GST Payment When One Fund is a Refund and One Fund is a Payment in Strata Master

This article will assist you when you have a payment to make to the Taxation Office for GST but either the Admin Fund or the Sinking Fund is a refund.

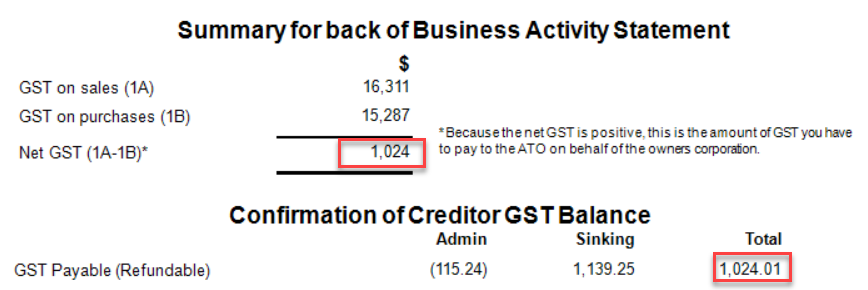

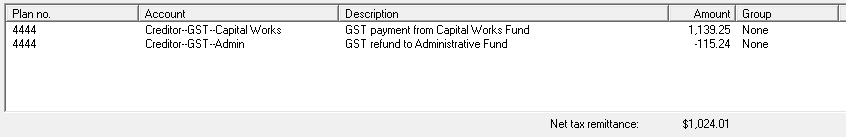

The figures above, taken from the Reports > GST Tax Reports, shows a Sinking Payment Due for $1,139.25 while an Admin Fund refund of $115.24 is also applicable. This leaves a net amount of only $1024.01 GST payable, for the BAS period selected.

Steps To Process the Payment

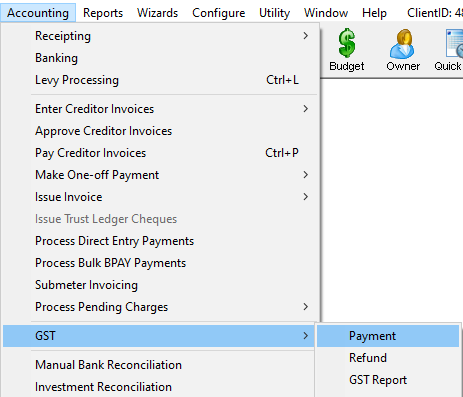

1. Navigate to Accounting > GST > Payment

2. When the Remit GST screen opens, enter the Plan number and check that the selected payment method is correct.

3. We are using the figures in the example above, you will enter the figure applicable to your BAS report. Enter the first 'dissection' or payable part of the transaction, which, in our example, will be the payment of the Sinking Portion (do not key in the ,) and then click 'tab' on your keyboard.

4. Select the GST payable button.

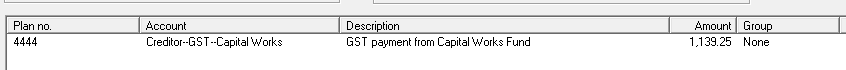

5. Then select the relevant Creditor-GST account, which in our example is for Creditor--GST--Capital Works.

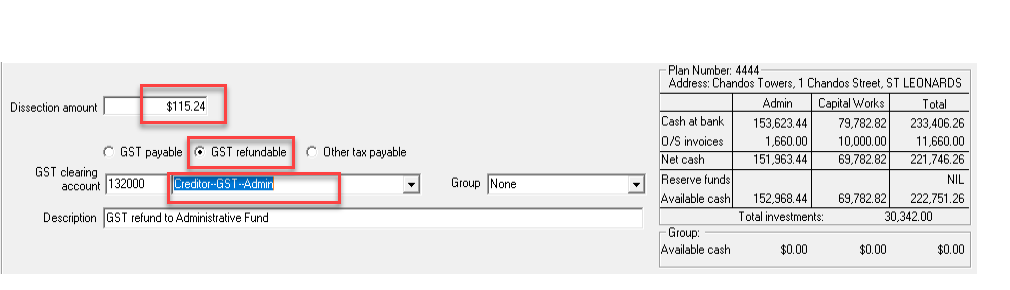

6. Edit the description as you require. It suggested you add the BAS period dates.

7. Click the Save button

8. The details entered will show on the screen.

9. Then enter the amount of the refund, the GST refundable button and the relevant Creditor-GST account. In our example this will be the Creditor--GST--Admin account.

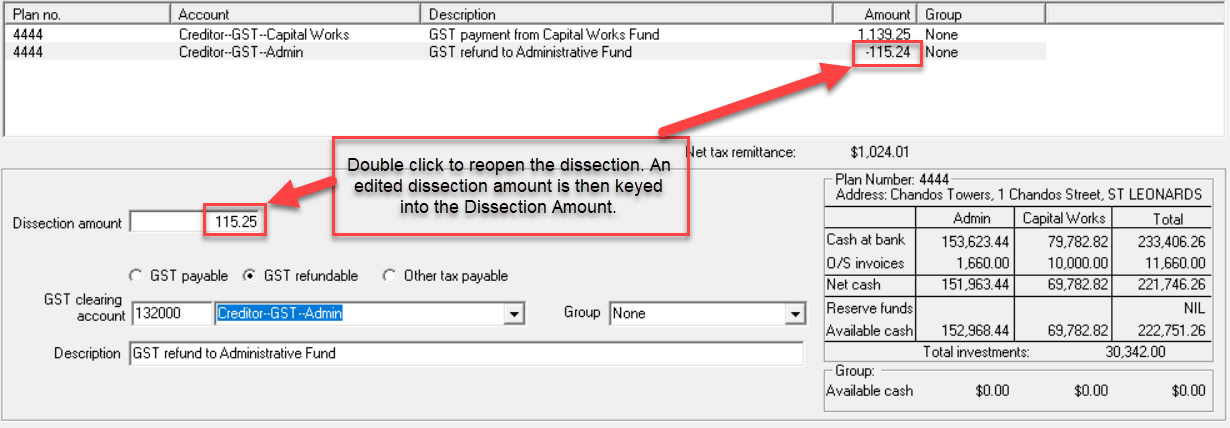

10. The details then show on the screen as below with both dissections visible. Note also the total of the dissections shows $1024.01 however the Taxation Office prefers round figures without cents values. Therefore we will adjust one dissection to change the total to $1024.00.

11. Double click on the refund or the payment and adjust by 1 cent. In this case we will adjust the amount by increasing the refund to 115.25. thereby taking up the 1 cent. Alternatively, the payment can be decreased by 1 cent.

12. Click the printer to save and process the payment.

13. Click 'yes' to the pop up query as below, if the details have printed correctly.

13. If paying by BPay or EFT, create your Bank file when you are ready to do so.