Changing a Holiday Booking Amount in REST Professional

Overview

You may have a scenario where one of your Holiday Booking tenants lengthen or decrease their stay from the original dates booked.

In most cases, the tenant may have paid the whole amount or part of the amount, which may have been paid towards the deposit or applied to rent and sundries.

This document will cover:

- What to do in REST if the stay length is increased

- What to do in REST if the stay length is decreased

- What to do if monies already disbursed to owner and rent refund required

What to do in REST if the stay length is increased

You can go into the Booking Maintenance and edit the booking amount as follows:-

- Go to Holiday Bookings > Booking Maintenance and enter the alpha index of the booking and press ENTER

- Go to the Booking Tab

- Change the amount from the old amount to the new amount taking into consideration the extra amount of days of the stay

- Click OK-F12

NOTE: This method can be used regardless if the funds have been receipted to deposit or applied to rent.

- Receipt the extra days rent to the deposit until after the stay or if monies already applied apply directly to the rent.

What to do in REST if the stay length is decreased

There may be two scenarios that you will need to deal with if the tenant decides to leave early and funds need to be refunded depending on how monies have been receipted:

- Funds applied to holding deposit only

- Funds applied as rent and sundries in current period

- Funds applied as rent and sundries in previous period

Funds applied to Deposit Only

If receipted as a deposit only, this is easy to rectify. You can go into the Booking Maintenance and alter the booking amount. You will then enter the amount to be refunded into the sundries table, to be paid back to the tenant (as you would refund a bond refund).

- Go to Holiday Bookings > Booking Maintenance and enter the alpha index of the booking and press ENTER

- Go to the Booking Tab

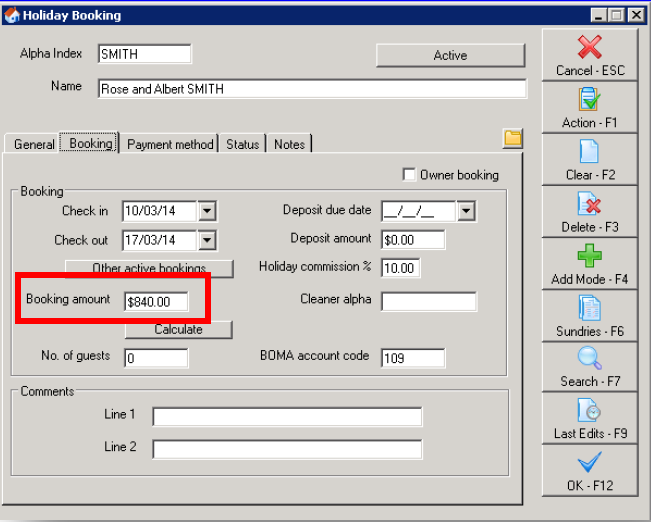

- Change the amount from the old amount to the new amount taking into consideration the amount of days early they are leaving i.e. Change from $840.00 to $720.00

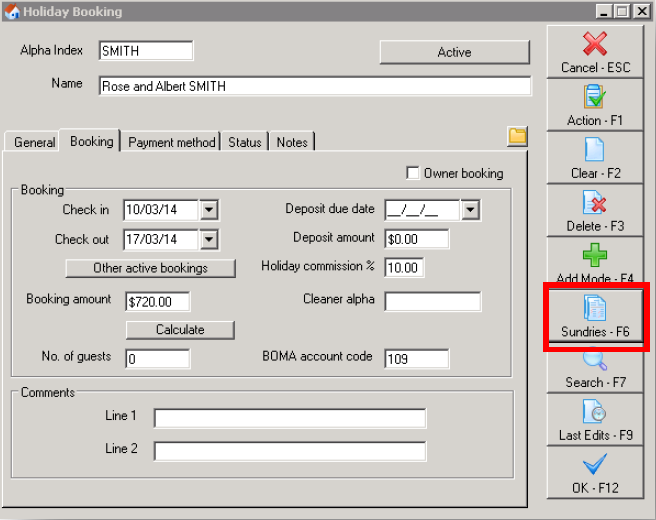

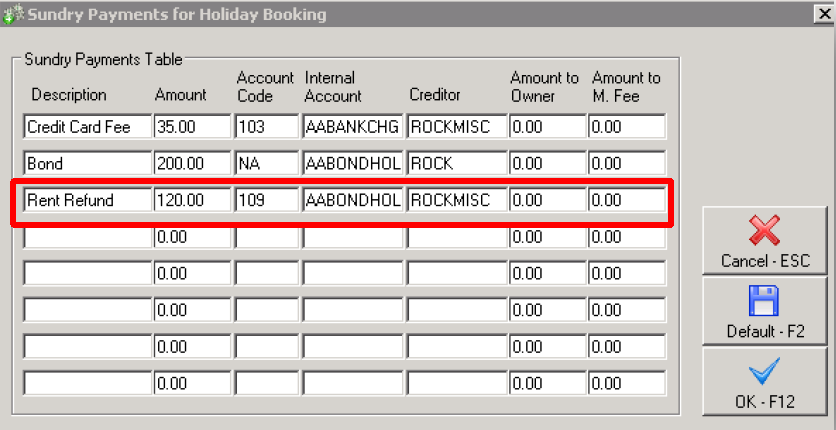

- Click on Sundries-F6

- Add in a sundry description i.e. Rent Refund (ensuring that the booking amount and the rent refund equal the same as the original booking amount)

