Water Usage Calculations in Rest Professional

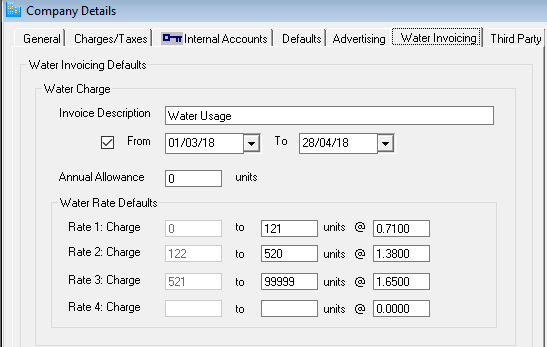

Important Note: All charges in REST are based on annual charges. As a result you must enter the rates into REST as annually. If you have the quarterly rates, you need to enter into REST as the quarterly rates x 4.

1st Charge units ÷ 365 x number of days in invoice = units chargeable at first rate

(2nd Charge units – 1st charge units) ÷ 365 x no. of days in invoice = units chargeable at second rate

(3rd Charge units – 2nd charge units) ÷ 365 x no. of days in invoice = units chargeable at third rate

Anything over 3rd charge units at charge rate above

An annual allowance is applicable in some states, usually 136kL per year. The allowance is the amount of units per year the tenant doesn’t have to pay water usage on. Eg if tenant has used total of 360kL in a year they will only pay for 224kL. Because the allowance is annual the below calculations is used to get an allowance amount for the invoice period. - Annual Allowance ÷ 365 x number of days in invoice period = allowance for this invoice.

EXAMPLE 1 – NO ALLOWANCE

Last reading 1256kL on 23/11/07 Invoice period = 92 days

Current reading 1398kL on 23/02/08 Units used = 142kL

First Tier 121 ÷ 365 x 92 = 30.4986,

Second Tier 398 ÷ 365 x 92 = 100.3178,

Third Tier anything over 520,

First tier 30.4986 x 0.71 = 21.65440

Second tier 100.3178 x 1.38 = 138.4386

Third Tier 11.18356 x 1.65 = 18.4529 Total bill $178.55

EXAMPLE 2 - WITH ALLOWANCE (a)

Last reading 1256kL on 23/11/07 Invoice period = 92 days

Current reading 1398kL on 23/02/08 Units used = 142

Allowance for invoice 34.2795 = 136÷365 x 92

First Tier 121 ÷ 365 x 92 = 30.4986, 0 due to allowance (Allow. Bal 3.7809)

Second Tier 398 ÷ 365 x 92 = 100.3178, 100.3178 – 3.7809 = 96.5369

Third Tier anything over 520, 142 - (30.4986+100.3178) = 11.18356

First tier 0 x 0.71 = $0

Second tier 96.5369 x 1.38 = 133.2209

Third Tier 11.18356 x 1.65 = 18.4529 Total bill $151.67

EXAMPLE 3 - WITH ALLOWANCE (b)

Last reading 1398kL on 23/02/08 Invoice period = 103 days

Current reading 1649kL on 05/06/08 Units used = 251kL

Allowance for invoice 38.3781 = 136÷365 x 103

First Tier 121 ÷ 365 x 103 = 34.1452, 0 due to allowance (Allow. Bal 4.2329)

Second Tier 398 ÷ 365 x 103 = 112.3123, 112.3123 – 4.2329 = 108.0794

Third Tier anything over 520, 251 - (34.1452+112.3123) = 104.5425

First tier 0 x 0.71 = 0

Second tier 108.0794 x 1.38 = 149.1496

Third Tier 104.5425 x 1.65 = 172.4951 Total bill $321.64

![]() These examples are purely given as a guide

These examples are purely given as a guide