Cash and Cheque Deposits To the Strata Trust Account - Banking

This article will assist you -

- locate a difference in your bank reconciliation

- when you receipt funds and do not see the receipt showing on your bank reconciliation

- recognise that you may have cash or cheques in the agency that need to be taken to the bank.

The Scenario

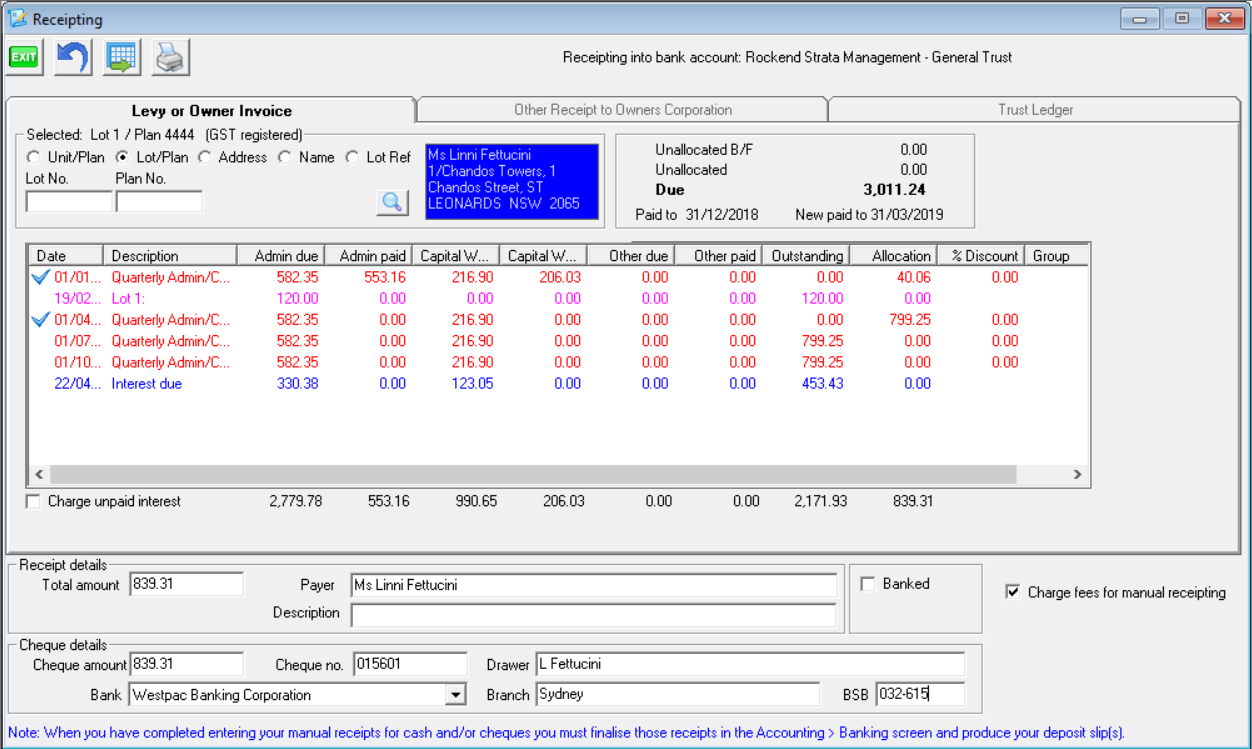

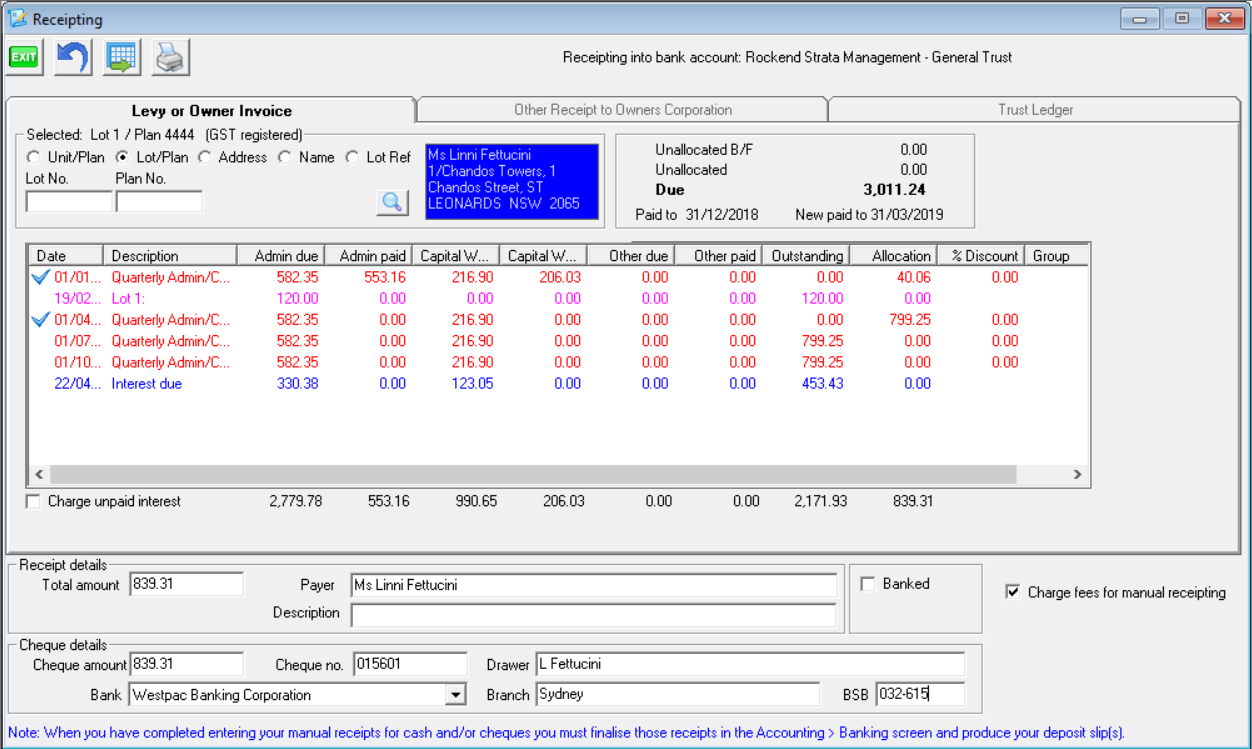

A Lot Owner posts a cheque in the sum of $839.31 to you for payment of levies owing on her Lot 1 property.

The Process

- Receipt the cheque funds to the owners Lot by clicking on the Receipt icon in your toolbar.

- Enter the total amount of the cheque, the cheque details and ensure you select, with blue ticks, the levies you want the funds to apply to.

- It is very important to ensure the box 'Banked' is left unticked, as this show the funds have not yet been banked and have not appeared on the bank statement.

- Then click on the process button, beside the print button.

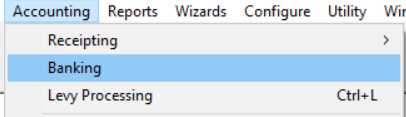

- Once the funds are receipted, and you are ready to collate banking, select the Accounting menu and the select 'Banking'.

- When the banking screen opens, you will notice that it is blank .... until you click on $ symbol. This does provide some security where the funds you are holding are not easily observed by others.

- The screen will then populate as below.