- Click OK-F12 to the sundries screen. Click OK-F12 to the main screen

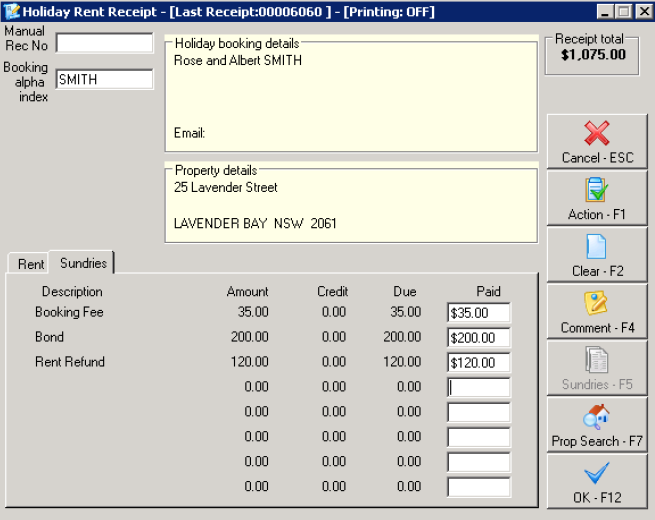

- When applying the deposit to the rent receipt pay the booking amount (i.e.$720.00) and then you will pay the extra rent amount to the sundries (i.e. Rent Refund $120.00)

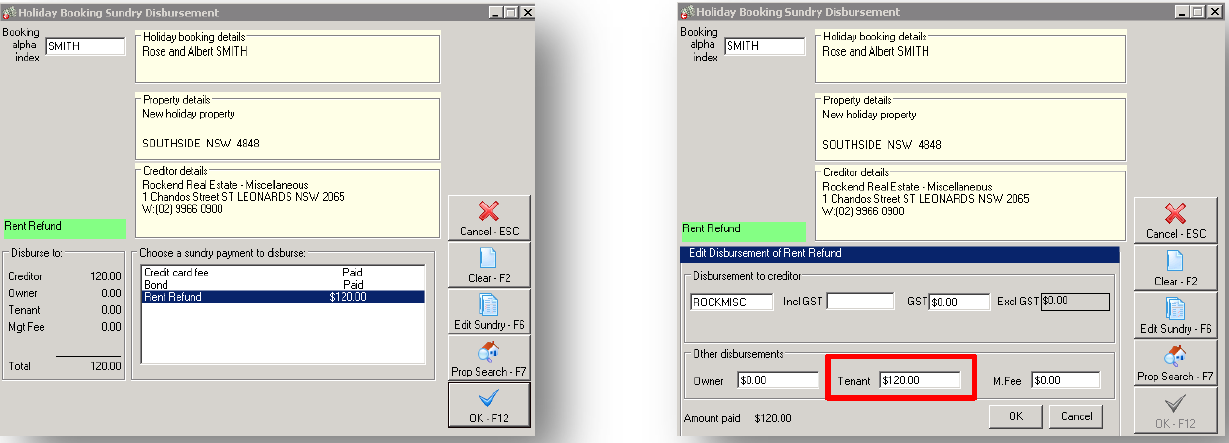

When sundry disbursing the holiday booking funds, go to Holiday Bookings > Sundry Disbursement and click on Rent Refund then click on Edit Sundry-F6. Change the amount to be paid to tenant from $0.00 to the refund amount i.e. $120.00 and click OK and click OK-F12.

Funds Applied as Rent and Sundries in Current Period

If the funds have been applied to rent and/or sundries in the current period, you will need to reverse the receipt and re-apply the correct amount to rent and as above the amount to be paid back to tenant as in sundries.

