estimated and the collected may be due to rounding as REST calculates the GST on each management fee etc. collected and this report calculates the GST on the total collected.

Larger differences may be due to some owners not being liable for GST or the GST start dates on some owners or properties may be blank. Go to Reports > Other > Owner and Property GST Dates. This will show the GST chargeable from date.

The owner balances report can be checked to see the amount of GST collected for an owner in a selected period. If the GST columns states 0.00 collected when there have been monies collected, there has been no GST charged for the period. This report can be accessed by going to Reports > Owner > Owner Balances.

We would also recommend checking all the internal owner accounts that appear on the Agency GST report. Manual journals in and out of these accounts that may not correctly reflect the GST component is a common cause for the difference. For instance, you may have journalled a refund of management fees and incorrectly not included the GST component. This may also happen for any fees charged such as letting fees that are charged by journal.

Example of troubleshooting the difference in GST collected and estimated

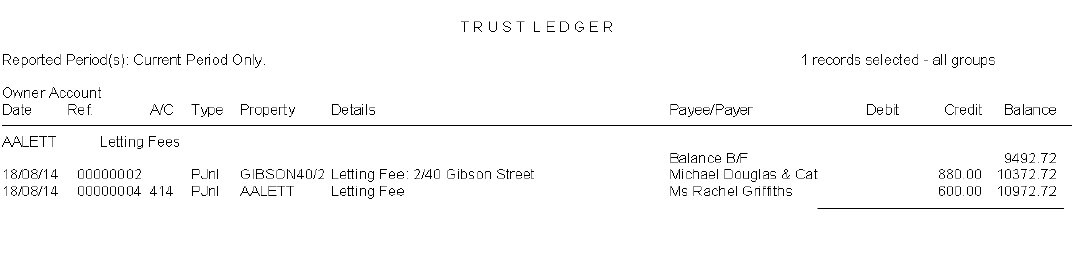

In the above Agency GST Report, there is a difference that REST has detected of 88.00. REST has calculated this by looking at the total amount of fees charge which is $980.00 and then calculating the 10% GST rate on this. REST is expecting a GST component of $98.00 but only collected $10.00 leaving a difference of $88.00.

By looking at the AALETT ledger we can see that there is an $880.00 letting fee which is likely the letting fee that is causing the issue, perhaps receipted without reflecting the GST component

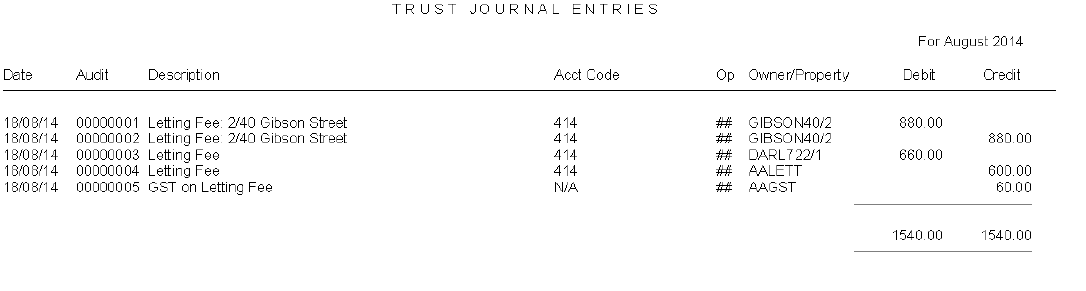

To further ascertain if this letting fee did not reflect the GST component, the journals report can be checked which will show the breakdown of GST. Go to Cashbook > Journals Report and select your criteria. In the example below you can see how this reflects on the journals report. The 660.00 letting fee clearly has GST whereas the 880.00 does not.