How to Setup a Management Fee Free Period

Overview

A management fee free period is a period of time where an owner will not be charged management fees on rent collected.

Setting this up in REST will ensure the owner will not be charged management fees and can be reverted back to charge the owner management fees when desired.

This document will cover the following:

- How REST charges Management Fees

- How to Setup to Not charge Management Fees

- How to Reimburse Management Fees Incorrectly Charged

How REST Charges Management Fees

In REST there are two separate fields where management fee charge amounts can be entered:

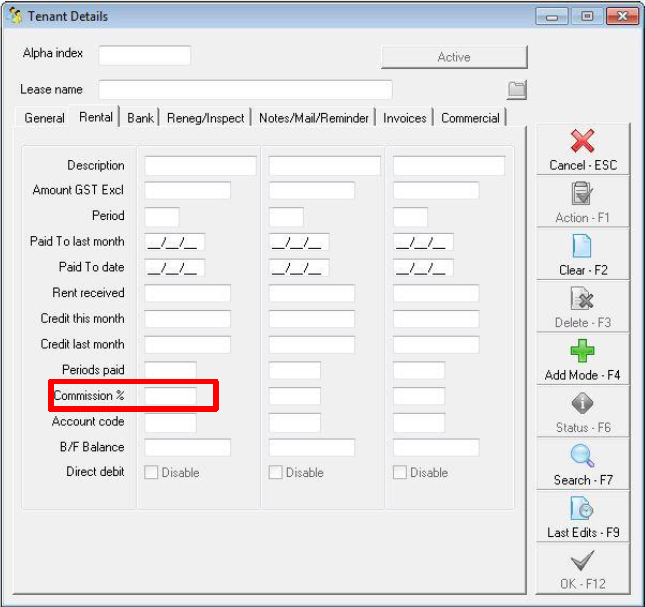

The management fee should be entered into the Commission % field via Files > Tenant > Rental or by clicking on the Tenant Details

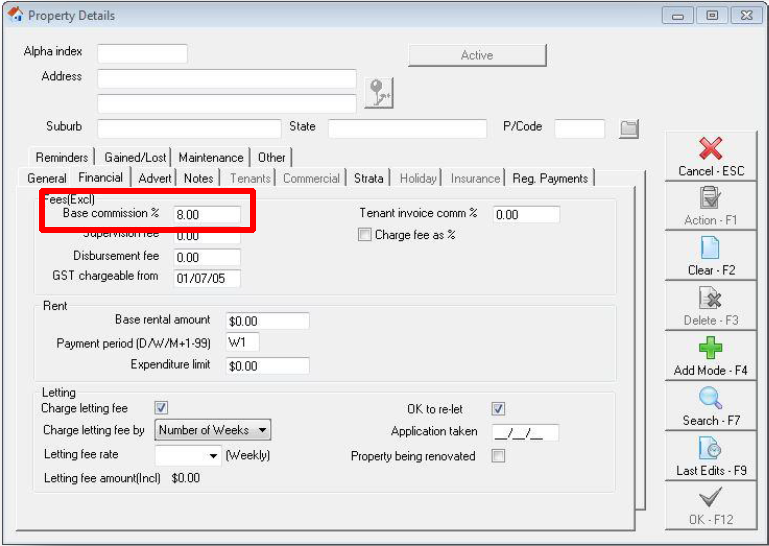

The management fee should be entered as the Base commission % field via Files > Property > Financial or by clicking on the Property Details

![]() Both these fields are exclusive of GST. REST will automatically calculate the GST on top of the base commission amount.

Both these fields are exclusive of GST. REST will automatically calculate the GST on top of the base commission amount.

How to Setup to Not Charge Management Fees

This process ensures an owner will not be charged management fees on any rent receipts entered after the change in REST.

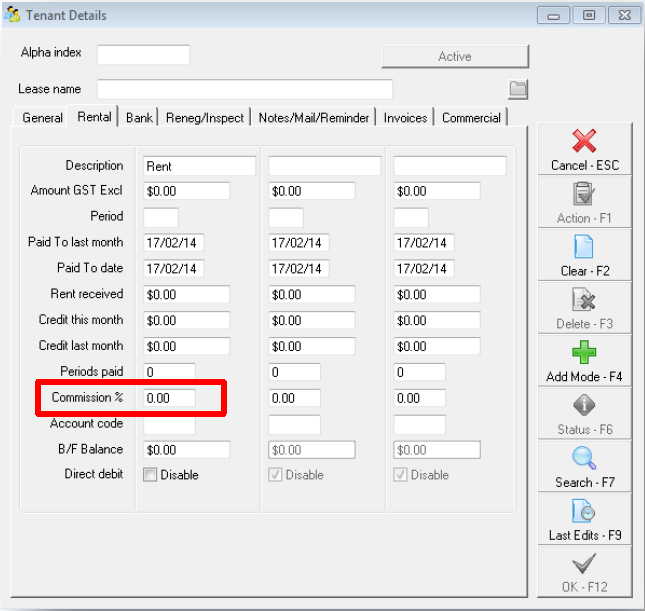

- Go to Files > Tenant Details and click on the Rental tab

- In the commission field, change the amount to 0.00

- Click OK-F12

- This will generate a WARNING that no commission has been entered, click OK

- You will now be prompted to update the property card. Say NO to this message (unless this is a permanent change to the commission). NOTE: if the management fee is removed for a specific period of time, ensure you set up an action/conversation diary reminder to re-enter the commission on a certain date. This can be added to the diary by going to Other > Action/Diary

How to Reimburse Management Fees Incorrectly Charged

This process will reimburse an owner that has been charged management fees during the management fee free period (for example, the management commission amount was not removed prior to the commencement of the fee free period).

