Pay Income Tax in Strata Master

If a Strata Plan is registered to pay income Tax, you will have a Tax File Number entered on the Corp screen in the Financial Tab. You will then be required to pay income tax once the Tax Assessment has been completed and lodged, and you receive a Notice from the Australian Taxation Office (ATO).

Note that Income Tax is different to paying GST.

If only Admin or only Capital Works has funds to pay, you can process through Creditor Invoice screen as usual. Otherwise you would need to use a Dissection Screen.

As always, please read through the instruction in full before actioning any part, to ensure you have selected the correct instruction for your purposes.

What is A Dissection

A dissection is when an invoice is being paid but portions of the amount to be paid are to be paid from different accounts or different Funds.

Check the Creditor Card

Income Tax is a Creditor Disbursement selecting the ATO creditor card for that purpose. Navigate to Manage > Creditors and select your existing ATO creditor card. Ensure that the payment method matches the notice you have received.

To Process the Payment Through Dissection

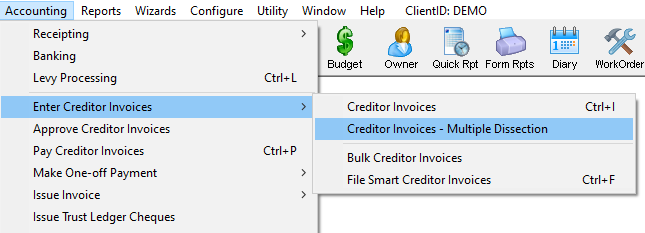

1. Navigate to Accounting > Enter Creditor Invoices > Creditor Invoices - Multiple Dissection

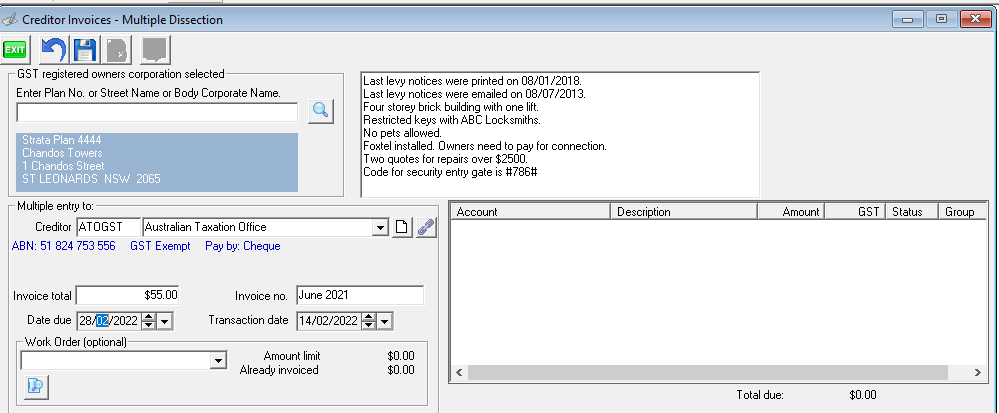

2. The Multiple Dissection Screen opens and you enter the information as on the screenshot below -

- Plan

- Creditor

- Nett amount of the Invoice / date of the assessment if no invoice number is provided

