Checks and Balances in Strata Master

There are a few accounts which process internally when you make an entry or transact, meaning that figures checked in 2 reports or screens should agree. These are "checks and balances".

These checks should be made regularly to prevent surprises when busily preparing for an event like an Annual General Meeting.

Bank Reconciliation

Most people are aware of this one, however many assume that doing bank reconciliations when the transaction volume is minimal is a waste of time - but in fact, fewer transactions means less to check if the balances do not agree. Reconciling often, daily in fact, can save you hours later on.

The Ledger side refers to the transactions in Strata Master and always includes all transactions to current moment, so you cannot reconcile retrospectively, so best to keep it up to date and ensure that reconciliations are balanced through June so on 30/6/xx it balances smoothly.

To Fix - https://kb.rockend.com/help/bank-reconciliation-does-not-balance

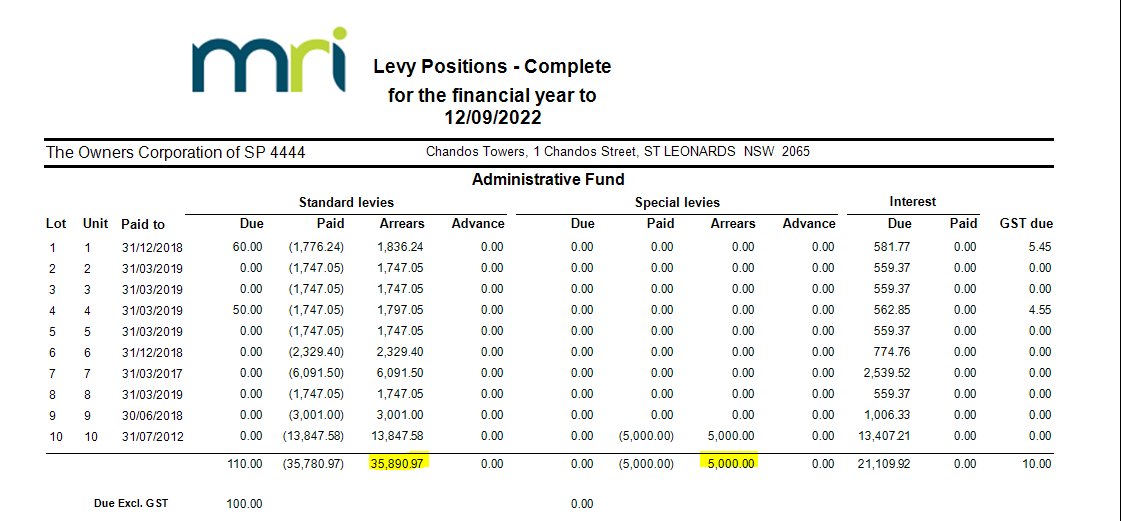

Balance Sheet and Levy Positions Report

Every time a Lot Owner card has a receipt recorded to a Levy or a Levy is posted, Strata Master automatically processes a journal which involves Receivable Levies accounts. It then updates the Levy Position Report.

The Balance Sheet shows Receivable Levies totals for Admin and Capital Works fund.

So the arrears on the Levy positions report should match the Receivable Levies figures on the Balance Sheet. All Receivable Levies transactions should be processed through an owner ledger.

If these reports don't agree, someone has processed a journal or other manual transaction to Receivable Levies.

To Fix - Both reports are found in Formatted Reports. Check Balances for end of each month and find out the month when it goes out of balance. Then check the transactions in Search/edit transactions for a transaction involving Receivables Levies account that is NOT a Levy or Levy Receipt.

Creditor Invoicing and Corp General tab

When processing invoices, periodically check that the Total beneath the list of invoices matches the figure in the lower right hand corner. These financials are replicated from the Corp screen, general tab.

To Fix - If the figures do not agree, check Search/edit transactions screen for any manual journals involving the Creditors Other accounts. Creditors Other is another account that is used only in automatic transactions within Strata Master.

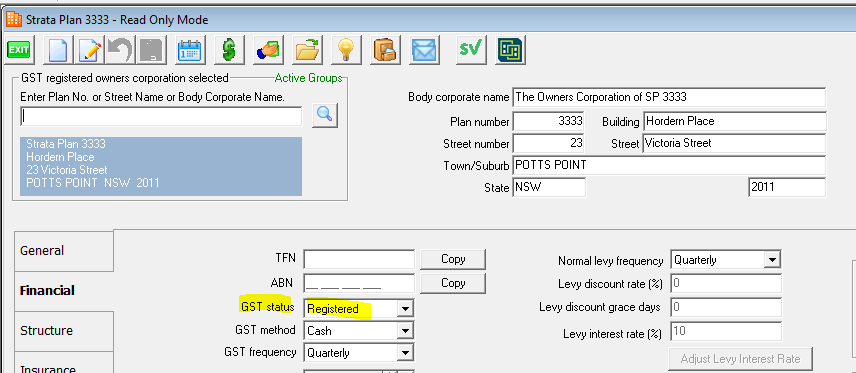

GST Registration

Ensure that the gst status of a Plan is correct.

If you find an exempt plan showing as gst registered, run a gst detail report for the Plan and you will soon find out if transactions have been processed with gst. This would only occur if a user has changed the status. Refer to the Audit Trail Report to find the user who has made a change.

To Fix - If the gst status of a Plan is incorrect, and there are only a couple of transactions, you would need to reverse the transactions and reinput. If there are many transactions, you may require assistance from a consultant to correct your data.

Single Trust Account

Those agencies with a Single Trust will also need to cross check the figures on the Strata Bank Balances report matches the Levy Positions report and Balance Sheets.

Further List of regular checks -

GST detail report and BAS report

It is worthwhile to check the BAS report in a timely before it is due for lodgement with Australian Taxation office.

Backups are being created

Best to check, to prevent rekeying of a month's worth of work - https://kb.rockend.com/help/creating-a-backup-in-strata-master

Other Useful Links

https://kb.rockend.com/help/agm-report-preparation-setup-and-use-guide

https://kb.rockend.com/help/reversing-a-status-report-fee-receipt

https://kb.rockend.com/help/strata-master-top-tip-92-quantity-based-fees-detail-report

https://kb.rockend.com/help/strata-master-top-tip-123-tax-report