Saving Your Bank Reconciliations in Strata Master

At any future date, you may be asked to produce a bank reconciliation for a particular date. Do do so, you will need to do more than just click the 'Save' button in the bank reconciliation screen. The save button only holds the figures you have entered, or items on tabs ticked, for the next time you open the screen. It does not print or save a copy.

Best Practice

The minimum standard for Bank Reconciliations is to save a hard or soft copy of a balanced bank reconciliation at the end of each month.

To be able to produce balanced bank reconciliations for each Plan, or a large Single Trust Account, each month, it would be expected that the Bank is reconciled throughout the month.

Our recommendation is that bank reconciliations be the first activity each morning before bank downloads or further transactions are made. If there are minimal transactions, then there is minimal time taken to balance.

Bank Reconciliation Report

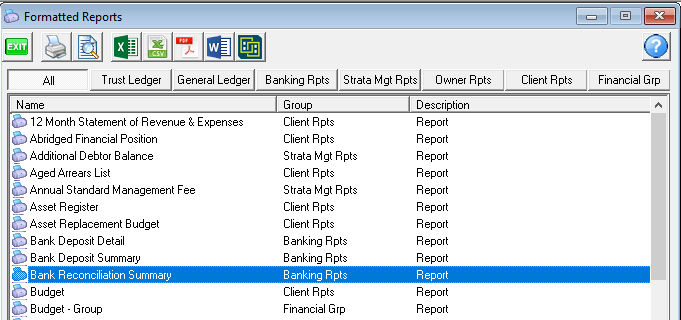

1. Select Form Rpts from the top toolbar > Bank Reconciliation Summary

2. The report that opens will show any unbalanced trust accounts.

3. You will notice, in the example above, that this report does not show details of the Outstanding Deposits or Unpresented Withdrawals. The report also lists each Strata Plan thereby providing a quick check of the trust account status. This report is suitable only for Agency use, and would not be issued to Owners Corporation members as it would create Privacy Act issues.

It is therefore necessary to save a copy of the individual Bank Reconciliations at the end of each month at a minimum.

Navigating to Bank Reconciliations

You will find the individual bank reconciliations by selecting Accounting from the top toolbar and then Manual Bank Reconciliation from the drop down menu.

Saving a Hard or Soft Copy of the Bank Reconciliation

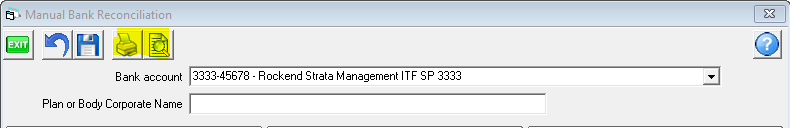

1. As mentioned previously in this article, the Save button will -

- hold the figures you have entered and any items you have ticked, will remain with ticks. This is particularly useful when you are interrupted after entering the bank statement figure.

- update the Bank Reconciliation Report discussed above.

2. Both the Print button and the Preview button will open a preview of the Reconciliation, which will list any items creating outstanding deposits or Unpresented Withdrawals.

3. This can be important if you are trying to reconcile. You can look back at previous reconciliations and view those outstanding or unpresented items items that have been ticked off since, possibly in error.

4. Once the preview has opened, you can then select from the buttons to save to excel, save as csv, save as a pdf or save as a Word document. For auditing purposes you would save as a pdf, as the other options are editable.

5. If you prefer, your other options are to email yourself a copy, or click the printer button and print a hard copy.

6. Which ever method you select is your choice. The main point is that you save a copy.

Not Balanced ?

When your bank reconciliation is not balanced, we suggest you save the figures you have entered as it prevents re-entering the bank statement figure over and over. There will be a pop up asking 'are you sure?' and reminding you that the bank is not reconciled.

Useful Links

https://kb.rockend.com/help/how-to-tick-off-transactions-bank-reconciliation

https://kb.rockend.com/help/bank-reconciliation-does-not-balance

https://kb.rockend.com/help/cash-and-cheque-deposits-to-the-strata-trust-account-banking