Correct a BAS Difference of Equal Amount in Admin and Capital Works in Strata Master

Summary

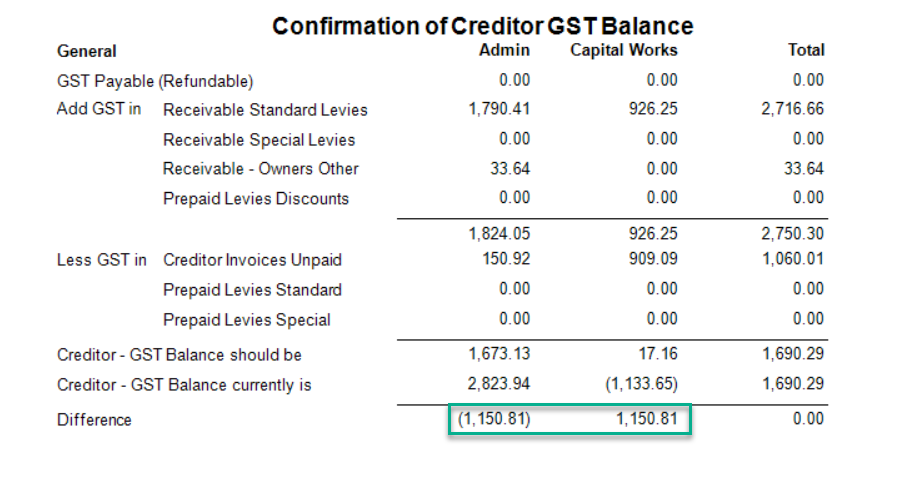

Learn how to correct a BAS difference where the Admin and Capital works differences are the same amount, but one figure is a positive, without brackets) and one is a negative, with brackets, however the Total difference is 0.00.

Overview

When you have a BAS difference with equal Admin and Capital Works differences, one negative and one positive, the Total difference is nil. The gst payment to the Tax Office is correct however the processing within Strata Master has resulted in some transaction being allotted against the gst of the wrong fund.

For example, you may find that a GST refund receipt, where part was a payment due and the larger part a refund, was not split between Admin and Capital Works. Ideally you would find the transaction, reverse it and reinput correctly, however this may not always be possible.

This is a simple workaround correction to the BAS report, which is your choice to make.

This article shows you the steps to take to correct the BAS where -

- the Admin difference figure is positive and the Capital works is a negative value

- the Admin difference figure is negative and the Capital Works is a positive value

Admin is Positive and Capital Works is Negative

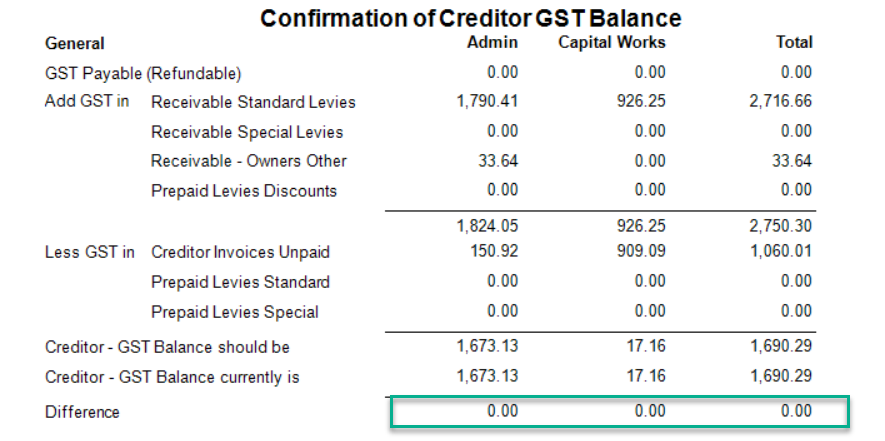

As in the example screenshot above, Admin has a positive difference and Capital Works has a negative difference of the same amount.

