Rent Increase Not Entered - Tenant with Inclusive Dates

How do I know if my system is on inclusive or exclusive dates?

Bring up a tenant card Files>tenant insert alpha index of the tenant >rental tab

- Inclusive dates: “Paid to Last Month” will appear underneath “Period”.

- Exclusive dates: “Paid from” will appear underneath “Period”.

Problem

Rent increase not entered in system

NOTE: This information gives examples for situations only when the client is on Inclusive paid to dates.

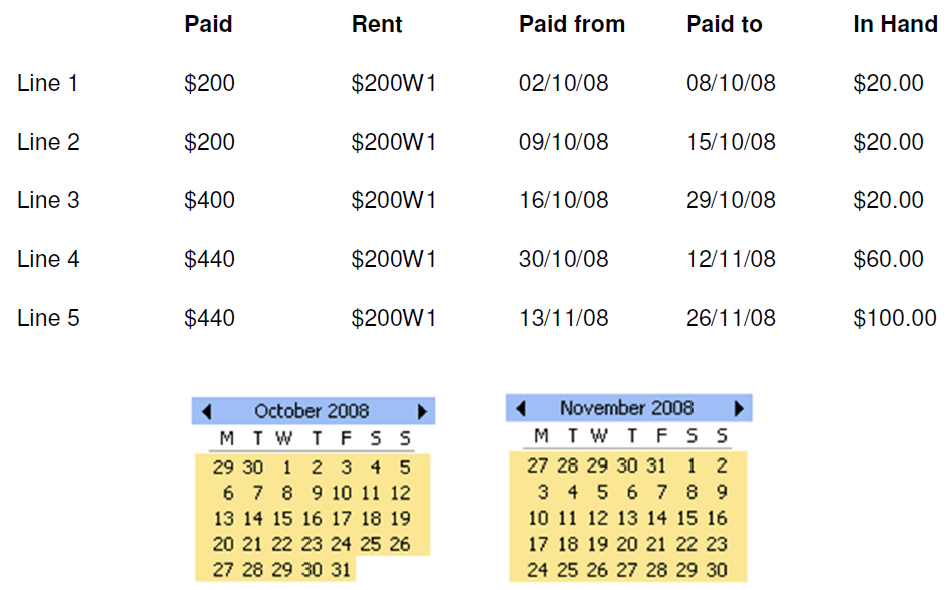

Example

A property is rented at $200pw and the rent increase was to be entered into the system to take effect on the 9th of October 2008 to fall in line with the anniversary date (paid to date) but was never entered. The tenant is now paid to the 26th of November. The new rent is $220 per week.

- From line 2 should be at the new rate $220 per week. If increase had been entered into REST, the client paid $200 and had $20 in hand = $220

- Paid to dates would remain and credit reduced to zero.

- Line 3 - Tenant paid $400 therefore this will move their paid to date forward one week and pay them to 22/10/08 and the balance ($180) will go to credit/in hand as it is not a full weeks rent.

- Line 4 - Tenant has paid two weeks rent at the correct rate therefore their paid to date will be from 23/10/08 -05/11/08 with $180 credit/in hand.

- Line 5 - Tenant has paid two weeks at the correct rate therefore this will pay them from 06/11/08 – 19/11/08 with $180 credit/in hand.

- The tenant’s actual paid to date should be 19/11/08 not 26/11/08 and the credit should be $180 not $100 which will need to be adjusted in REST.

- Bring up the tenant card and click on the rental tab. Change the amount from 200 to 220. Change the paid to date from 26/11/08 to 19/11/08.

How to alter credit

There are three important fields to take note of when altering credit under the rental tab of a tenant card and they are:

- Rent Received

- Credit this month

- Credit last month

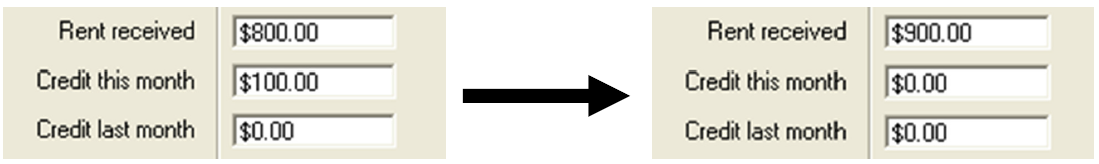

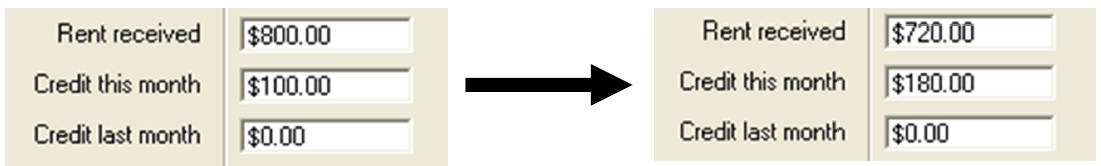

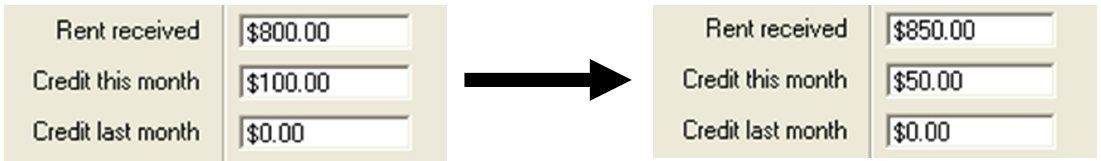

Credit last month can be altered or deleted as required. Any change to Credit this month field will affect the rent received field. The credit this month and the rent received fields must always equal the funds received for the current accounting period.

$800 in rent received and $100 in credit this month and you want to clear credit this month so the tenant shows no credit.

You would like to credit the tenant $180 and they had $800 in rent received, $100 in credit this month, zero in credit last month.

You would like to credit the tenant $50 and they had $800 in rent received, $100 in credit this month, zero in credit last month.

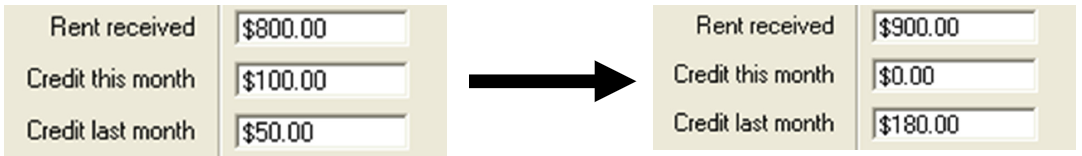

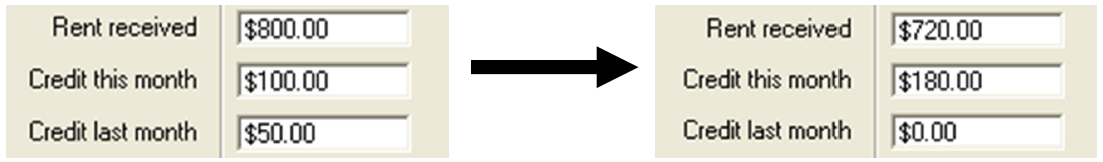

You would like to credit the tenant $180 and there is $800 in rent received, $100 in credit this month and $50 in credit last month.

- Option A

- Option B

Finally, remember to check your “Periods paid” field and ensure it corresponds with the changes made.