Reverse or Cancel Investment Interest Entered in Strata Master

This article will assist you to reverse an entry in Strata master where interest has been added to an Investment Account balance in error.

Please read through the whole article, to ensure it is the relevant article for your needs, prior to commencing any process.

Important Notes -

- Always run a back up prior to cancellations, adjustments or any unfamiliar processes. This enables you to restore and start again if necessary. This link will provide instructions - Creating a Backup in Strata Master | MRI Knowledgebase (rockend.com)

- Interest is usually added to Investment total in Accounting > Investment Reconciliation or by a journal - debit Investments (type) and credit Interest on Investments (type)

- Investment Accounts are named 'Investment - Admin' or 'investment - Capital works' Note that where there are multiple Investment Accounts, the account names may be numbered, eg Investment 1 - Capital Works, or be identified by a more specific description eg lift upgrade

- It is important to ensure you are selecting the correct Investment Account.

- Investment funds are NOT part of the operating trust account balance that is balanced in your bank reconciliation. They do show on your Balance Sheet as they are part of the overall assets of the Plan.

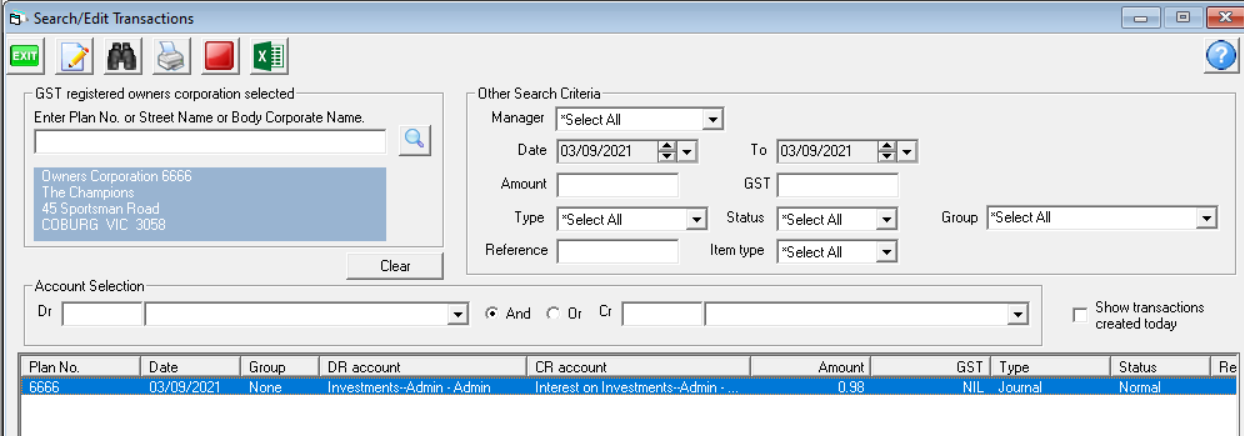

Check the Transactions for the Interest Entry Made in Error

1. Check Accounting > Adjustments > Search/edit transactions to locate the accounts used and ensure they are as above - debit Investments (type) and credit Interest on Investments (type). This transaction would have increased the investment balance (asset increases with a debit) and increased the income/revenue account for interest earned on an investment (revenue increases with a credit).

If your transaction differs to the above, contact Support for assistance.

Process To Reverse the Entry

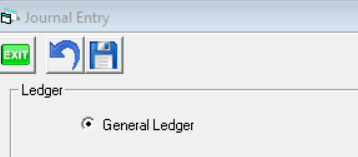

2. To undo/cancel that interest transaction, a journal is processed to do the opposite, called a reversal. Go to Accounting > Adjustments > Journal entry

3.Make sure the radio button is on 'General Ledger'.

4. Enter the relevant plan number

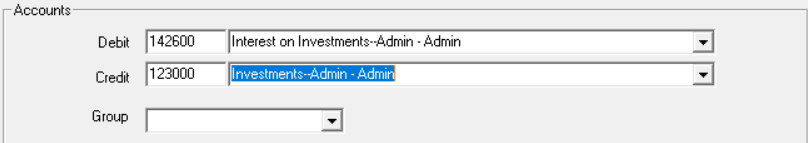

5. Enter your debit and credit by entering an account number or commencing to type 'investment' and then selecting the correct account as noted in step 1 above.

As this will be the reverse to the entry in step 1, you will need to enter -

Debit Interest on Investments (type) and credit Investments (type). Note the example below, may have different account numbers, or naming style to your required reversal eg it may be a capital works investment.

6. Date as current date (today) or back date carefully, ensuring there is no impact to a prior financial period reporting. There should be no GST on interest earned.

7. Enter amount of interest to be reversed and relevant Description.

8. Check your reports to ensure the adjustment done is correct. You can locate the reversal in Accounting Adjustments > Search Edit transactions. Your investment balance should have decreased on your Balance Sheet.

9. Check your Investment Reconciliation screen. Accounting > investment Reconciliation.

Useful Links

Reconciling an Investment Account | MRI Knowledgebase (rockend.com)