Recording Insurance Premiums in Strata Master

The article will provide answers to the most common questions in regard to Insurance Premium payments.

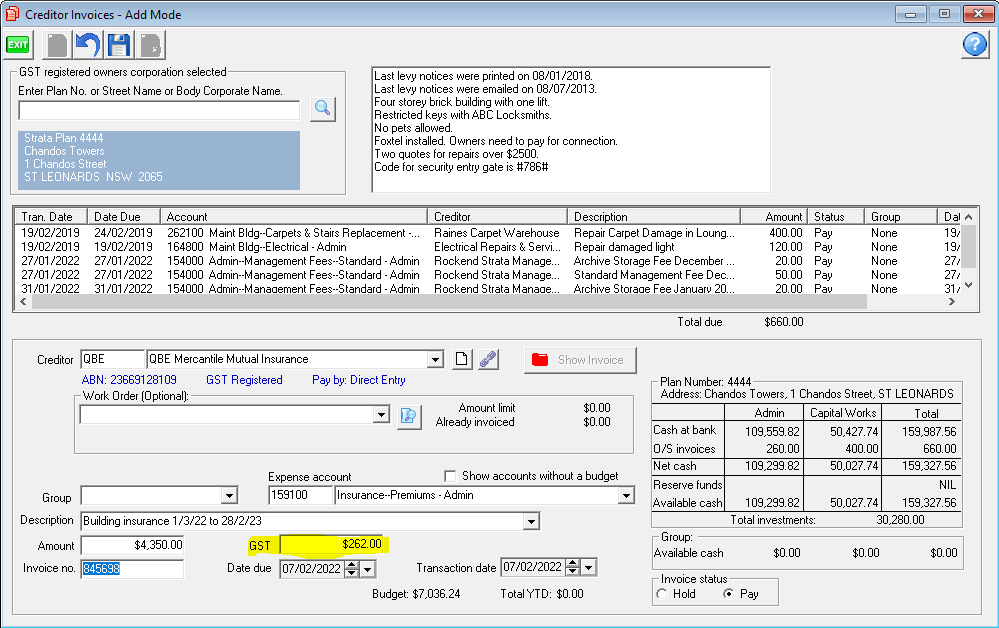

Is GST payable on Insurance Premiums

Generally, there is a gst component on insurance premiums, however it is unlikely to be 1/11th of the premium. That is because some components of the premium are gst free. It is important to check your invoice from the Insurance Company for the gst amount. You can change the gst amount when processing the invoice.

Prior to payment of the invoice, you can open this screen and edit the gst if necessary.

If the Plan is not registered for gst, there will not be a field for gst. In this case the gst is not recorded.

To Know Which Account To Select?

Insurance premiums are an Expense to the Plan, so you select your Insurance Premium Admin or Capital Works account. Ultimately, selection of an account is your decision.

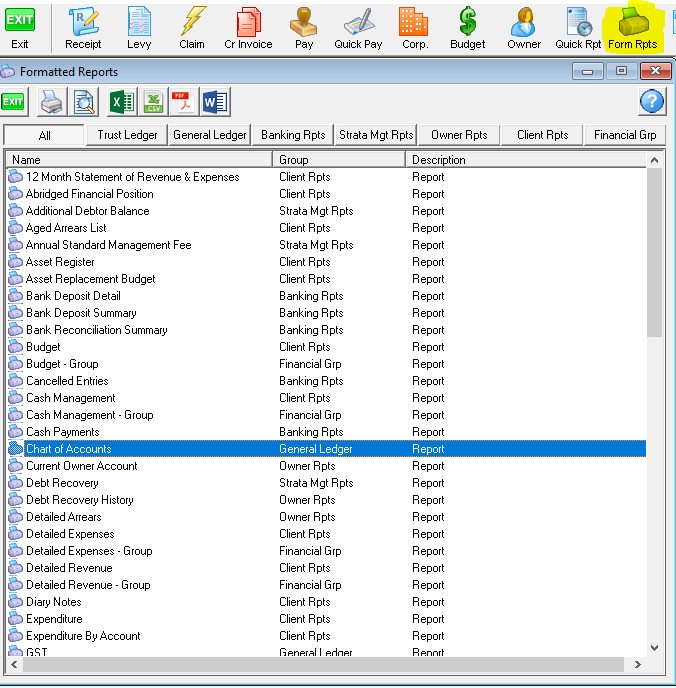

You will find a list in Formatted Reports > Chart of Accounts.

In a Hurry and Needing to Send the Premium now?

You can click on the 'Quick Pay' icon and enter relevant details. You still select the Insurance Premium expense account.

This article link will assist you - https://kb.rockend.com/help/payments-by-quick-pay-strata-master

You Want to Pay in Monthly instalments

This article will assist you to enter a number of instalment invoices for different due dates -

https://kb.rockend.com/help/how-to-part-pay-an-invoice

The Invoice has been Paid, But the GST Amount was Incorrect

You will need to process a journal to reverse the invoice (not the payment) and the process another journal to enter the correct figure.

Strata support Team have an instruction sheet, to correct the gst with the 2 journals, that cannot be linked here. Please log a case, and the Support Team can send you an instruction.

Useful Links

https://kb.rockend.com/help/how-to-part-pay-an-invoice

https://kb.rockend.com/help/payments-by-quick-pay-strata-master