Recording Loan Repayments in Strata Master

A Strata Plan or other type of Strata Corporation may take out a loan from a financial institution and need to make repayments. If you have a loan and need to process a repayment deducted from your trust account, this article may assist you to determine how the loan has been set up in your data.

This article will show you how to reduce the loan amount with instalment records, and also record the interest portion of loan repayments. Note that only the interest paid is an expense.

For issues where you have a Balance on the Balance Sheet once the loan has been fully paid, please see below "Balances on Balance Sheet"

Important Notes - Must ReadNote that Strata Master Support is supporting and assisting with the software. We do not provide Accounting advice, so the suggestions here are simply a guide as to how you can record loan repayments in Strata Master.

|

Components Comprising the 3 Steps to Record a Loan

- The initial loan funds deposited to the trust account. This requires a loan liability account in Chart of Accounts.

- The deduction of an instalment from the trust account. This requires a loan liability account in Chart of Accounts.

- The application of interest accrued to the loan. This requires an interest expense account in Chart of Accounts.

The Chart of Accounts

Go to Formatted Reports > Chart of Accounts. Check to see whether there are existing loan liability and loan interest expense accounts that can be used.

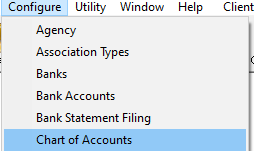

If not, go to Configure > Chart of Accounts and add suitable accounts.  Keep the Naming convention as generic as possible to allow it to be useable for other Plans. For example, Loan - Roof New/Repair - Capital Works is more useful than Loan PX6047893896 - Capital Works, as the Latter cannot be used by any other Plan.

Keep the Naming convention as generic as possible to allow it to be useable for other Plans. For example, Loan - Roof New/Repair - Capital Works is more useful than Loan PX6047893896 - Capital Works, as the Latter cannot be used by any other Plan.

You need to check your Chart of Accounts in Formatted Reports to find a suitable account number that is free/not in use.

Here is an example of an account being created -

The Initial Funds - Step 1

Receipted to the Liability Loan Account for the purpose. The funds are technically not Revenue or Income and if applied as such, will inflate the income figure and affect taxation if the Plan pays income tax. You receipt as revenue if you wish, however the steps in this article would not apply.

As mentioned above, seek a recommendation from your Accountant to suit your circumstances.

The Repayment Deduction from the Trust Account - Step 2

Most Banks will deduct one instalment each month, which includes both capital funds and interest. Unless you know the interest amount included, apply one journal to reduce the loan total. Journal > debit to the liability account (to reduce the loan liability as a premium has been made) and credit cash at bank (to reduce cash at the bank).

A variation is -

If you know the interest portion in the instalment deducted from the Bank account, you can apply just the capital amount to the journal above and record another journal for the interest amount > Debit Interest on Loan and Credit Cash at Bank. You would then not need to proceed to Step 3.

The Interest Applied to the Loan Account - Step 3

This journal is required where the interest amount is now known, but wasn't known when the instalment is deducted from the bank account, and where the interest amount is included in the instalment deducted from the loan liability as above. For this transaction you would find the interest amount on the loan statement or other correspondence from the Bank..

Journal > debit the expense account for Loan Interest (to record the interest expense on the I&E report) and credit liability account (to increase the loan amount owing on the Balance Sheet)

Cannot be entered in the Bank Reconciliation screen as this transaction does not involve cash at bank.

Reports

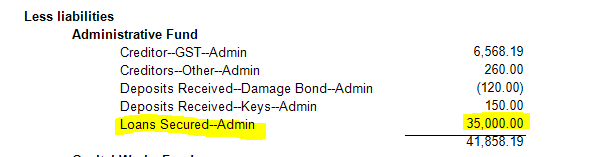

Balance Sheet at end of January shows the loan funds received

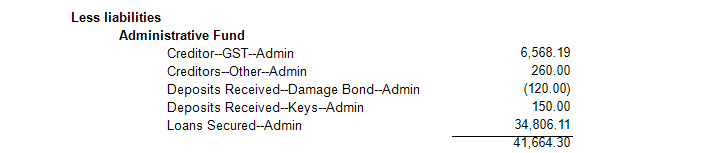

Balance Sheet at end of February shows reduction of loan balance as $315 was deducted and interest of $121.11 was added

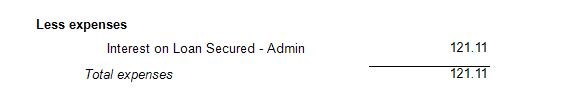

I&E report for just the month of February shows the interest expense of $121.11 for that month

Variations

As mentioned above, and we reiterate, we have provided a common method of recording and reporting loans in the above steps, however the method you choose is entirely your decision, and that suits your needs.

If you wish, you can use sub accounts, and show the repayments figure, in addition to the loan amount, with a nett figure. Some Auditors may prefer this. Notice that the sub account is for instalments and has the Loan account as its parent. On the Balance Sheet, both account balances will show with the subtotal being Loan less instalments.

Bear in mind that variations that are widely different to the above can make it difficult for Support to assist you with queries, if you have errors. Your query may be referred to a Consultant as chargeable support.

Balances on Balance Sheet

The Balance of the loan in Strata Master should be checked regularly to the Bank Loan Statement and ensure it matches.

If you use the above method, there should not be a figure for this loan on the Balance Sheet once the loan is fully paid. If you have a balance on the Balance Sheet, then -

- Repayments have not been entered and the Balance of the loan account not balanced with the Bank Statement from time to time

- Interest amounts entered have been duplicated or overstated and once again, the Balance of the loan account not balanced with the Bank Statement from time to time

- Another method of recording the loan has been used. Please note that it is not Strata Master Supports role to check for accounting/entry errors, however if you find an error, we can assist you to fix it ensuring you use approved methods for the platform.

- If another method has been used, check the Accounting > Adjustments > Search/edit transactions to see how previous instalment entries have been made. Note the debit account used in instalment payments. That is the account where the repayments are recorded, and if different to the Loan liability account, we suggest you discuss with your accountant to clear the balances.

Useful Links

https://kb.rockend.com/help/search-for-a-transaction