Cancelling a Levy Discount Receipt on a Strata Master ledger

When a discount is allowed on a levy receipt, and that receipt is later cancelled, the discount given is not cancelled. The discount needs to be reversed manually through other means.

This article will provide the steps to reversing the discounted portion.

Note - Read through all the steps prior to actioning. If you do not understand this process, please contact Support for an explanation so you can proceed with confidence. We always recommend processing a back up prior to any adjustments, corrections or unfamiliar transactions. You can then restore your data if you make any errors.

Where is the discounted amount now

When a discount is applied, the funds equal to the discounted amount is provided by the Owners Corporation to the Lot. In other words the Owners Corporation contributes the funds toward the Lot Owners levy.

The funds may be sitting in unallocated funds. If they are not, they may have been applied to another levy since. To proceed you will need to have funds in the unallocated funds of the Lot.

To Allocate Funds to the Unallocated Balance of the Lot Ledger

If there are no funds sitting in the Unallocated Funds of the Lot, or not enough funds to equal the discount allowed, you would need to reverse a receipt to the Lot and re-receipt the funds applying enough funds to the Unallocated funds to equal the amount of the discount allowed. Please log a case to Strata Master Support if you are unable to determine a receipt to cancel or unsure of this step.

1. Refer this link to cancel a receipt - https://kb.rockend.com/help/cancel-a-lot-owner-receipt

2. Refer this link to receipt to unallocated funds - https://kb.rockend.com/help/receipt-to-unallocated-funds

The Process when the Funds are held in Unallocated Funds on the Lot ledger

Lets use an example where the amount of the discount is $157.80.

1. Calculate how much of the 157.80 is Admin and how much is Capital Works. Your General Ledger accounts for 'levy discount allowed' expense (possibly number 159500 for Admin or 259500 for Capital Works in your data) will tell you. These accounts will show you the amount of discount provided on the day of receipting, with a debit, as the debit increases the expense to the Owners Corporation of providing the discount. Check both Admin and Capital Works.

2. We will use the proportion of $106.83 Admin and $50.77 Capital works. Account 159500 would show $106.83 given for the relevant receipt.

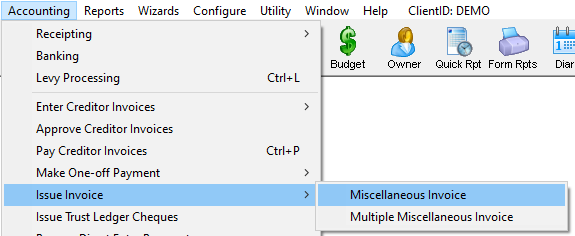

3. Go to Accounting > Issue Invoice > Miscellaneous Invoice

4. Enter the Lot Number

5. Select 'Expense' Account and choose 'levy Discount Allowed Admin' expense account for $106.83 or whatever you work it out to be. GST may or may not apply depending on whether the Plan is GST registered. Strata Master will complete as applicable.

6. Description - something along the lines of reversing discount allowed for receipt #xxxxx and click Save

7. Do the same as in step 3 to 6 but select Levy Discount Allowed Capital Works $50.77 or whatever you work it out to be. Total should be $157.80 for both invoices.

8. Check the owner ledger and ensure that the unallocated funds apply to the misc owner invoices. This puts the funds back to the discount allowed account. The lot owner has effectively refunded the discount money back to the Owners Corporation. Below screenshots show -

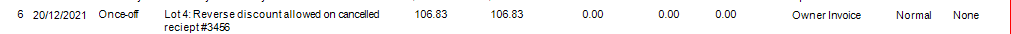

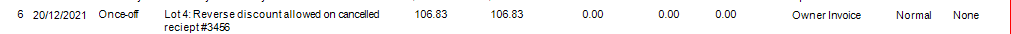

- the Levies record showing the misc owner invoice charged to the owner to repay the discount and

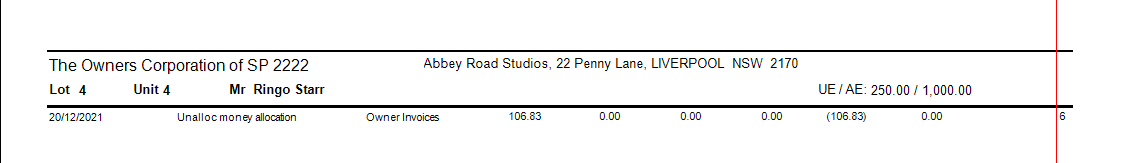

- the Receipts record showing the unallocated funds allocated to the Misc owner invoice.

This link will assist if you need to manually allocate the unallocated funds to the misc owner invoice https://kb.rockend.com/help/how-to-process-an-allocation-receipt

Useful Links

https://kb.rockend.com/help/receipt-to-unallocated-funds

https://kb.rockend.com/help/how-to-process-an-allocation-receipt