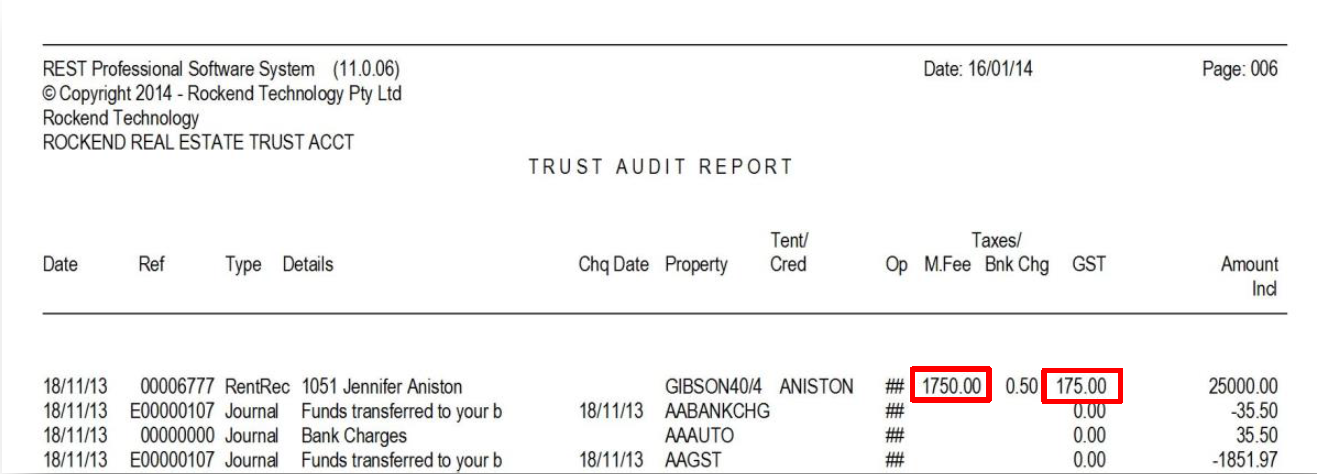

- Calculate the amount of overcharged managements including GST to be refunded. NOTE: You can ascertain the exact amount charged by checking the audit report by going to Cashbook > Audit Report, select the month that the rent was receipted in and ensure you tick Include Fees and click PREVIEW-F11

The Audit Report will display a list of transactions within the specified period and itemise the m/fees and GST charged on the receipt.

- Take note of the management fee and GST component charged

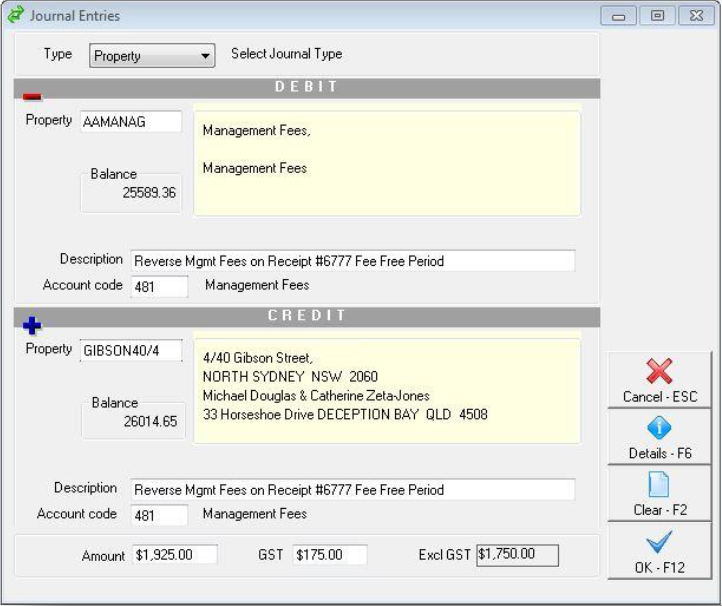

- Reverse the management fee via Transactions > Journals. Enter the details of the journal:

- Debit Property – select AAMANAGE internal account and press ENTER

- Description – Enter a description for management fees refunded

- Account Code – Use account code 481

- Credit Property – Select the property to be credited to

- Amount - Enter the amount (inclusive of GST) to reimburse the owner, and ensure the GST component is correct.

- Click OK-F12