How to Create or Enter a Journal in Strata Master

Strata Master is an Accrual double entry accounting platform, therefore it is important to understand Accounting Basics to process any type of journal.

- Journals DO NOT affect Owner Ledgers.

- We recommend you log onto our website and view the Accounting training for Strata Managers. Link is - MRI Software | Training Academy | Live Schedule | Australia then select Browse Rockend Training Courses.

This article is provided for those users with double entry accounting experience, and provides navigational assistance.

While Rockend MRI provides support to the software, a lack of accounting knowledge of users that requires Support assistance to fix, can be chargeable support. For this reason training is recommended, or that transactions be processed by users with double entry accounting experience.

Navigate to Journal Entries

Navigate to Accounting in the top toolbar > Adjustments > Journal Entry > radio button should be on General Ledger.

In this section the radio button 'GL with auto reversal' is for Balance Day journal entries, where transactions are to be moved across periods.

The radio button 'Trust Ledger' is for use with single trust accounts.

In this article we are only referring to the General Ledger option.

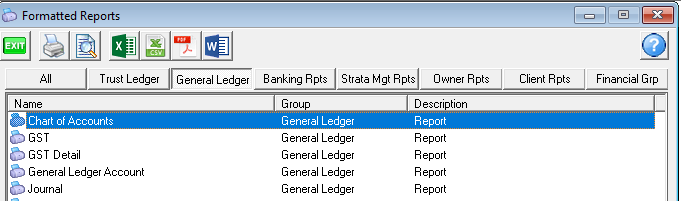

Note that the gst field will show when the relevant accounts are entered. If the gst field still doesn't show, it means the account you have selected has not been created as a taxable account. Refer your Chart of Accounts in Formatted Reports.

The General Ledger

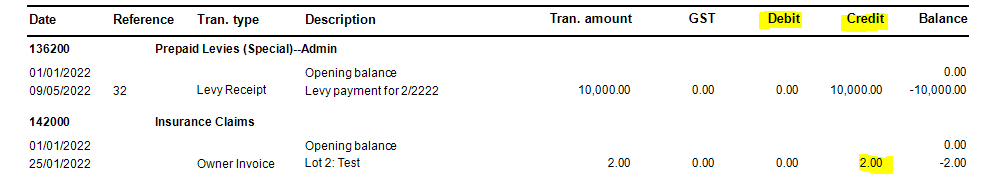

The General Ledger is a list of all transactions within your Strata Master data, whether the transaction has been processed automatically by Strata Master when you have used a function, such as receipts, or whether a manual journal has been created.

Prior to any journal being entered to reverse a transaction, the General Ledger should be checked for the following reasons -

- to check that a reversal has not already been performed

- to clarify whether a debit or credit is required to reverse the transaction

- to check whether the transaction includes gst

- while many users check the Accounting > Adjustments > Search/Edit Transaction screen, a more complete history is available in General Ledger

In the example above, to reverse the $2.00 transaction on 25/1/2022 from account 142000, you would need a debit in your reversing journal. The credit was used to enter the transaction, so a debit is used to remove it.

You can find the General Ledger in Strata Master in 2 ways -

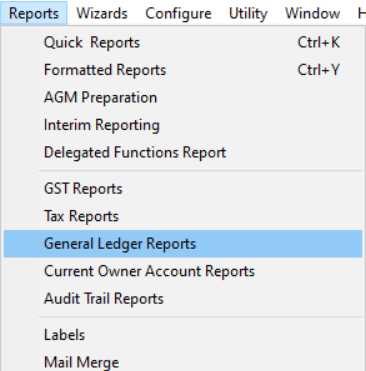

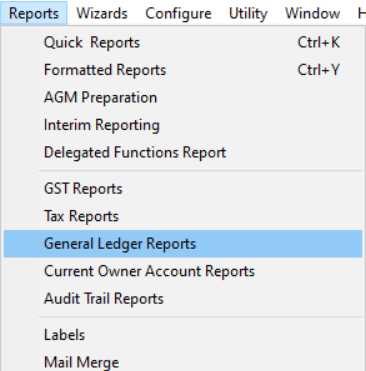

- Reports in your top toolbar > General Ledger Reports. Here, you can select a number of accounts to check transactions for a selected period.

