How to Setup Linked Disbursements in REST Professional - Advanced Commercial

Overview

This option is available in REST Professional if you have the Advanced Commercial Module.

It links a commercial tenant tax invoice with a creditor outstanding disbursement and does not pay the disbursement to the creditor until the tenant invoice is paid. When the invoice is paid, REST automatically process the outstanding disbursements linked to the paid tenant invoices. If the tenant invoice is part paid then the creditor disbursement will be part paid.

The outstanding disbursements created by linked invoices are treated differently from other outstanding disbursements in that REST does not withhold owner funds at statement time for these and they are shown separately on the outstanding disbursements tab of the Owner Details.

NOTE: The system option to save all creditor disbursements as outstanding must be switched on.

Set Up

You will need a response code from Rockend Support to activate Linked Disbursement. To turn on linked disbursements go to Other > Utilities > System Options > Miscellaneous Tab and check ‘Pay linked disbursements’.

When you switch on this option REST will also switch on the system option to save all disbursements as outstanding which must be enabled before linking can work. When this option is selected, all creditor disbursements are posted to the outstanding disbursement file regardless of whether there are sufficient owner funds. By using this option, you may prioritise the disbursements and when you process outstanding disbursements at the end of the month, the disbursement will be processed in the order of priority set. The option does not apply to internal accounts. If there are sufficient funds, disbursements from internal accounts are posted immediately.

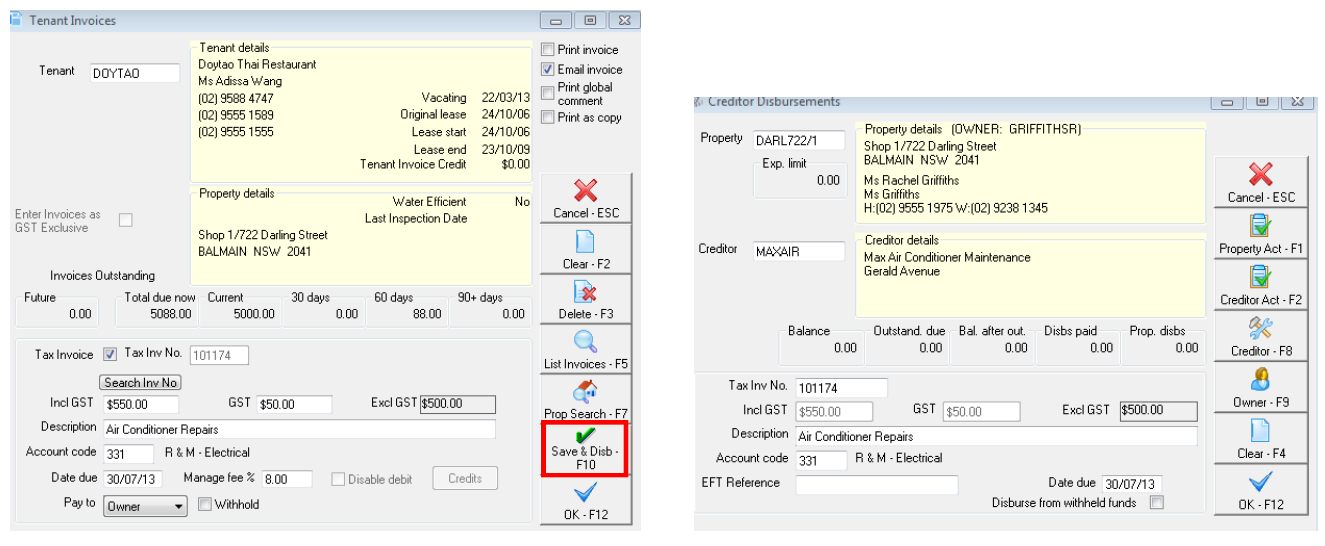

Linking the Disbursement to the Tenant Invoice

- Select Transactions > Invoice Entry and enter the details of the invoice and click OK-F12

- Click on Save & Disb F10

- The Creditor Disbursement screen will now appear

- Enter the Creditor alpha and press enter

- You will note that the tax invoice number generates from the tenant invoice and the amount of the disbursement and the description defaults also from the tenant invoice

- Enter the Account Code

- Enter the Reference and click OK-F12

- Select Priority – Select from Normal, High or Must Pay for the disbursement

When the tenant invoices are paid REST checks whether the invoices are linked to disbursement, and automatically processes the linked outstanding disbursements and if there is sufficient funds, creates creditor payments for the invoice amounts paid.

If the owner has insufficient funds, REST will display a message reminding you to process outstanding disbursements when there are sufficient funds. If the tenant invoice is part paid, then a creditor disbursement is created for the part paid amount and the amount of the outstanding disbursement is changed to the balance owing on the invoice.

If there are insufficient funds in the owners account to cover any fees related to the invoice or linked disbursement, such as Tenant Invoice Commission and/ or Bank Charges, outstanding disbursements will be created for the fees.

Linked invoices & applying a credit

You may not enter credits against tenant tax invoices that are linked to outstanding disbursements. If you want to add a credit to a linked tax invoice, you must first cancel the linked outstanding disbursement.

Edit/Cancel Outstanding Disbursements

You may not change the amount of an outstanding disbursement that is attached to a tax invoice and you may not change the tax invoice number so if you have made an error, you have to cancel the outstanding disbursement and enter a new one.

When you cancel an outstanding disbursement that is attached to a tax invoice, REST warns that a tax invoice is linked to the disbursements before proceeding with the cancellation.

Receipt Reversals

You may not reverse a tenant receipt that includes linked tenant invoices if the outstanding disbursements for those invoices have been processed. You should cancel the creditor disbursements which will return them to outstanding disbursements and then reverse the receipt.