Auto Reversing Journals in Strata Master

These journal entries are used to reflect Balance Day or End of Financial Year Adjustments.

Can these journals be used for purposes other than end of financial year adjustments ? Similar journals can be created to move a transaction to a prior period, however you would be selecting a linking account which will show a balance in reports between the two dates selected.

We would suggest you seek advice from a suitably qualified Accountant, regarding any diversion from this article, as Strata Master Support staff are essentially software support and can only make suggestions of accounts to use.

The Purpose of Auto Reversing Journals

The purpose of these entries is to bring to account Expense and Revenue items that should be included and/or excluded from the financial year under review such as:

- Money that is due but not received e.g. Insurance Claim proceeds.

- Invoices received after the close of the year that should have been paid in the previous financial year.

- Invoices that have been entered for expenses such as Insurance but relate to the next financial year.

- To adjust the accounts for cancellations made after the end of the financial year.

Identifying Transactions Requiring Adjustment

To assist to identify any transactions that may need adjustments it is suggested to review the following reports:

- Non Levy Income Report

- Outstanding Invoices Report

How an Auto Reversal Journal Works

When the entry is saved, two journal entries are automatically created.

There will be a journal that creates the entry in the required period for $x and a journal that reverses the entry in another period for $x. $x can be a portion of the original transaction (as often occurs in balance day adjustments) or for the whole amount of the original transaction.

Check Current Transaction Details In Search/Edit Transactions

A vital step is to check the Search/edit transaction screen for details of the account to be moved. Write the below steps out. Review the logic.

Eg Transaction 1/8/2020 for $356.00 needs to be moved to prior year ending 31/7/2020.

1. Original transaction to be moved is - Debit expense account and Credit Creditors Other

2. To reverse that transaction would require - Debit (adjustment account that helps move the transaction. Do not use Creditors Other or Cash at Bank) and Credit expense account dated 1/8/2020

3. To enter in correct date would require - Debit expense account and Credit (adjustment account) dated 31/7/2020

Whichever of the above is the FIRST date is the one entered in the Auto reversal journal and the later date is entered as the reversal.

Navigating to the Auto Reversing Journal

Navigate to Accounting > Adjustments > Journal Entry > select the button for GL with auto reversal

Dating Your Journal Notes

When the GL with auto reversal button is selected a reversal date is displayed at the bottom of the form. By default the date is the first day of the month following the

date of the journal entry.

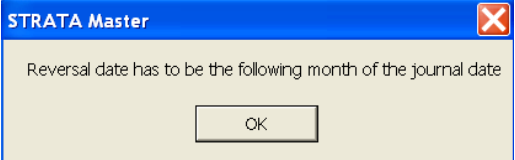

If a date is selected that is in the same month as the original journal the following error message will appear and the user will not be able to save the journal.

Care should be taken with these journal entries particular where the plan is registered for GST.

An Example

An entry was made in previous period for expected hail damage funds (debit account 142000 and credit account 126000), and that transaction needs to be moved to the next period.

Always create a backup prior to processing any adjustments or corrections or unfamiliar transactions.

1. Navigate to Accounting > Adjustments > journal Entry.

2. Select GL with auto reversal, as selected in example below.

3. Enter Plan number, debit and credit accounts as below for this example.

4. Dates will be last day of the prior period (usually financial year end for the Plan) and reversal date as the first day of the next period.

5. Enter the Amount to be adjusted, which in this case is the whole of the claim funds received.

6. Provide a suitable description which will show the reason for the journal entries.

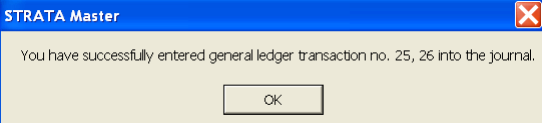

7. Click Save, depending on the journals being created and the current date, you may receive a message. Click ok if satisfied that your selections are correct.

8. A message shows

Accounts You Could Use to Move Transactions to Prior or Next Year

Check your Chart of Accounts for suitable accounts such as Prepaid Expenses, Suspense, Accrued Expenses.

So if you are moving a portion of an Insurance Premium to the next financial year of the Plan, it would appear as

Seek advice from an Accountant or BAS Agent if you need assistance to decide on an account to use. You may need to create a suitable account for period end transfers.

Useful Links

https://kb.rockend.com/help/how-to-create-or-enter-a-journal

https://kb.rockend.com/help/understanding-double-entry-accounting

https://kb.rockend.com/help/change-an-account-code