Elders Group – Set up Statement Fee Procedure

This workaround is designed for offices on clearing statements who want to run owner statements regularly BUT only want charge one statement fee per month, regardless of how many statements have been ran for that owner in any given month.

Step 1 - Remove all "Postage Fees" and apply to "Income & Expenditure Fee"

- Select Owner>Tax & Charges. The Postage & Sundries field should ALWAYS be $0.00 (Or else REST will charge a fee every time you run a statement)

- The Income & Expenditure field is where you must enter the sundries & postage amount, which will display to your owners as "Statement Fee"

- Please put any Income & Expenditure fees under the notes. At EOFY Elders Property Managers to do a global change back to relevant I&E fee for owners who pay for an I&E report, then change back to postage amounts

Please refer to the below owner screen shot for further details:

Step 2 - Charge One off Statement Fees

The one of owner charge function in REST is designed to charge owners and I&E fee via a global journal. We are using this function and changing the internal account, description and account code to charge for a monthly statement Fee.

This step should be ran every month, on the last day off the month BEFORE starting the EOM wizard

- Select Transactions>One off Owner Charge from the menu

- When the process owner charges screen displays insert Internal Account "AASUNDRY"

- Type description "Statement Fee month/year"

- Insert account code 483 - Postage

- Select OK - F12

Please refer to screen shot below for further details:

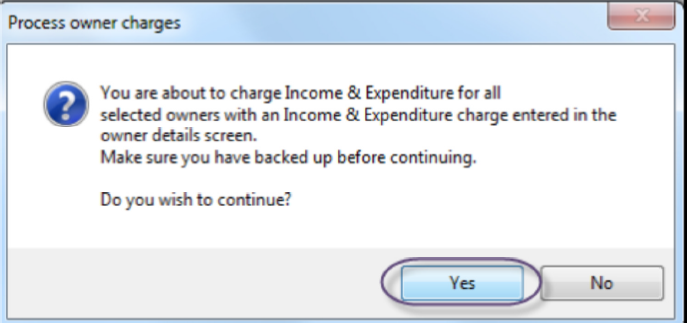

- When prompted "do you wish to continue" select YES

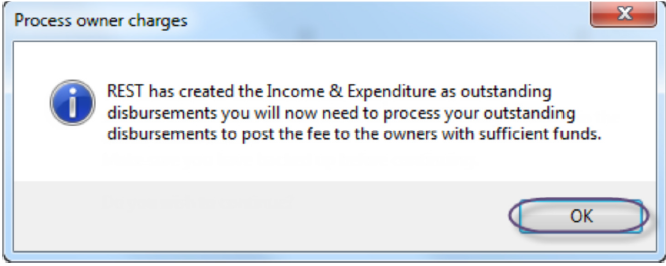

- When REST advises that your transactions have been processed to your outstanding disbursements files select OK

- This will add your charges to the Outstanding Disbursements file of which you will process as a part of the end of month wizard