Income Tax Calculation Worksheet Setup & Use

This report has been designed to produce a worksheet to assist you, or your tax agent to complete an Income Tax Return for your owners corporations.

In many cases the tax year for an owners corporation is different to their financial year, so if you wish to produce the worksheet or tax report you must ensure that the tax year recorded in the Financial tab in the Corporation screen is correct.

The report will calculate the Income Tax at the end of the tax year, based on the total of the general ledger balances for:

- Income received

- Direct deductions, and

- Apportioned deductions

The report will also display Income Tax paid during the tax year.

In order to ensure that the correct accounts are used for calculating the income tax, you must first configure the revenue and expense accounts to be included in the worksheet.

Setup Instructions

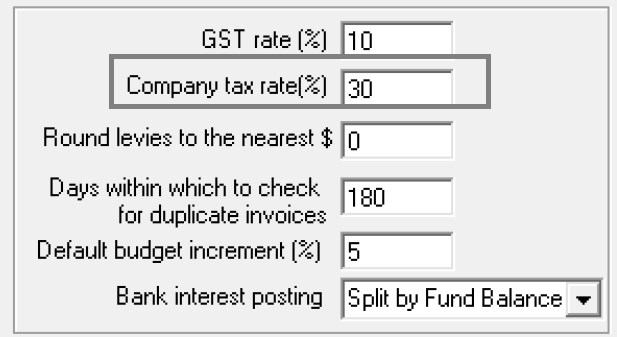

Configure > Agency > Options # 2

You must first record the Company tax rate for your owners corporations. This new field, which is displayed directly under the GST rate has been added to the agency configuration, and allows for the rate to be altered if the tax rate is changed in the future.

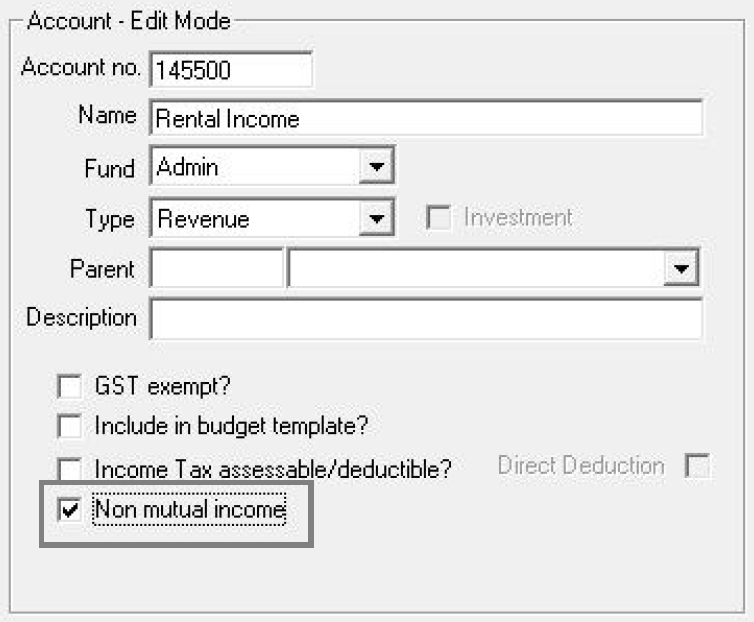

Revenue Accounts

You need to determine which revenue accounts are assessable for income tax (non-mutual income).

During the upgrade to Version 5.5 the default setting for all revenue accounts is set to mutual income.

To update your revenue accounts, users with the required permission must open the Chart of Accounts, under the Configure Menu.

- Select the revenue account to be updated.

- Place the screen in Edit mode.

- Tick the checkbox non-mutual income.

- Save.

This should be repeated for each non-mutual revenue account in both the Administration & Sinking Funds.

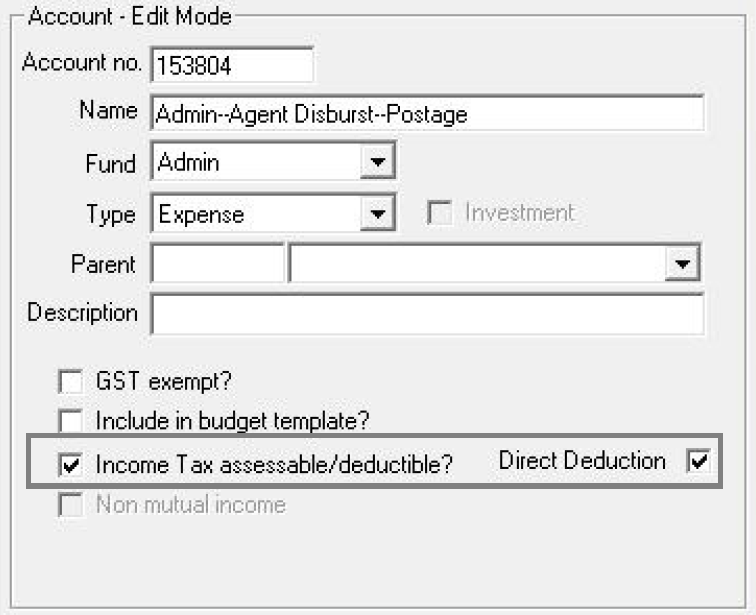

Expense Accounts

You will need to determine which expense accounts may be deductible for income tax.

During the upgrade to Version 5.5 the default setting for all expense accounts is not deductible.

