Enter a Credit Note From a Supplier/Creditor in Strata Master

When a supplier/creditor is overpaid, they will usually reduce the next invoice that is sent through.

From time to time, you may instead receive a credit note from a supplier that has been overpaid. A credit note is the supplier saying you can deduct the credit note amount from the next invoice you receive.

To Process the Next Invoice for Lesser Amount or Process A Credit Note

If you process a credit note, and also process the next invoice at the reduced figure, you will be short paying, so you will need to have a procedure in place that dictates how you will handle this situation.

Processing The Credit Note

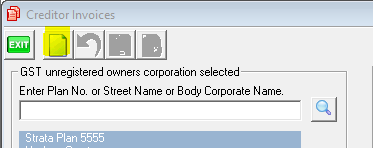

1. Click on Creditor Invoicing icon

2. Enter the relevant Plan and click the add button.

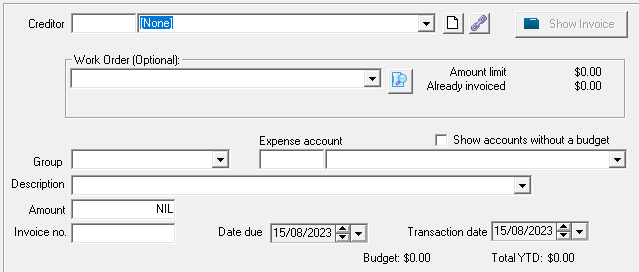

3. Then to the lower part of the screen to enter the details of the credit note.

4. Enter creditor and expense account, use the expense account that was used in overpaid invoice. Note the following field entries -

- the description refers to credit note and the invoice paid

- the amount is a negative figure

- the invoice number refers to a Credit Note. You can enter "CN 7658" if you have a credit note number

5. Click Save.

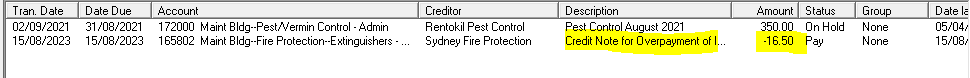

6. The creditor invoicing screen now shows the credit note as a negative figure. It will remain here until this Plan makes a payment to that creditor, and reduce the payment amount accordingly.

Why Can't a Credit Note Be Uploaded To The Bank

The Bank file only carries positive amounts, which relate to where your Plan is paying another entity. A Credit Note would entail deducting funds from another entity's bank account, which your Plan does not have authority to do.

If Another Invoice Is Not Due From the Supplier/Creditor

In this case you would need to seek a refund from the Creditor, explaining that an invoice would not be received in the short term, from which to deduct the credit note.