How to Reverse Invoice Receipts from a Previous Period

Overview

Reversing invoice receipts from a Previous Period must be done manually in Rest Professional. NOTE: When reversing invoices from a Previous Period, the reversal will not display on the tenant ledger, unless a manual receipt comment is added at the time of the next receipt.

To reverse a Rent Receipt from a Previous Period that includes invoices, please visit: How to Reverse Rent and Invoice Receipts from a Previous Period

How to Reverse an Invoice Receipt from a Previous Period

Your owner must have funds available in order to reverse the receipt in Rest. You must also locate the receipt number first for the receipt you wish to reverse. The receipt must be reversed manually by doing a disbursement and refunding fees as necessary.

1. To reverse the Invoice:

- Go to Transactions > Quick Disbursement

- Property – Enter the property the funds are to be reversed from and press Enter

- NOTE: You must check if the invoice was paid to the actual owner or the agent, if the invoice was paid to the agent, you must enter the property as AATENINV)

- Amount – Enter the invoice portion of the receipt

- Cheque Number – Cheque Number 999999 (Self-presenting cheque number)

- Payee – Enter the tenant’s name

- Description – Enter a description, i.e. Reverse Water Usage Receipt ######

- Account Code – You must use the same account code it was receipted against initially

2. Click OK-F12

NOTE: You will need to repeat the process for each tenant invoice component on the receipt if more than one

3. If you charge management fees on invoices, you must manually reverse the fee. To reverse the management fees on the receipt you must first find the exact amount of management fees amount that was charged on the receipt.

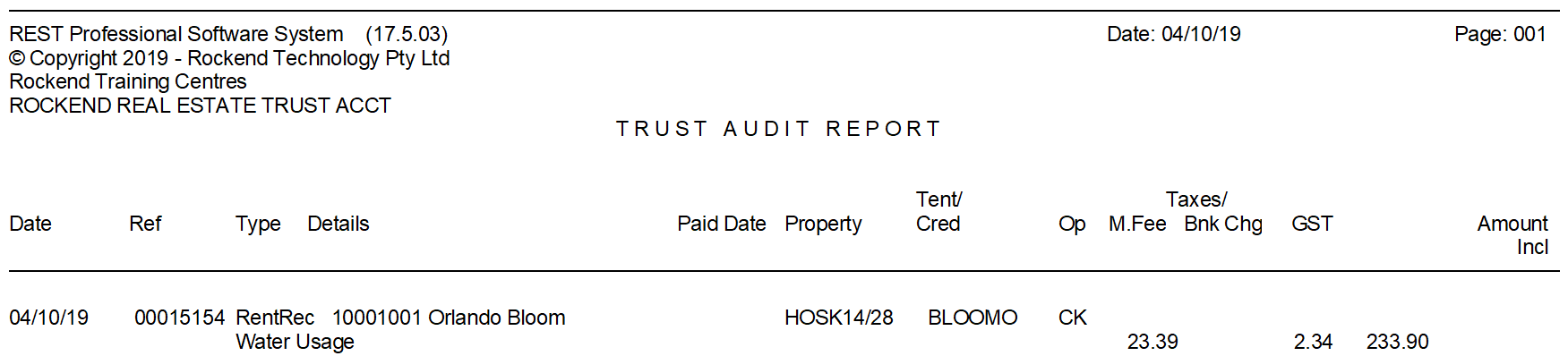

- Go to Cashbook > Audit Report select the month to print to be the accounting month in which the receipt was processed, enter a date range for the receipt, tick the box to Include Fees and click on Preview-F12

- Locate the receipt number you require and the management fee total, in this example Total $25.73

4. To refund the fees go to Transactions > Journals

Debit

- Property – Enter in AAMANAG and press Enter (Management Fees Internal Account)

- Description – Reverse Management Fees on Receipt ######

- Account code – Enter account code 481 (Management Fees)

Credit

- Property – Enter the property you are refunding the management fees to

- Description and Account Code – This will auto-fill with the above description and account code.

- Amount – Enter the amount of management fees you require refunding Incl GST (In this example above $25.73) Rest will automatically calculate the GST

5. Click OK-F12

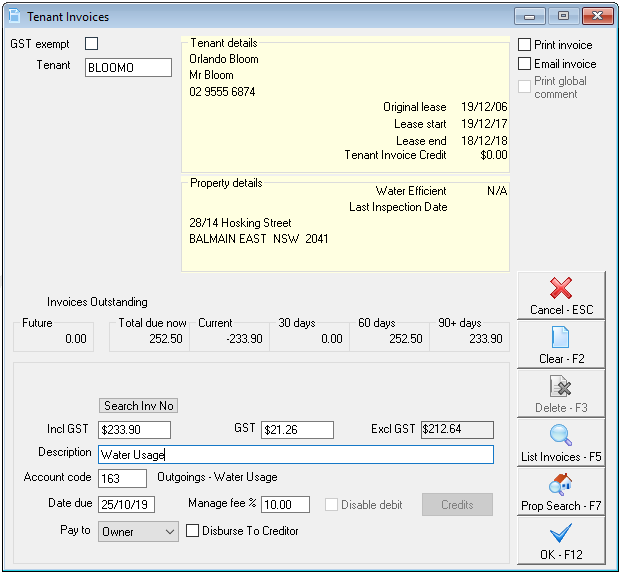

6. For any tenant invoices reversed that are still required to be paid, re-enter the invoice in Files > Tenant > Invoices Tab, click on Add new invoice, fill in the required information and click OK-F12