Correcting an Expense Account Used in a Creditor Payment in Strata Master

Summary

This article will provide you with an overview of the methods that are used to correct the expense account entered when the invoice was recorded. There will be links to articles with more detailed steps if required.

- Overview

- Current Period and Same Fund

- Prior Period and Same Fund

- Current Period But Different Fund

- Prior Period But Different Fund

Overview

When entering a Creditor Invoice, an expense account is selected. You may be required to later change that expense account, as seen in the detailed expenses report. When the invoice has been paid, the expense account selected in the invoice can be changed

The Invoice carries the expense account information so this is the transaction to be corrected, not the Payment.

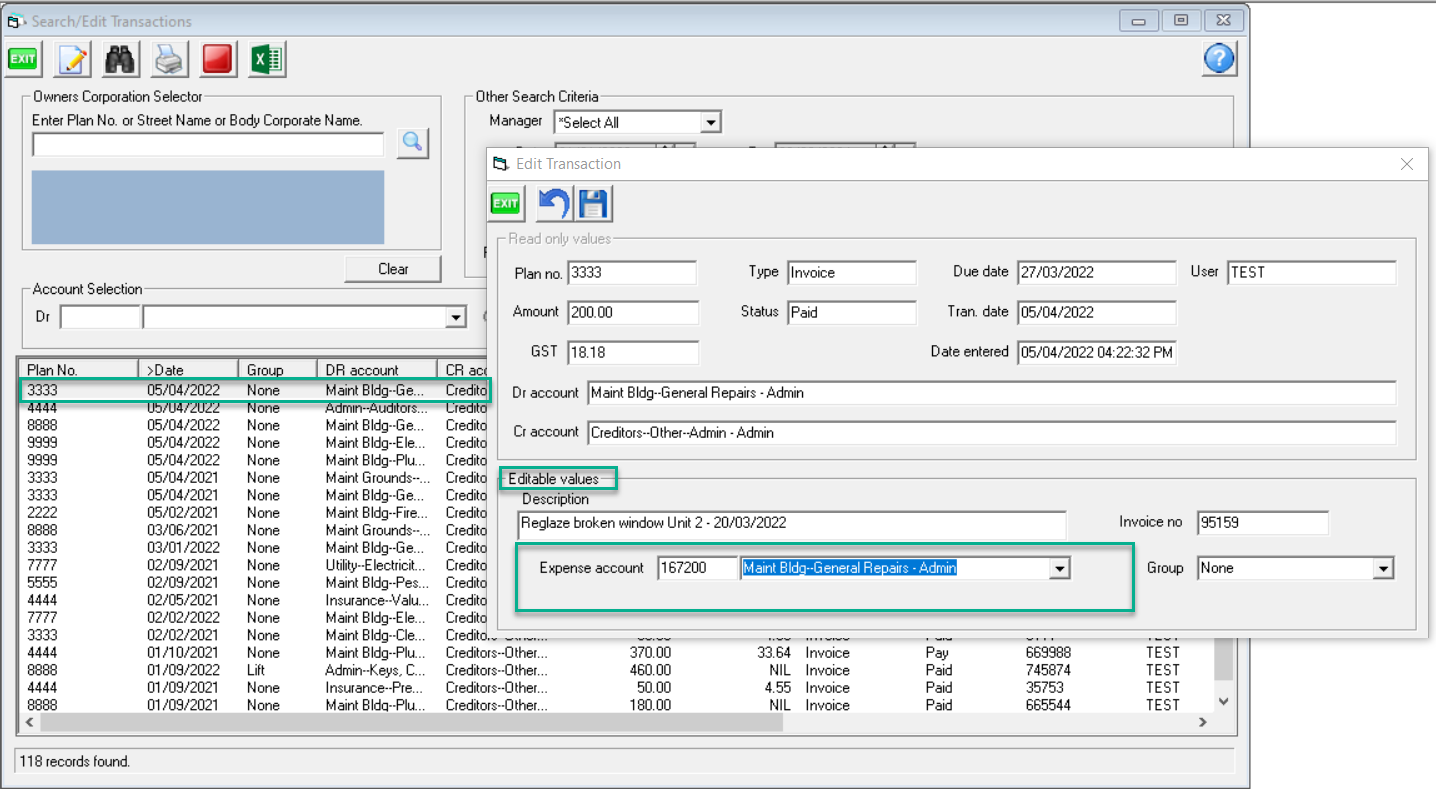

Current Period and Same Fund

This refers to the transaction when it is still in the Current Financial Year Period.

If the invoice was in the current period, and is to be changed to an expense in the Same Fund (Admin or Sinking) you can edit the expense account in the Search/edit Transaction field. Note that the GST code also needs to be the same, and usually is amongst expenses.

To make the edit -

- double click on the relevant invoice transaction, and

- edit the expense account, then

- click the save button.

