Understand Negative Interest on a Lot Owner Ledger in Strata Master

Summary

Negative interest on Owner Cards is caused by -

- grace days or interest free periods being changed to a greater period

- interest rates on overdue levies being decreased without using the 'Adjust Levy Interest Rate' button

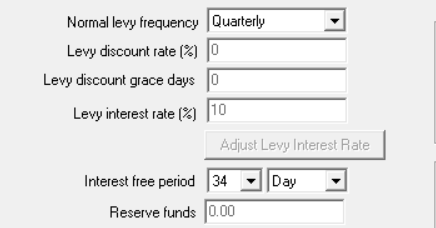

Grace Days / Interest Free Period

From time to time, a change to grace days or interest free period may be voted by an Owners Corporation. Changing these figures for any other reason is not recommended.

If you go to the Corp screen > financial tab > and simply change the grace days or interest free period, this will affect levies due from previous due dates.

Increasing grace days or interest free period can result in an owner showing negative interest if they have been paying interest. Strata Master recalculates the interest due according to the new setting. This can result in the owner having paid more interest than is calculated to be due.

Owners who have debt recovery in place due to overdue levies, will gain from an increase in grace days from 34 to 40 for example. They will gain because the interest owing will reduce.

An Action You Can Take to Overcome Lost Interest

We suggest you review this article regarding interest rate changes, Interest Rate Changes - WA Legislation Update 1 May 2020 | MRI Knowledgebase (rockend.com). It will guide you to check reports for interest accrued prior to any change to interest settings and then check the same report after the change. You can then process miscellaneous owner invoices to Lot Owners whose interest has reduced, or provide Credit Lot where Lot Owners interest has increased as result of the change.

Interest Rates

Versions From 12.0.4

A function was introduced in version 12.0.4 to allow interest rates to be changed from a set date. This will overcome any negative interest arising.

Select edit and click the button 'Adjust Levy Interest Rate'.

Versions Earlier Than 12.0.4

If your Strata master is an earlier version, and you do not have the 'Adjust Levy Interest Rate' button as above, you will need to read on.

Although the interest rate can be changed in Corp > Financial tab, be aware that simply editing the rate button 'Levy interest rate %' to a lower rate will adjust historical interest arrears. This means that the full amount of interest accrued per lot will be adjusted which will result in some owners having a negative interest figure. Please refer to this article for information on how to account for the change in interest that will result from a % change -

Interest Rate Changes - WA Legislation Update 1 May 2020 | MRI Knowledgebase (rockend.com)

When a Change is Temporary and Short Term

Temporary Grace day or Interest free period increases are sometimes provided when levies are processed late.

In this situation there will be a temporary reduction of the levy interest accrued on ledgers. However when the grace day or interest free period is reinstated at its original setting, the accrued interest will recalculate. Where the change is short term, the accrued interest on ledgers can be the same or similar to the amounts prior to the change.

This will not be true of all ledgers as the individual scenarios can vary from ledger to ledger.

| Note - This is important to bear in mind should there be a query on accrued interest figures at a later date. |