How to Reverse a Sales Receipt in Rest Professional

You may be required to reverse a sales receipt created in Rest for various reasons.

This document will assist you to:

- Reverse a Sales Receipt (Current Period)

- Reverse a Sales Receipt (Previous Period)

- Re-receipt a Sales Deposit (Previous Period)

Steps to Reverse a Sales Receipt (Current Period)

- Ensure you have the receipt number. You can get this from the Sale Ledger if you are unsure

- Go to Transactions > Cancel Transaction > Receipt Reversal

- Enter the sale receipt number in the Reference No. field and press enter

- Check the details and description of the receipt you are about to cancel and then click Yes to the message to confirm cancellation of the transaction.

How to Reverse a Sales Receipt (Previous Period)

Sale Receipts from a previous period cannot be reversed in Rest. You will need to process a Sale Disbursement to manually cancel the receipt. You can do this as follows:

- Go to Transactions > Sales > Disbursement or click on the Sale Disbursement icon

- Enter the Sale Property Alpha

- Select From Trust Account

- Select To Buyer (or whoever the funds have been received from)

- Payment method must be Cheque.

- Change the Payee Name to “Cancelled Sales Deposit Receipt”. Press OK. Say No to update the buyer’s details on the property file when requested.

- Enter the Amount ensuring that the GST is set to zero

- Enter the Description ‘Reverse Sales Receipt No XXXXXX’

- Enter a Ref/Invoice as the property address

- Click OK-F12

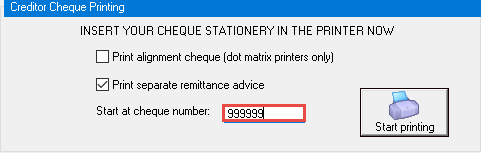

- Enter the cheque number as 999999 (self-presenting cheque number)

- Click Start Printing

- Click on Print to print the remittance advice and to print the cheque

![]() If you are manually cancelling a Sales Deposit receipt, you must be aware that the deposit amount information has not been updated to reflect the refunded/cancelled amount. As a result Rest will show that you have taken the deposit and any further sales deposit receipts will be added onto the initial amount receipted.

If you are manually cancelling a Sales Deposit receipt, you must be aware that the deposit amount information has not been updated to reflect the refunded/cancelled amount. As a result Rest will show that you have taken the deposit and any further sales deposit receipts will be added onto the initial amount receipted.

Steps to Re-Receipt a Sales Deposit (Previous Period)

If you need to re-receipt a sale deposit that you have cancelled from a previous period, ensure you select TYPE as Sundry if receipting to the same Sale Card. If Type is selected as Deposit, It affects the Account Sale Report by duplicating the deposit and commission amount on the report. Below is instructions on how to receipt to the same sale card a sales deposit without affecting the deposit amount:

- Click Transaction > Sales > Receipts or Sale Receipt icon

- Enter the Sale Property Alpha

- Select From Buyer (or Solicitor Buyer if applicable

- To Trust Account

- Select Type Sundry from the drop down list

- Enter the Amount ensuring that any GST component is removed

- Enter the Description i.e./ Re-receipt Sales Deposit cancelled on xxxxxxx

- Click OK-F12

- Enter the banking details for the receipt and the banked date as at the original receipt date if by Direct Deposit. Select OK-F12