Understanding Calculations of the Mandatory Audit Report in Strata Master

Summary

Learn about the Mandatory Audit Report is included in presentation of Annual General Meeting Reports for NSW and ACT.

Covered in this article:

- Overview

- Breakdown of the figures

Overview

An understanding of the Mandatory Audit Report will benefit in answering queries in meetings.

The report can be generated through:

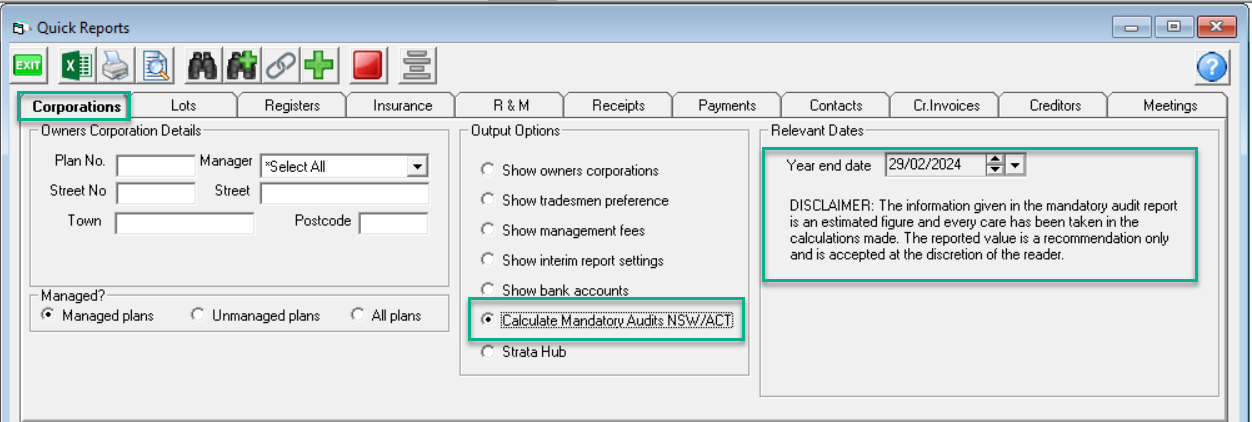

- Quick Reports > Corporations tab > Output Options > Calculate Mandatory Audits NSW/ACT

The system calculation adds the below figures for calculating the yearly budget amount.

- Levies due for the financial year - Total $ figure of levies RAISED

- Any income RECEIVED during the financial year - Any Revenue code other than levies/special levies. Only counted if revenue received (receipted)

- Opening Balance of Cash at Bank including investments

Breakdown of the Figures

Levies due for the financial year

This is calculated as any revenue that hits Account Code:

- 143000 - (Levies Due - Admin)

- 143100 - (Levies due special admin)

- 243000 - (Levies Due - Capital Works)

- 243100 - (Levies due special capital works).

Income received during the financial year

This can be calculated as all revenue received from every revenue account code Minus the 4 account codes mentioned above.

This is on the cash basis, so this is amounts 'receipted' from these account codes, rather than 'due' as in point 1. Review the Chart of Accounts, for every account code with the ‘Type’ as Revenue.

Opening balance of cash including investments.

This is the balance as at the start of the financial year for the following accounts:

- 121000 - Cash at Bank Admin

- 121500 - Cash on hand

- 123000 - Investments -Admin

- 221100 - Cash at Bank Capital Works

- 223000 - Investments - Capital Works

- 321000 - Cash at Bank - Unallocated