To update your expense accounts, users with the required permission must open the Chart of Accounts, under the Configure Menu.

The revenue account configuration will requires that you differentiate between direct and apportioned deductions.

- Select the expense account to be updated.

- Place the screen in Edit mode.

- Tick assessable/deductible checkbox.

- Tick Direct deduction (if required) *.

- Save.

* Where the Direct deductions checkbox is not ticked, the balance of the general ledger account will be included in the apportioned deductions section of the worksheet.

This configuration must be repeated for deductible expense account in both the Administration & Sinking Funds.

Note: The upgrade will not change the flags which may already be recorded against general ledger accounts, except where the flag is recorded against an Asset or Liability account. In this case the flag will be cleared.

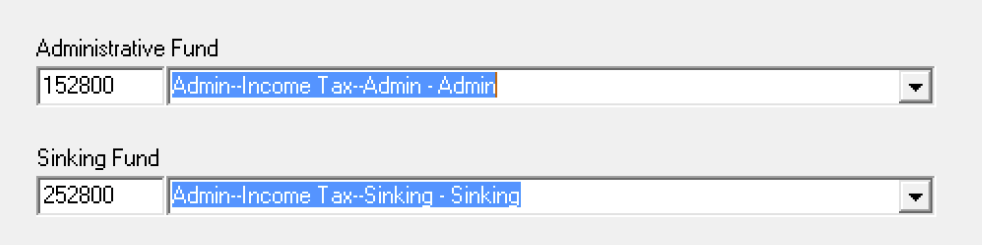

Utility > Set Standard Fund Accounts

When producing the report, STRATA Master can identify any tax paid during the tax year of the owners corporation.

This utility allows you to choose an expense account from each fund to be reflected on the worksheet.

When the accounts have been configured the screen will look like this.

Producing the Worksheet

When you have past the end of the tax year for your owners corporations you can produce the worksheet based on the above configuration, against the total of the general ledger accounts for the period.

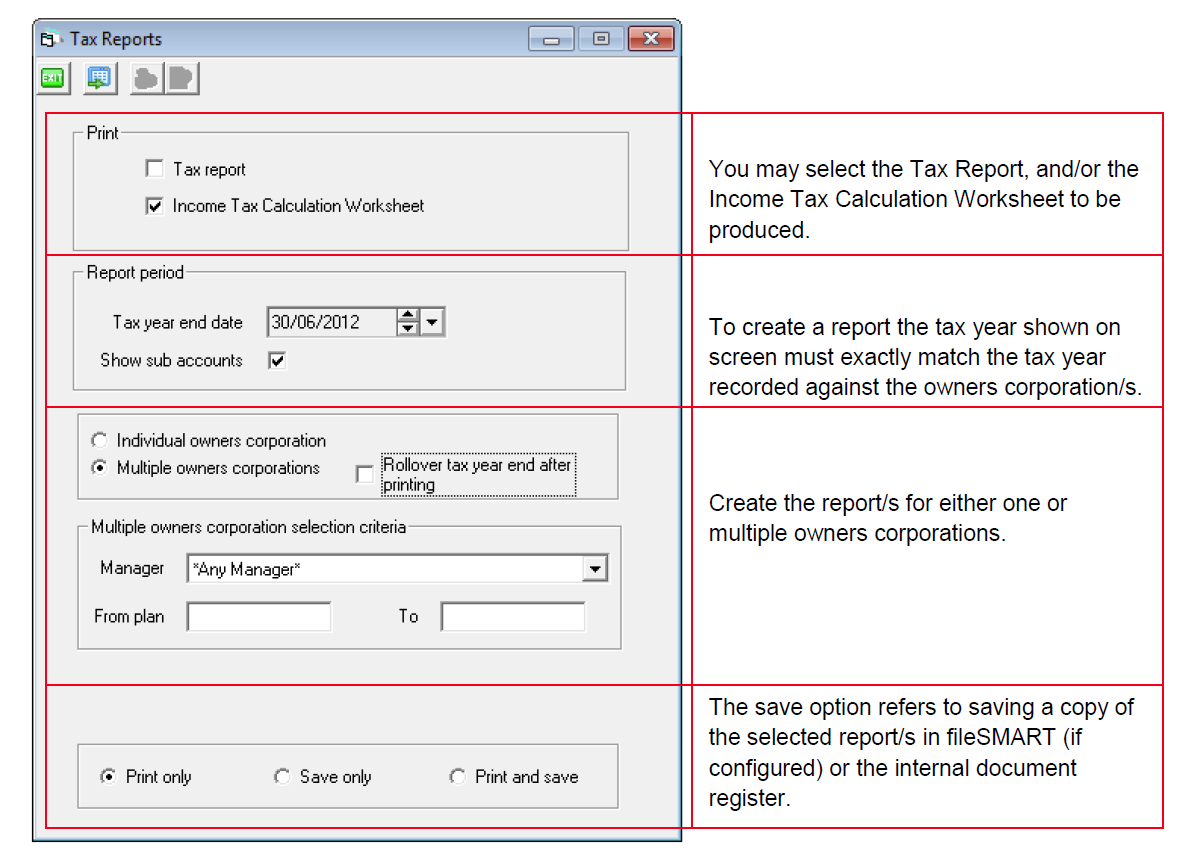

The report is produced in the Reports Menu, under Tax Reports. There are a number of options available from this screen;