Making a Plan GST Registered in Strata Master

This instruction assumes that the Plan is currently not registered for GST and that the Owners Corporation has requested registration effective from a set date. At the bottom of this article is a note regarding the change from GST Registered to Unregistered.

The adjustment will often require transactions to be reversed with the Plan set as Unregistered, then the change in status is made, followed by re-entry of the reversed transactions once the Plan is set to GST registered.

Do not change the status of the Plan to GST registered prior to the reversals.

Important Notes

- Note that the more notice you have of a change date for gst, the better, as less transactions will need to be reversed. If you can anticipate the change and be prepared for it, you are then able to plan the change eg instead of posting 4 quarters of levies, you may only post 2 levy quarters expected to be prior to the change date.

- Note the steps below are a guide, and it is recommended that an experienced Trust Accountant manage the change, therefore exact steps are not provided. MRI has accredited Consultants who can manage the process if you prefer. For their contact details please log a case with Strata Master Support.

- Depending on the length of the period requiring adjustment, this can be a lengthy project.

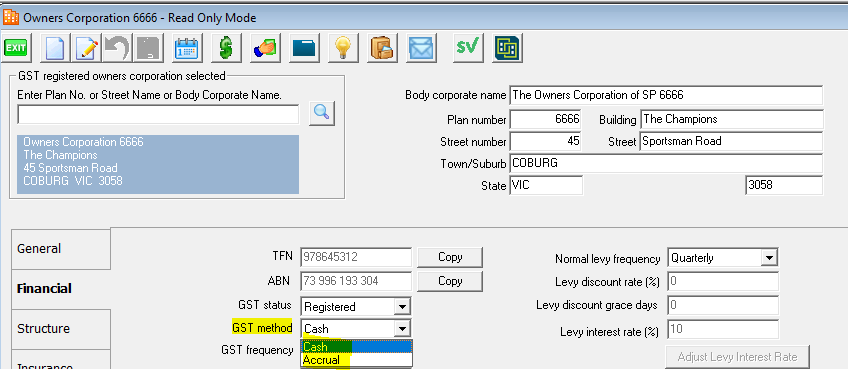

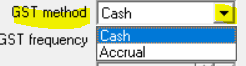

- Once the Plan is GST registered, the GST will be accounted for on a cash basis as the default in Strata Master, unless your Strata Plan has a turnover exceeding $1 million, when the Australian Taxation office will request that your GST be accounted for as accrual GST. In this case, you will select GST method as accrual on the Corp > Financial tab.

- Your advices as to which transactions should be subject to gst and which ones not, should come from your Taxation Office or a BAS Registered Accountant. Strata Master Support cannot provide such advice, however can assist you with Software processes to comply with the requirements.

Summary of the Process

1. Reverse transactions processed as unregistered, that should be registered.

2. Change the gst status of the Plan from Unregistered to Registered for GST.

3. Re--enter the transactions reversed in step 1.

Steps to Reverse Relevant Transactions

| Note - if you have planned ahead, it could be that you have no transactions to reverse. Items to be reversed are items that are dated after the date of registration but entered without a gst component. |

1. Familiarise yourself with the date of change required by the Australian Taxation Office. Your Accountant may have this information. Record the date range that requires adjustment eg from date of registration xx/xx/20xx to today xx/xx/20xx.

2. Make sure the Plans Bank Reconciliation is in balance before proceeding.

3. Create a backup in Strata Master in Files > Backup. Link to instructions here - https://kb.rockend.com/help/creating-a-backup-in-strata-master

4. Print an Outstanding Creditors Report for the plan and cancel any unpaid invoices. Highlight them because you will need to re-enter them later, after you change the Plan status to GST registered.

5. Print a Levy Postings report to see which levies have been raised without gst. Cancel the levies with a due date between the dates in step 1 above as they will need to be reinput later after you change the Plan status to GST registered. Go to Accounting > Adjustments > Search/cancel Levy Postings. If you have no levies posted after the date of registration then this step is not required.

6. Check that the Plans Bank Reconciliation is still in balance before proceeding with the below reversals

7. Print the Journals reports for the period recorded in step 1 above and ensure there are no journals previously entered that require reversal if affected by the change in GST status of the Plan. This would only affect accounts that accrue GST liability or refund eg expense accounts.

8. Using the Cash payments report or a list of payments made from Quick Reports, reverse each Creditor payment by journal. once again, these will need to be re-entered after you change the Plan status to GST registered. -

- Date as original date of the transactions

- Debit -- Cash at Bank Admin or Sinking (as relevant) and Credit -- Expense account to which the payment was allocated

- Amount as original transaction with NO GST

- Description similar to "Correction of payment by Direct Entry*/BPay*/Cheque* No xxxxx made excl GST

9. Lot owners receipts will become unallocated funds when the levies are cancelled. They will then re-allocate with GST when the new levy is posted. Note that having some funds re-directed to gst may affect your budget as there will be a shortfall in funds available for expenses.

10. Non-levy income should be cancelled and re-entered later, after you change the Plan status to GST registered.

11. Any Miscellaneous Owner Invoices should be cancelled, via Accounting > Adjustments > Levy Journal and re-entered later, after you change the Plan status to GST registered.

Change the GST Status of the Plan

Once all the necessary reversals have been completed, you can change the GST status of the Plan from Unregistered to Registered. Refer the screenshot at the top of the article.

Final Steps

The final steps are to re-enter all the cancelled/reversed transactions through steps 4 to 11 above.

Then inform your BAS agent if there are any transactions that would have been in a previous BAS period.

Additional Information About GST Reporting

Strata Support are able to assist with queries regarding the software, in processing of gst. Which transactions you reverse are ultimately your decision.

Strata Support cannot provide information on what has a gst liability and what doesn't, as this information can change. Support are also not qualified/certificated to provide such advices. Please refer queries such as these to the Tax Office or your BAS Agent.

To Change a Plan from GST Registered to Unregistered

The process is the same as the above however the reversals are of transactions that are GST Registers, then make the status change for the Plan to Unregistered, then re-enter the transactions.

Ensure you inform your BAS agent if there are any transactions that would have been in a previous BAS period and already lodged to the Tax Office.