- If you have a cash figure, find a safe place to count the funds and ensure the figure matches with the amount on the Banking screen. There are times when this may differ. In this case, you will need to find out the reason for the difference. For example, someone may receipt funds and then take them to the bank without processing through the Banking screen. If that has been done, the bank reconciliation will not balance.

- When ready to take cash and cheques to the Bank, click on the Preview button

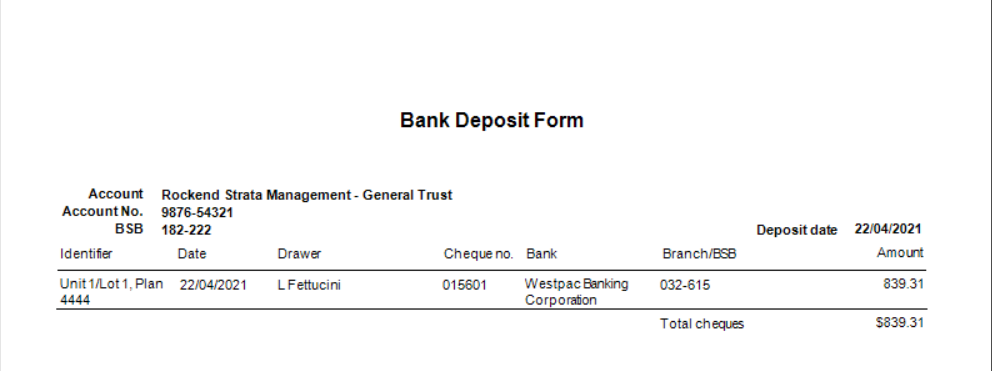

- The Bank Deposit Form shows, with details of any cheques received. You can print the form and take it with you to the bank. Best Practice is to also print a copy for the office, especially if you make any alterations. In the case of alterations, make a note of the reason for the alteration that will 'jog' your memory in 12 months time when you are asked for an explanation.

- If you have individual trust accounts, and receipts are for differing Plans, then you will have more than one Bank Deposit Form. If you click Exit on the top form, the next form will show.

- When your forms are printed or saved, and you are happy with the figures in Banking, click the Process button.

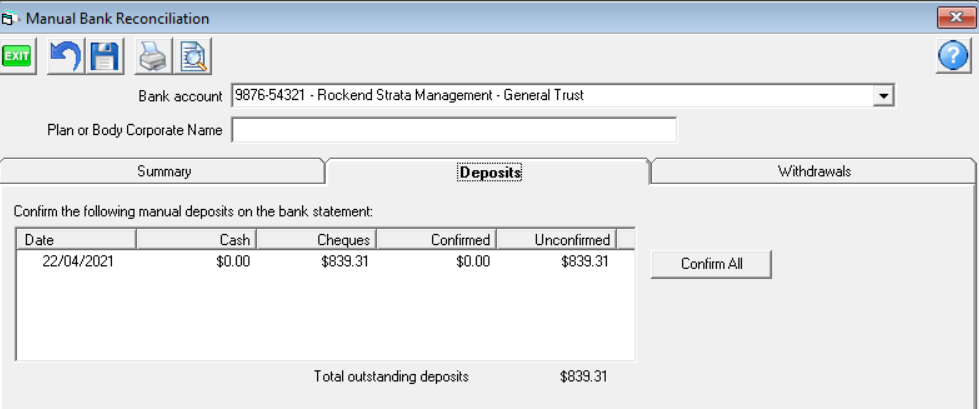

- Your bank reconciliation will then show the Bank Deposit total on the Deposits tab as below. From this you can see that if the Bank Deposit Form has not been processed, the funds will not show in the Bank Reconciliation despite having been receipted, so the bank reconciliation would be unbalanced.