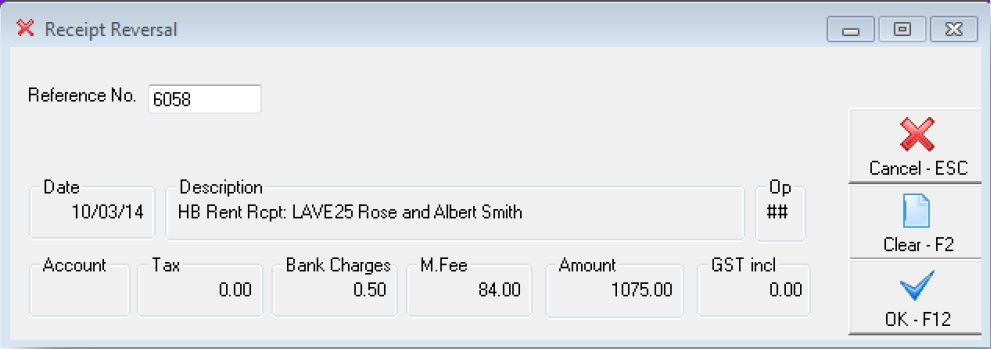

- Go to Transactions > Cancel Transactions > Receipt Reversal

- Put in the receipt number and press enter, proceed to cancel the receipt

- Amend the booking through Holiday Booking > Booking Maintenance as in previous steps (i.e. change the rent to the lesser amount and add in the amount to be refunded in Sundries-F6.

- Re-receipt by applying the deposit to the lesser rent amount and sundries as above using payment method Direct Deposit

Funds Applied as Rent and Sundries in Previous Period

If the deposit has been applied to rent and/or sundries in a previous period, you will not be able to cancel the receipt. We would recommend that the overpaid rent be disbursed out and receipted in against sundries and then disbursed to the tenant/booking:

- Go to Transactions > Quick disbursement and enter the alpha index of the property and press ENTER

- Incl GST – Enter the amount of the overpaid holiday rent and zero out the gst

- Cheque Number – Use self-presenting cheque number 999999

- Pay to – Tenants’ name

- Description – Overpaid rent from xxxx to xxxx refunded

- Account code - 109

- Refund any management fees on the refunded amount to the owner by doing a Journal. Go to Transactions > Journals and debit from AAMANAG (or AAManag), credit the Owners Property using account code 481 for the amount including the GST component

- Amend the sundries to reflect the refund. Go to Holiday Bookings > Booking Maintenance and click on Sundries-F6 and add in a new Sundry description Rent Refund for the amount that you are refunding, use account code 109 (Holiday Income) and click OK-F12 to the Sundry Payments screen. Click OK-F12 to the main screen.

- Receipt the amount to Sundries. Go to Holiday bookings > Rent Receipt and click on the Sundries tab. Make the payment method direct deposit.

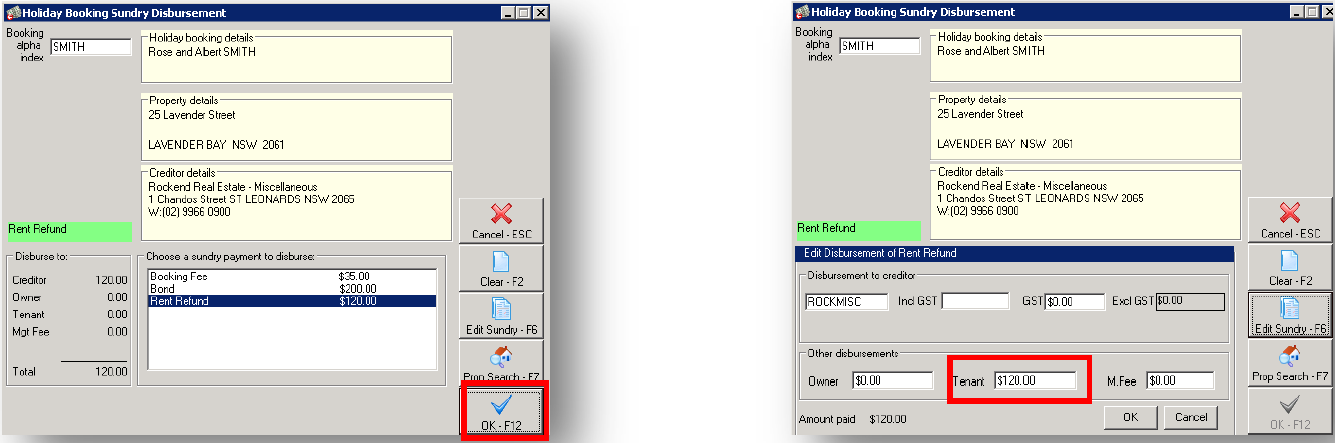

- Do a sundry disbursement to the tenant. Go to Holiday Bookings > Sundry Disbursement. Click on the Rent Refund to disburse and then click on Edit Sundry-F6

- Take the amount out of the Disburse to creditor field and populate the refund amount in against the Tenant and click OK. Click OK-F12 against the main screen.

- Payout the tenant set up as a temporary creditor by going to Reports > Creditor > Remittance and Payment and follow the prompts remembering to create the ABA file for upload to bank through Transactions > Create file for upload to Bank > EFT (ABA) Payments.