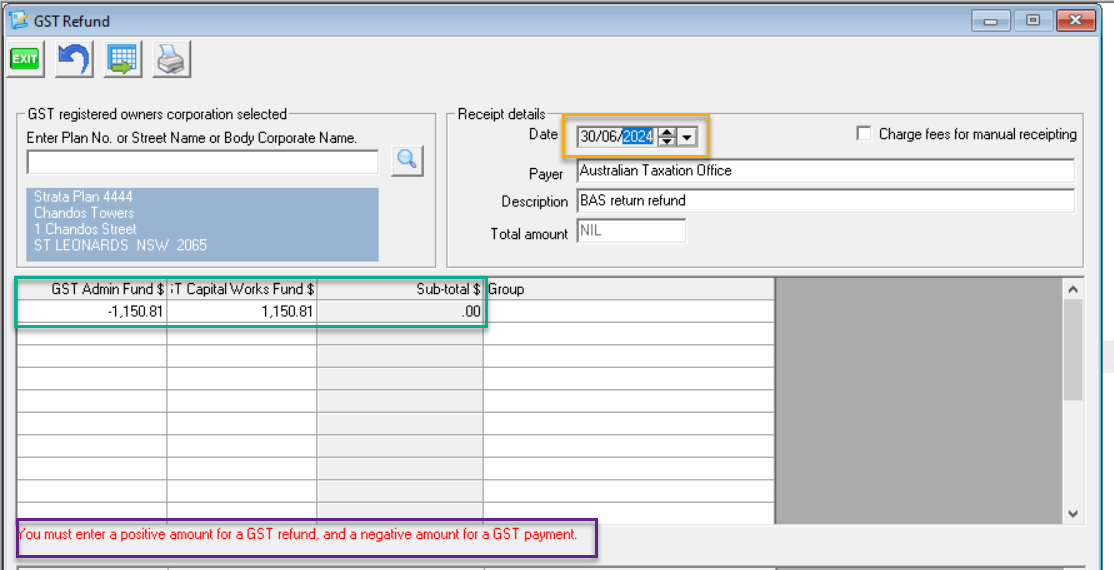

1. Navigate to Accounting > GST > Refund.

2. Input date as last day of the BAS period of the report, unless that is the financial year end of the Plan. If it is, you will need to use the next day or current date.

3. Enter an appropriate description.

4. Enter Admin amount of your difference as a positive + amount (which represents a refund) and Capital Works amount as negative - (which represents a payment).

5. Ensure the sub-total $ is auto recorded as 0.00 and the total amount is auto recorded as NIL.

6. Click the process button in the top left hand corner.

Admin is Negative and Capital Works is Positive

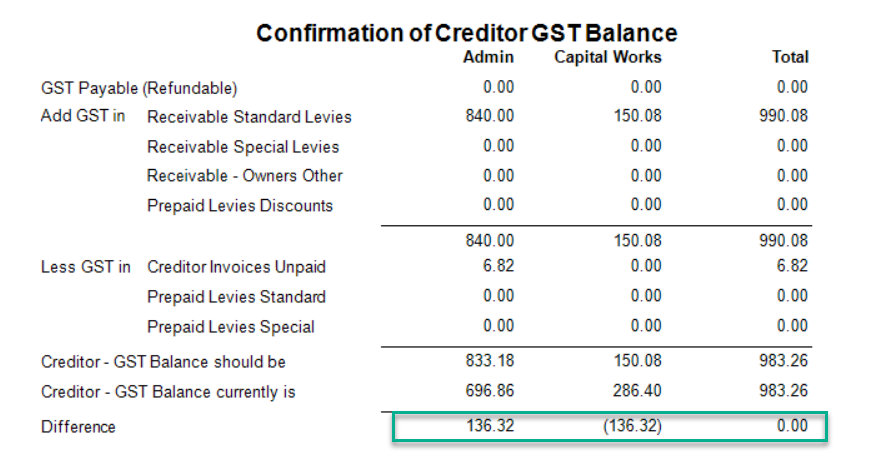

As in the example screenshot below, Admin has a negative difference and Capital Works has a positive difference of the same amount.

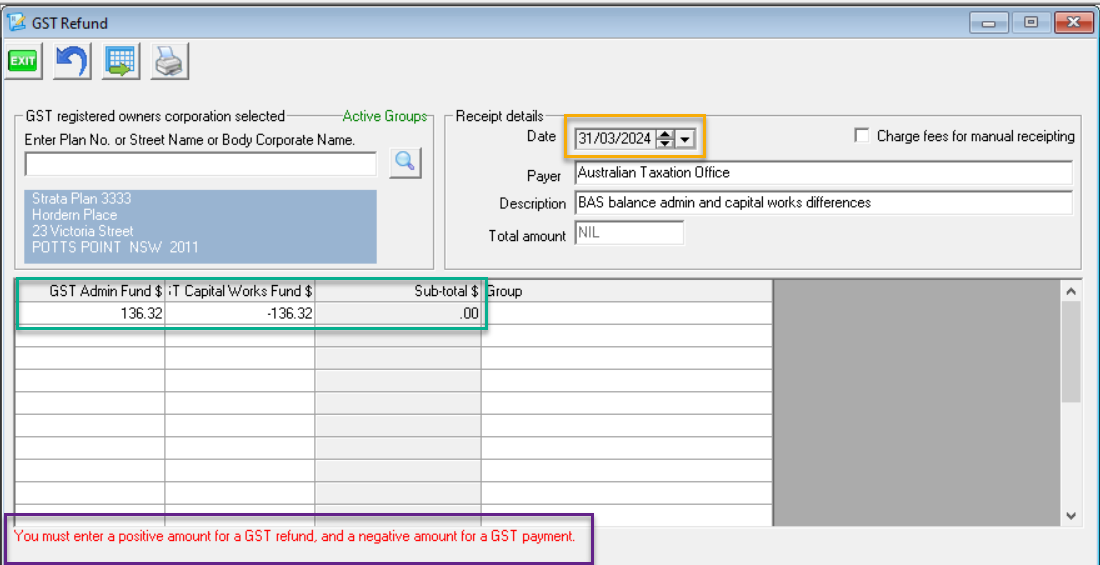

1. Navigate to Accounting > GST > Refund.

2. Input date as last day of the BAS period of the report, unless that is the financial year end of the Plan. If it is, you will need to use the next day or current date.

3. Enter an appropriate description.

4. Enter Admin amount of your difference as a negative - amount (which represents a payment) and Capital Works amount as positive + (which represents a refund).

5. Ensure the sub-total $ is auto recorded as 0.00 and the total amount is auto recorded as NIL.

6. Click the process button in the top left hand corner.

The BAS Report Once Adjustments Are Made

When adjustments are completed, the BAS report result is a difference line with nil balances -