Residential Tenant with Exclusive Dates – Rent Increase not Entered

How do I know if my system is on inclusive or exclusive dates?

Bring up a tenant card Files>tenant insert alpha index of the tenant >rental tab

- Inclusive dates: “Paid to Last Month” will appear underneath “Period”.

- Exclusive dates: “Paid from” will appear underneath “Period”.

Problem

Rent increase was not entered for tenant

- System is set to use exclusive dates

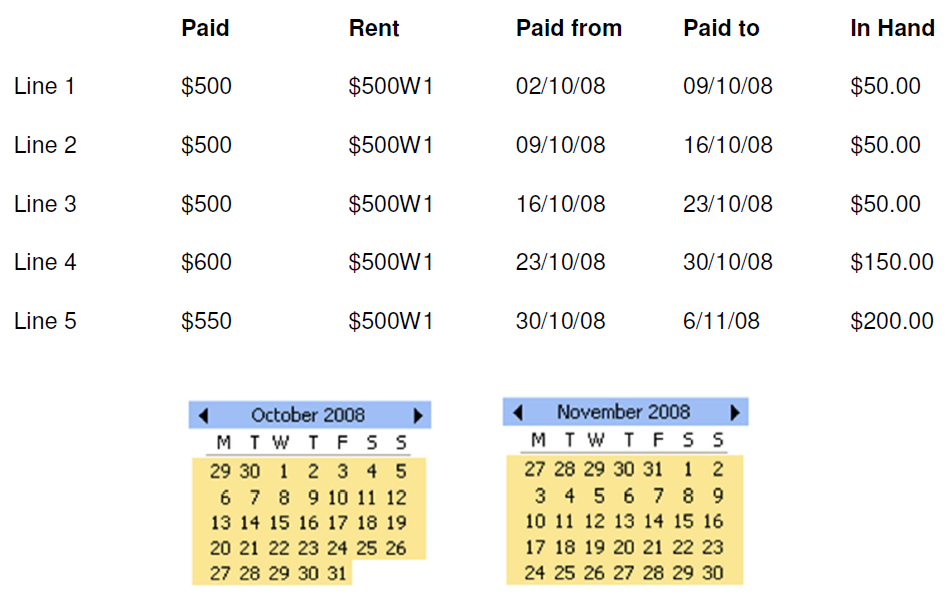

Example 1:

A property is rented at $500pw and the rent increase was to be entered into the system to take effect on the 9th of October 2008 to fall in line with the anniversary date (paid to date) but was never entered. The tenant is now paid to the 6th of November 2008. The new rent is $550 per week.

- From Line 2 should have been at the new rate $550 per week. If increase had been entered into REST, the client paid $500 and had $50 in hand = $550

- Paid to dates would remain and credit reduced to zero.

- Line 3 - Tenant paid $500 which is not a full week therefore paid to date will remain at 16/10/08 and $500 will go to credit/in hand.

- Line 4 - Tenant has paid $600 ($600 + $500 = $1100) equivalent to two weeks rent therefore their paid to date will be from 16/10/08 -30/10/08 with no credit/in hand.

- Line 5 - Tenant has paid one week at the correct rate therefore this will pay them from 30/10/08 – 06/11/08 with no credit/in hand.

- The tenant’s paid to date should remain the same and the credit should be zero not $200 which will need to be adjusted in REST.

- Bring up the tenant card and click on the rental tab. Change the amount from 500 to 550. If we needed to change the paid to date this could be done in the paid to date field.

How to alter a tenant credit

There are three important fields to take note of when altering credit under the rental tab of a tenant card and

they are:

- Rent Received

- Credit this month

- Credit last month

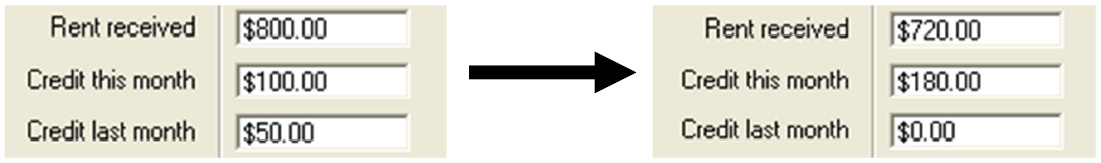

Credit last month can be altered or deleted as required. Any change to Credit this month field will affect the rent received field. The credit this month and the rent received fields must always equal the funds received for the current accounting period.

Examples

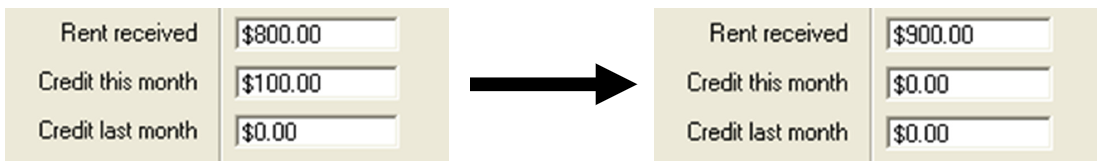

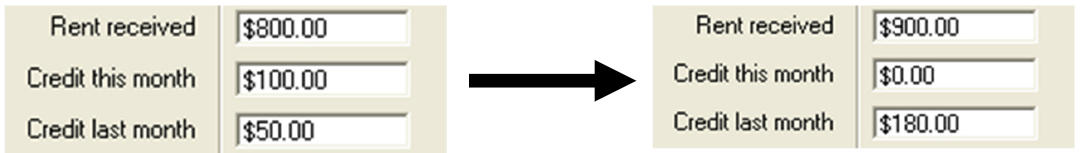

$800 in rent received and $100 in credit this month and you want to clear credit this month so the tenant shows no credit.

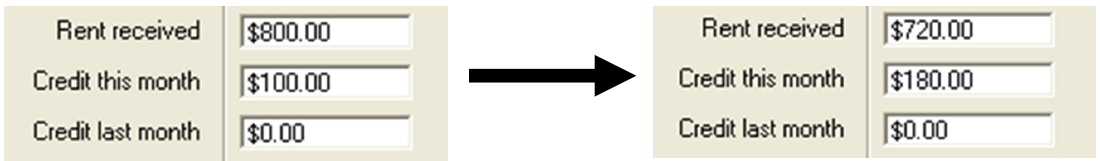

You would like to credit the tenant $180 and they had $800 in rent received, $100 in credit this month, zero in credit last month.

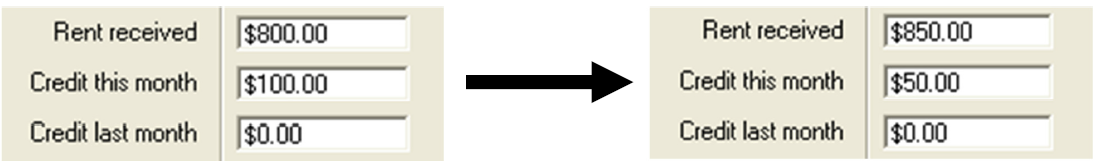

You would like to credit the tenant $50 and they had $800 in rent received, $100 in credit this month, zero in credit last month.

You would like to credit the tenant $180 and there is $800 in rent received, $100 in credit this month and $50 in credit last month.

- Option A

- Option B

![]() Remember to check your “Periods paid” field and ensure it corresponds with the changes made

Remember to check your “Periods paid” field and ensure it corresponds with the changes made