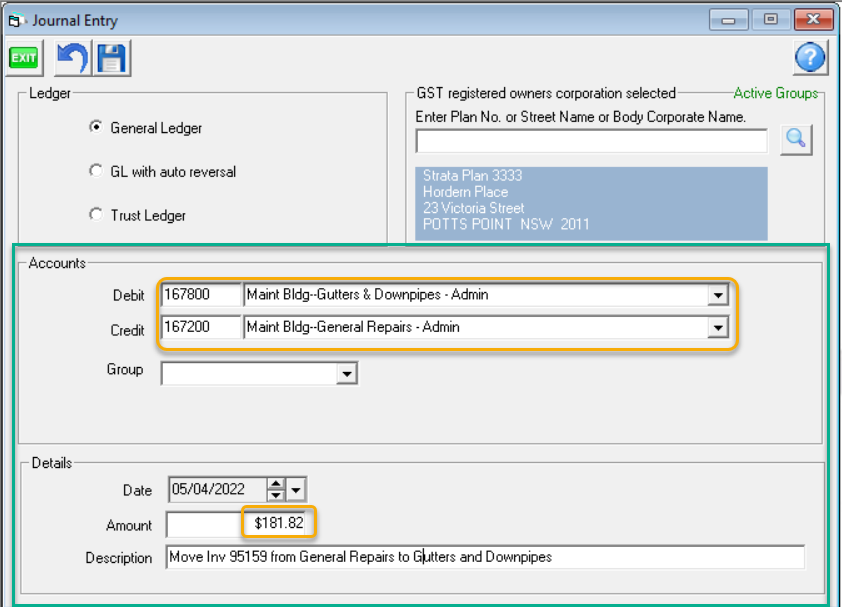

Prior Period and Same Fund

This refers to the transaction when it is prior to the last rolled Financial Year End.

You can do one simple journal Debit--the correct expense account and Credit--the incorrect expense account, amount gst exclusive figure if the Plan is gst registered. Backdate if you wish as prior financials change is only the account that the transaction is listed under.

Screenshot below is using transaction in the search/edit transactions screenshot above.

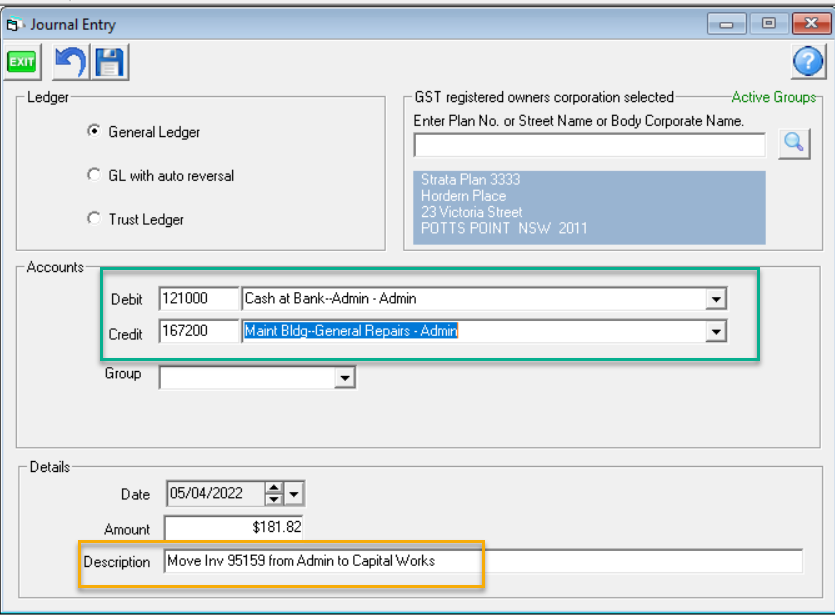

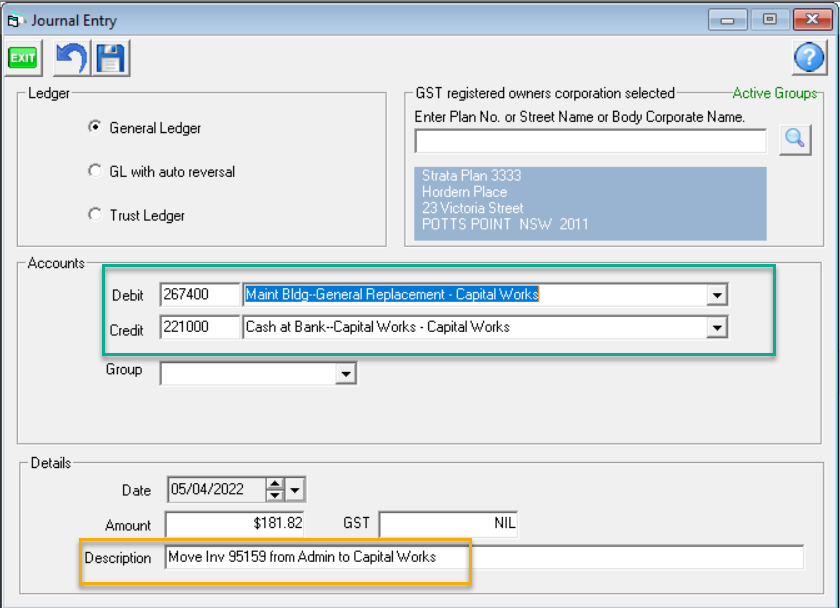

Current Period but Different Fund

This refers to the transaction when the transaction is in the current period but need to be reallocated from Admin to Sinking or the reverse.

If the invoice was in the current period, but is to be changed to an expense in the other Fund (Admin or Sinking) you will need to do 2 journals as in this article. One journal to reverse the invoice as it is now, and one journal to re-enter it into the other fund. You can use the gst excl figure.

Screenshot below is using transaction in the search/edit transactions screenshot above.

Prior Period but Different Fund

This refers to the transaction when the transaction is in a prior period but needs to be reallocated from Admin to Sinking or the reverse.

Refer link in " Current Period but Different Fund" as 2 journals are always required if you are changing an account to a different Fund.

The difference will be deciding the date to use and whether the change has been, or needs to be, approved by the Owners Corporation.