About the Mandatory Audit Report in Strata Master

Summary

Learn about New South Wales Legislation Compliance, the criteria for determining Owners Corporations affected by the Legislation and how to generate a report, for those Owners Corporations.

Overview

Owners Corporations Affected

Criteria For Audit

Generating a List of Affected Owners Corporations

Overview

Section 95 (4) of the Act requires any plans with an Annual Budget of $250,000 or more or 100 or more registered lots, to complete a Mandatory Audit at the end of the financial year.

Part 3 – Clause 21 of the Regulations expand on the way to calculate the Annual Budget, where the plan does not have 100 or more registered lots.

Owner Corporations Affected

Note: this is a guide only and if unsure of an Owners Corporations status in relation to this Legislation, make enquiries with the New South Wales government.

In many cases it will be simple to make this determination, for example where there are more than 100 registered lots or where they have bank balances or levies due totaling more than the $250,000 threshold.

Produce a list of plans which require a Mandatory Audit through Quick Reports. You can access further details on the figures included in this calculation.

Criteria for Audit

The table below indicates the criteria for the requirement for Audit.

Criteria

Audit Required

Audit Reason

< 100 registered lots + < $250,000

No

No criteria met

> 100 registered lots + < $250,000

Yes

Number of Registered Lots

< 100 registered lots + > $250,000

Yes

$ Calculation

> 100 registered lots + > $250,000

Yes

Number of Registered Lots

Criteria

Audit Required

Audit Reason

< 100 registered lots + < $250,000

No

No criteria met

> 100 registered lots + < $250,000

Yes

Number of Registered Lots

< 100 registered lots + > $250,000

Yes

$ Calculation

> 100 registered lots + > $250,000

Yes

Number of Registered Lots

Generating a List of Affected Owners Corporations

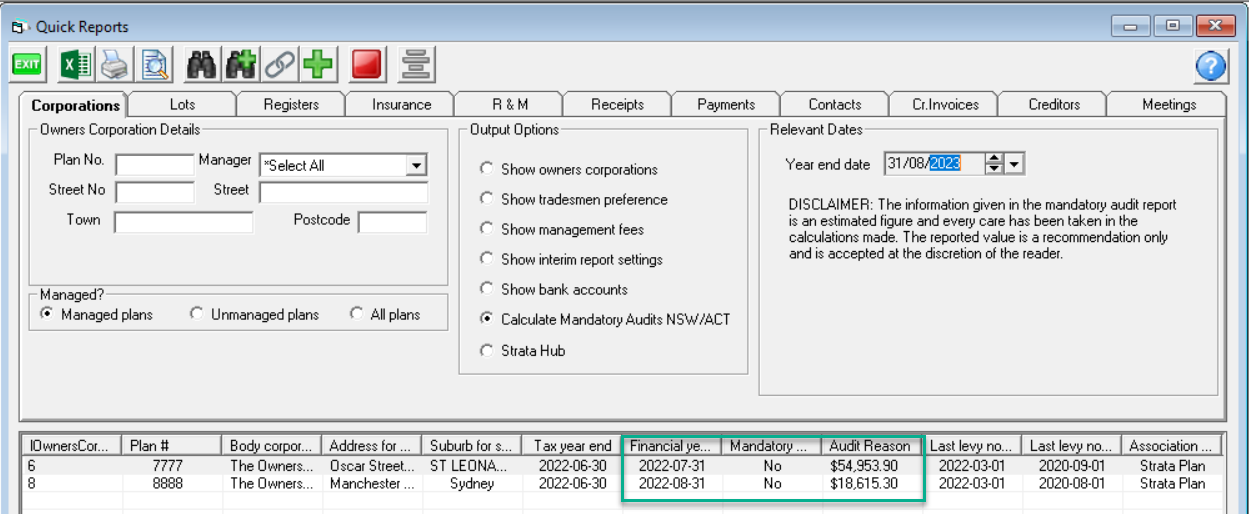

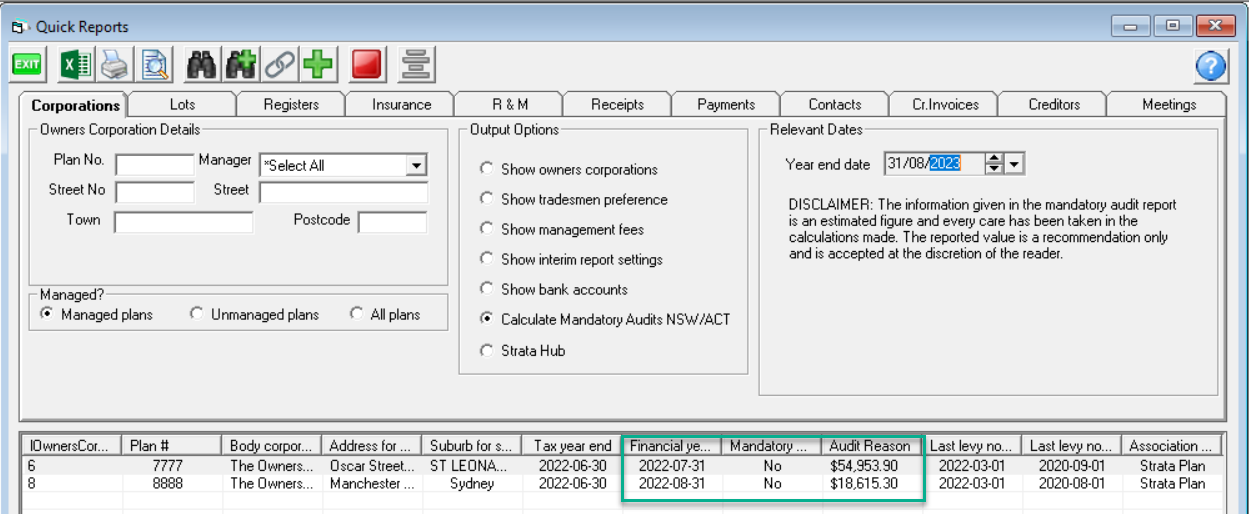

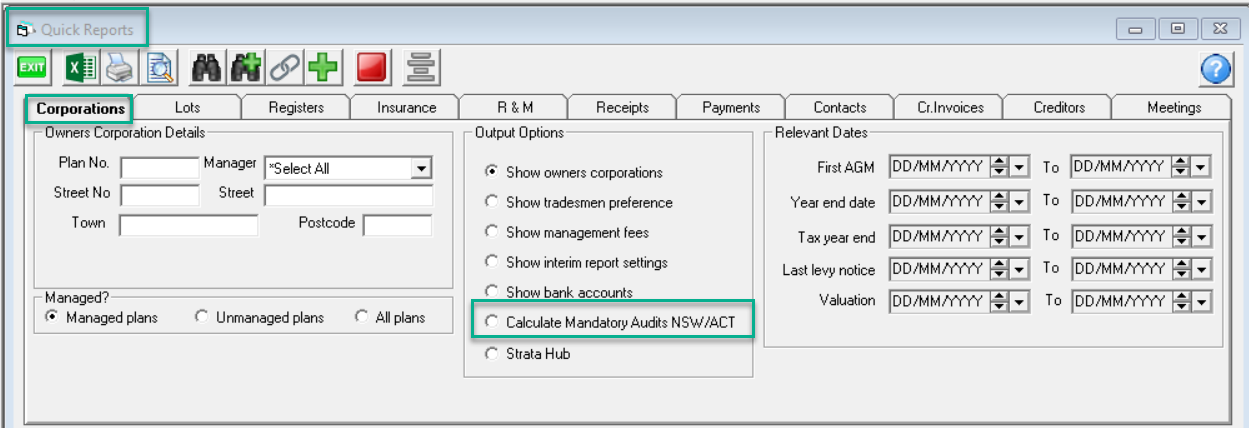

A relevant output is found in Quick Reports > Corporation > select Calculate Mandatory Audits for NSW.

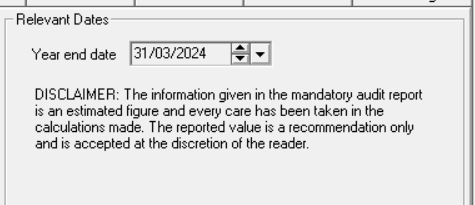

This box shows displays when 'Calculate Mandatory Audits NSW/ACT' is selected. To produce a list of plans requiring the Mandatory audit, enter a financial year end (in the past).

To report on multiple year ends, you can enter each year end to be reported and select the Add to search icon.

All plans with a financial year end matching the date entered (date and month only) will be displayed providing two columns identifying:

- Mandatory Audit Required column displays Yes or No

- Audit Reason column will display the method used to reach the outcome, as in table above.