South Australia Water Usage Metering

Overview

- The water authority in South Australia is SA Water.

- They are the only water authority for the state.

- SA Water increases their rates every financial year.

- In general you would not change the charges in REST until about September as that is when they would receive bills for water usage for the first quarter of the financial year.

- Only some tenants get an allowance for water usage. The average allowance is either 125kL per year or 136kL per year. A situation where a tenant may be given an allowance is if they are responsible for garden maintenance at the rented premises.

- If all tenants don’t get an allowance, then the allowance should be set on the individual property and tenant card NOT in company details.

- Some tenants also have to pay a quarterly Water Supply charge which is separate to water usage (so they can set up a separate tenant invoice for that).

Important Note: The SA water website will generally display the water rate charges as quarterly whereas the charges in REST are based on annual charges. As a result you must enter the rates into REST as annually (the quarterly rates x 4).

How REST charges

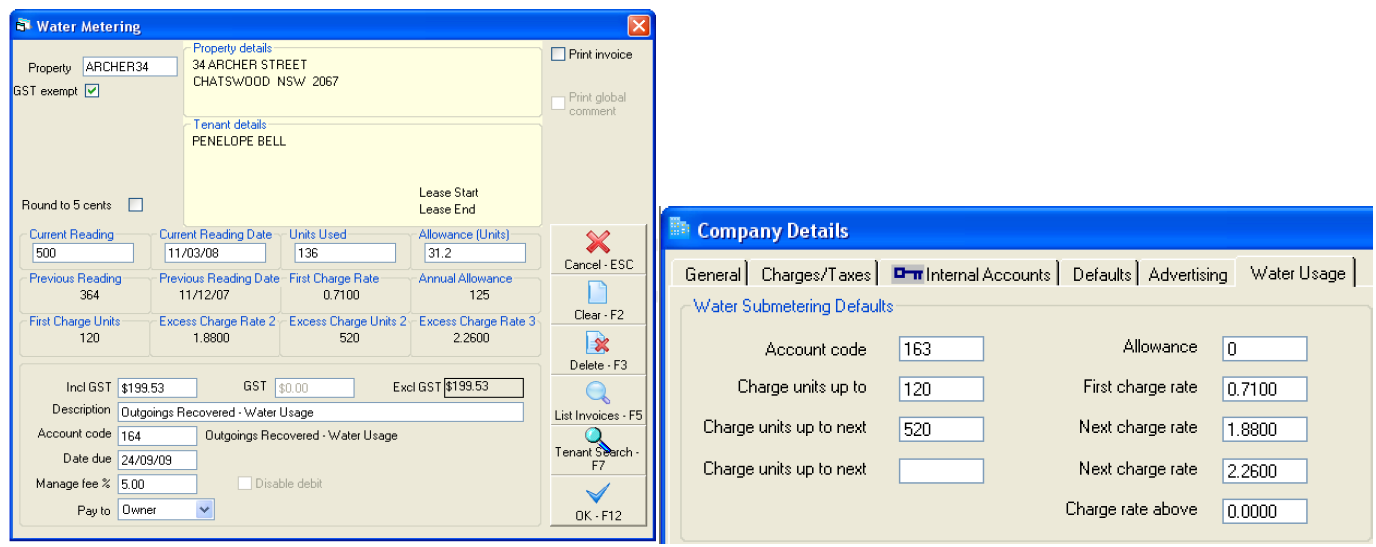

Example where the tenant gets an allowance

Penelope has an annual allowance of 125kL. The allowance breaks down based on the number of days in the billing period.

So, 125kL / 365 days in a year x 91 days (in this billing period)= 31.2kL

If the total annual allowance (so in this case 125kL) is more than the allowed kL for the first charge rate, then that charge rate is skipped and any water use over the allowance for the billing period is charged at the 2nd rate.

If Penelope has used 136 units this quarter and her allowance for the quarter is 31.2 units, that leaves 104.8 units that are chargeable (136 – 31.2 = 104.8).

Her chargeable units will begin at the 2nd charge rate because her allowance is 125kL per annum which goes over the end of the limit of units charged at the 1st rate (1st rate ends at 120kL).

In the 2nd charge rate bracket, there is a 400 unit span (from 120 – 520kL) so an additional 400kL per year (100kL per quarter) can be used safely before being charged at the 3rd charge rate.

Because Penelope’s allowance goes 5kL over the first tier, we subtract those 5kL from the 2nd charge rate which means she can use and additional 395kL per year (98.75kL per quarter) before being charged at the 3rd charge rate. However, as mentioned previously, she has 104.8 units that need to be charged, BUT she is only entitled to 98.75 units for the quarter at the 2nd rate, which means anything left over (6.05 units) will then be charged at the 3rd rate.

So:

31.2 (free units for the quarter) x $0 = $0

98.75 (units allowed for quarter based on 2nd rate) x $1.88 (2nd charge rate) = $185.65

6.05 (left over units going beyond entitlement for 2nd rate) x $2.26 (3rd charge rate) = $13.67

Total = $199.32 (rounding)

Example Where tenant pays for all water used – no allowance

If Ryan has used 96 units in a 6 month period and he doesn’t get an allowance, then he is charged for all 96 units used.

His chargeable units will begin at the 1st charge rate because he gets no allowance.

So:

120kL (annual limit for 1st charge rate) / 365 (number of days in a year) = 0.3287kL per day allowed to ensure tenant stays within 1st charge rate).

Number of days in period 25/12/08 – 24/06/09 = 182 days

182 days x 0.3287kL = 59.82kL (amount allowed for 182 days to stay within 1st charge rate)

So, 59.82kL x $0.71 (1st charge rate) = $42.47

Because Ryan has used 96kL in 182 days, the left over kL will then be charged at the 2nd rate.

So, 96kL – 59.82kL = 36.18kL

36.18kL x $1.38 (2nd charge rate) = $49.93

Total bill should be $42.47 (amount charged at 1st rate) + $49.93 (amount charged at 2nd rate) = $92.40

(rounding).

Problems that you may come across

- There have been situations where a tenant has not used all of their entitled units in a period and so those units carry over to the next billing period. This will not work in REST as REST does not carry over unused units. Ie/ Tenant is entitled to 30kL in first quarter but they only used 20kL in that quarter. The unused 10kL then gets carried forward to the next quarter so they get an entitlement of 40kL for the next quarter. SA Water does not charge this way so this may be something the clients do as an individual thing.

- Some tenants have to pay a quarterly supply charge, which is different to water usage, this should be set up just as a standard tenant invoice.

- When the water usage invoice in REST doesn’t match the bill received if the tenant pays the entire bill. This is because SA Water charges the landlord the first 120kL at the beginning of each year at a lower rate but REST charges the tenant on a pro rata annual basis.

![]() These examples are purely given as a guide

These examples are purely given as a guide