- Date Due / Transaction Date

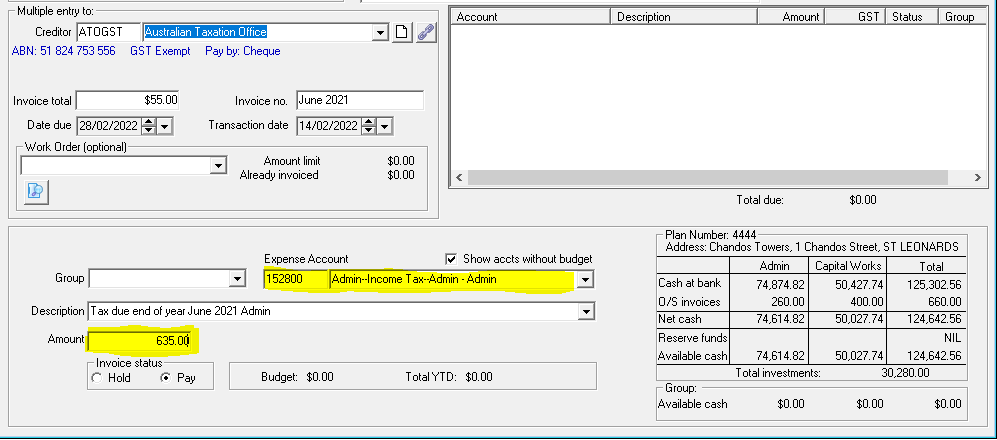

3. Then enter the first dissection being the Fund with the due amount, if one has a due amount and one a refund amount -

- select the expense account for INCOME tax for that fund, in this example Admin

- Enter the amount that this fund is to pay

4. Click the 'save' button.

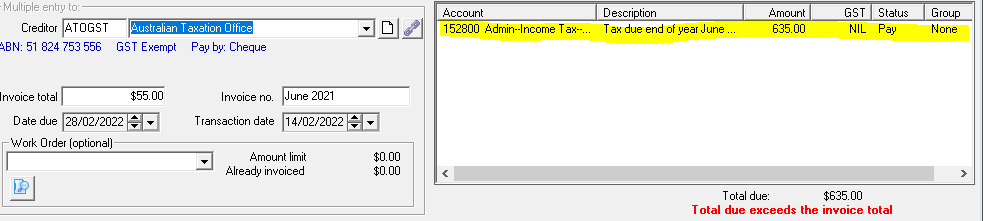

5. You will notice your entry showing in the top right hand corner, with a note in red that the amount you have entered does not yet equal the Invoice total.

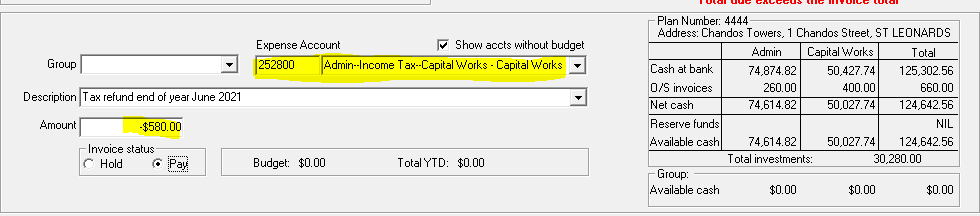

6. Then enter the second dissection for the other Fund. If a refund, enter a negative amount as below.

7. Click Save again, to save that dissection.

8. You will notice both dissections listed in the top right hand corner, and the red warning has disappeared as, in this example, $635 less $580 = $55.00 to be paid.

9. Click the Process button, to finalise the entry.

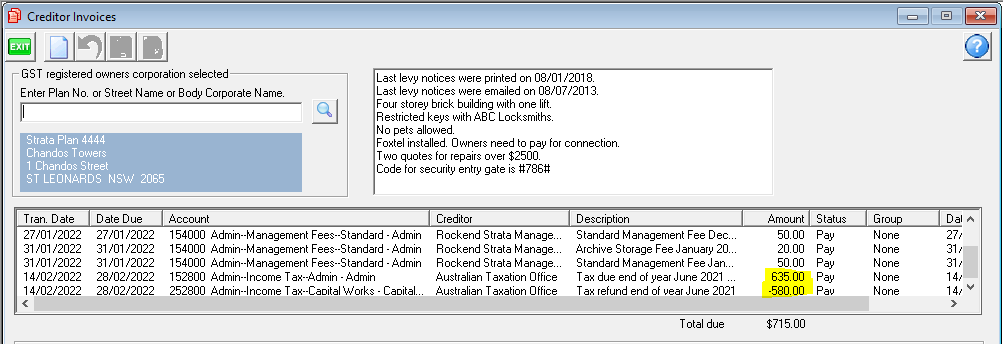

10. Click on the Cr Invoices icon in the toolbar, to check the creditor Invoices screen to ensure the 2 dissections show. When you process this payment it will net the result off and send the balance, being $55 in this case.

11. Click on the Pay icon on the toolbar and enter the ATO card (note the screenshot below is ATOGST just for illustration purposes, you will select whichever ATO card you selected to process the dissections)

12. You can tick the advanced box and a list of Plans with payments to that creditor shows. Select the Plan you wish to send payment for. You can select all if you wish to send them all.

12. Click Process

13. You can then create a file to upload to the bank if you are ready. Select Accounting > Process Bulk Bpay Payments or Process Direct Entry Payments as applicable.

Useful Links

https://kb.rockend.com/help/setup-a-gst-creditor-and-paying-gst