Reversing Overcharged Management Fees in Rest Professional

Problem

An owner has been overcharged management fees and needs to reimburse this to the owner.

Solution

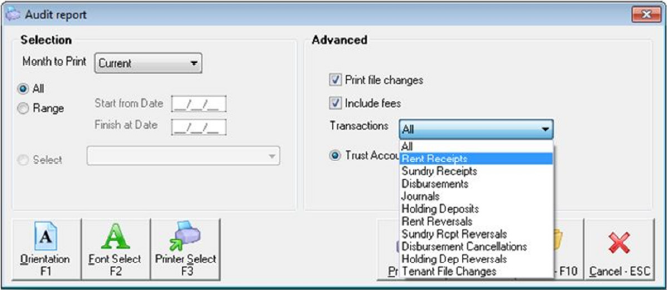

- Determine the incorrect management fee charged against an owner. The most common way to determine this is via Cash Book > Audit Report. Select the appropriate month to print and date range in the Selection Items, then select Print File Changes, Include Fees and Rent Receipts in the Transactions drop-down menu in the Advanced Items.

![]() Depending on the circumstances and the amount of rent charged, the management fee may need to be manually calculated.

Depending on the circumstances and the amount of rent charged, the management fee may need to be manually calculated.

- Click on Preview. Rest should then display the appropriate transactions in accordance with the criteria selected. The management fee charged on each receipt is displayed on this report.

- The reversal of the management fee can be reimbursed by doing a journal. To do this go to Transactions > Journals, provided there are enough funds in the AAMANAG internal account.

- Debit Property – The property to debit is AAMANAG. This is where Rest is currently holding the charged fees

- Description – Enter a description of the reversal, such as “reverse Incorrectly charged Management Fees on receipt ######’

- Account code – Enter the Account code 481 -

- Credit Property - Enter the property to reimburse the management fees to

- Description and Account Code in the property to credit will automatically populate with the same data entered in the debit portion of the screen

- Amount - Enter the total amount to journal, inclusive of GST. The GST component can also be modified

When Can An Owner Be Overcharged Management Fees?

An owner can be overcharged management fees when:

- The management fee charged in the Financial tab of the Property Details is not consistent with the management fee charged in the Rental tab of the Tenant Details, see the below example

![]() The management fee charged is based on the Commission % entered into the Rental tab of the Tenant Details.

The management fee charged is based on the Commission % entered into the Rental tab of the Tenant Details.

- A management fee-free period is not reflected in Rest - For example, as part of an agreement for a new management, an owner is entitled to a management fee free period of one month. To reflect this, the management fee should be changed to 0.00% in the Tenant Details on the Rental Tab. Unfortunately the fee amount was not changed; hence the landlord was charged management fees on rent collected during the management fee-free period.

- A management fee amount has not been correctly entered into REST - For example, a management fee of 8.00% excluding GST is to be charged to an owner for managing a property. However, the management fee was entered as 8.00% inclusive of GST.