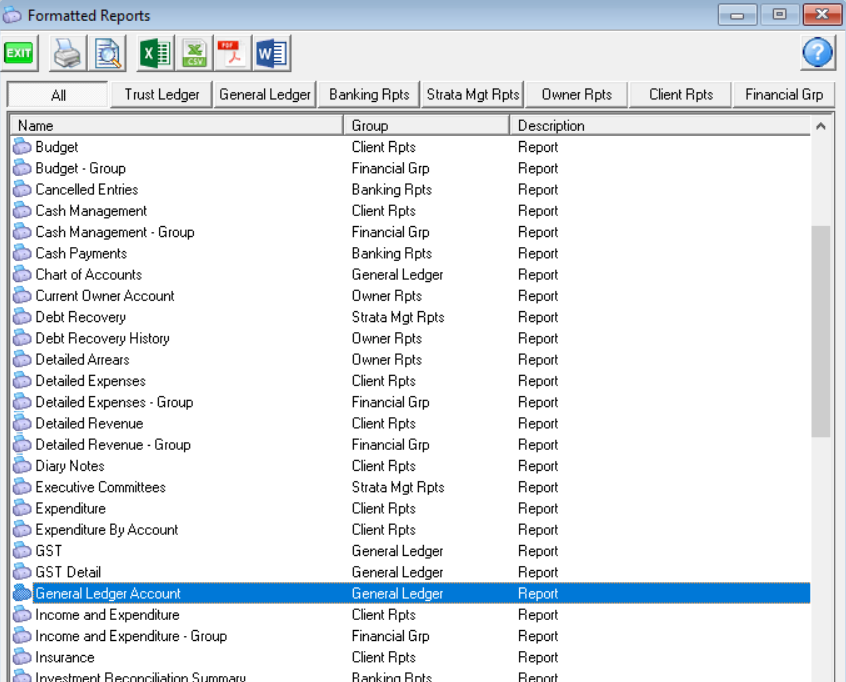

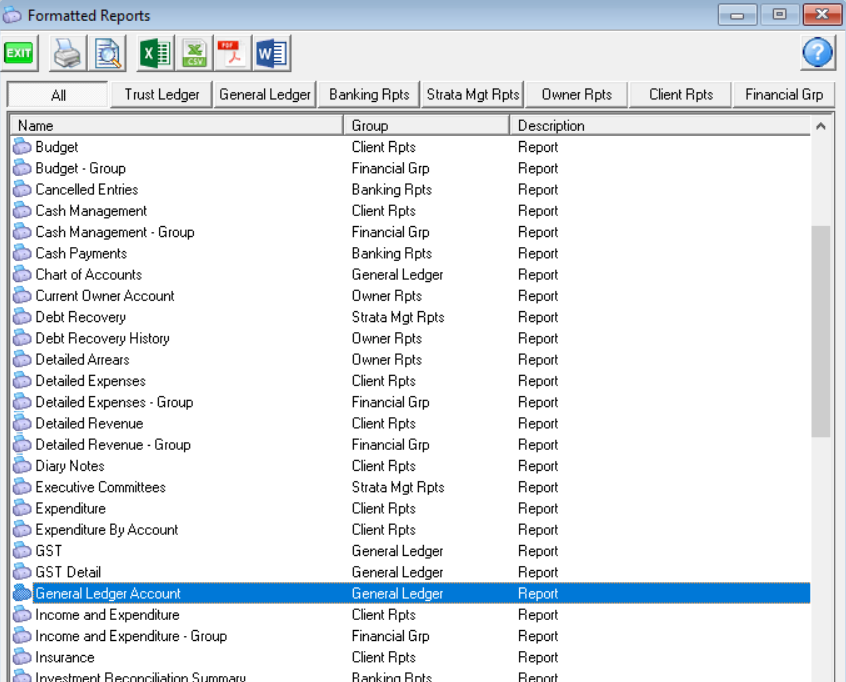

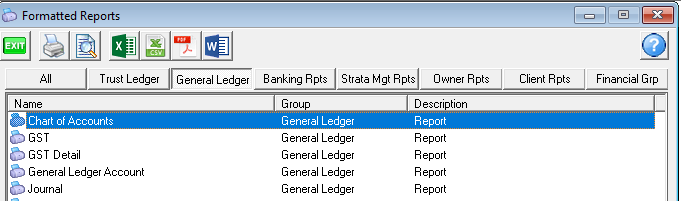

- Formatted Reports icon > General Ledger Account. Here you can view all accounts for a period or 1 account for a period.

To Edit a Previous Journal

Studying transactions in the General Ledger for the account you need to change and the account you select instead, you will be able to to determine whether you need a debit or a credit to 'move' the funds. In other words, if a credit increased the balance of the account, then, provided both accounts are the same Fund (eg Admin) -

- a debit is required to decrease that account again.

- and the corresponding credit would be required for the other account. (Note - a credit increases revenue and liability and decreases expenses and assets)

- use current date if possible or if backdating, be aware of BAS return dates if gst is involved, or whether end of financial year reports have been presented.

- if unsure what kind of accounts you are dealing with, check your chart of accounts.

Entering a Transaction

When entering an insurance instalment or other transaction, that is not a correction. You can check 'Search/Edit Transactions' to see which account is debited and which is credited. Go to Accounting in the top tool bar > select Adjustments > select search/edit transactions > filter as required and click the search binoculars.

Functions instead of Journals

Many transactions within Strata Master can be processed via Functions. This removes the need to create journals for most transactional purposes. If a function is available, we recommend it be used. Functions are selected in the Tool Bar or in the Icons.

For example, a journal may affect the general ledger for the Plan but will not affect a Lot Owners ledger, so levy receipts need to be processed by function and not by journal.

Similarly cancellations can be done via Accounting > adjustments functions.

An Example

Scenario - A entry for bank charge $15.40 needs to be reversed, was entered to the wrong Strata Plan 4444.

Current Status - In Search/edit Transactions the entry shows a debit to account 151400 Admin - Bank Charges and a credit to 121000 Cash at Bank - Admin.

Date - The original transaction was processed 27/05/22 and as only a couple of days have passed, and no End of Period has occurred in the meantime, the reversal can be dated as 27/05/2022 (caution: be very careful when changing dates from today's date, that you enter the date correctly, especially the year)

Note that the debit to cash at bank, INCREASES the cash at bank as the original bank charge processed would reduce the cash at bank. This Plan needs to have that cash returned by processing the journal. The Credit to Bank Charges expense account REDUCES the figure for that expense.

The bank charge would then be processed to the correct Strata Plan.