How to Audit Tenant Holding Deposits

Overview

If you are using tenant holding deposits, it is important to ensure you are auditing the reports monthly to ensure they are reconciled. This document will take you over the steps to ensure the Tenant Deposits Held report matches the internal owner account for Tenant Holding Deposits.

Steps

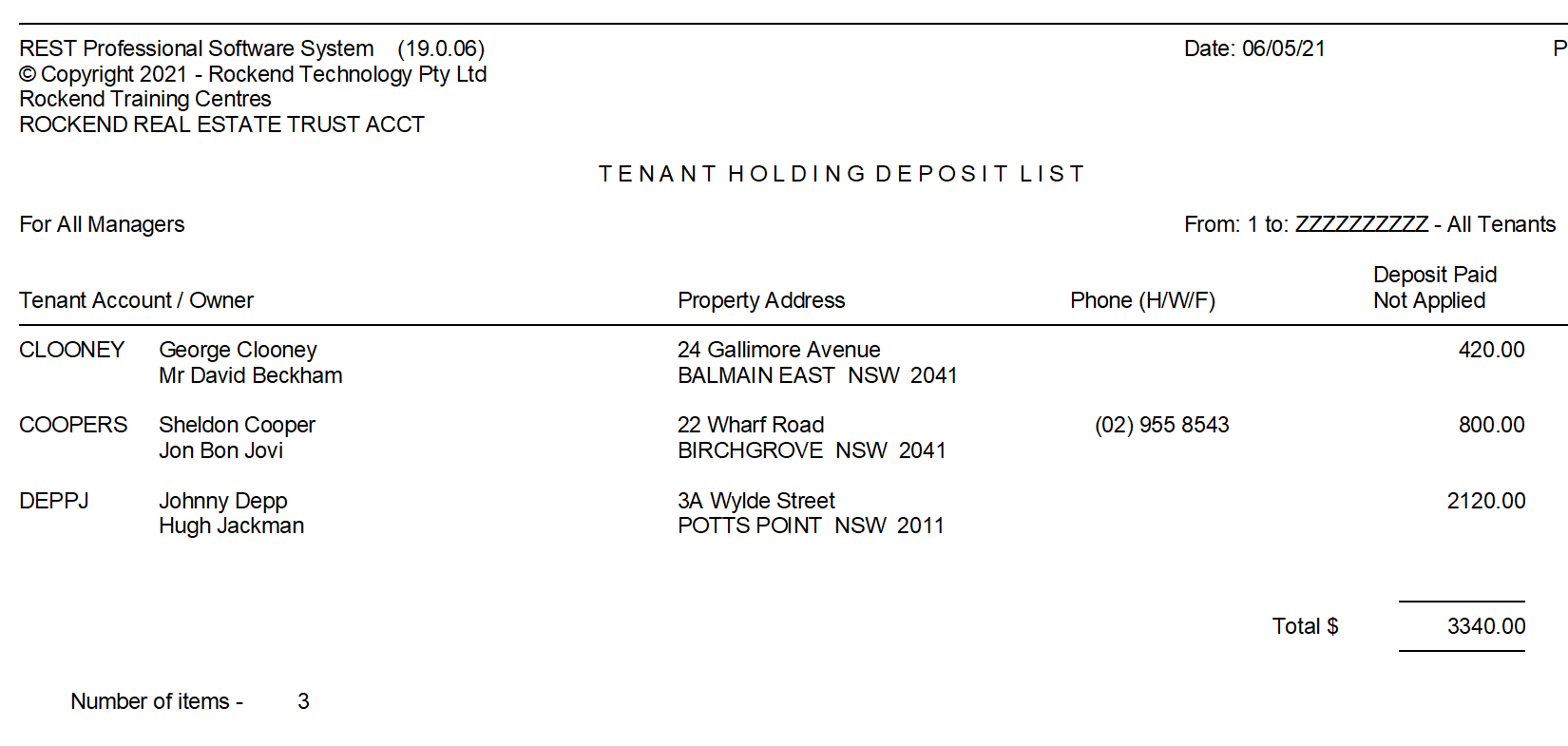

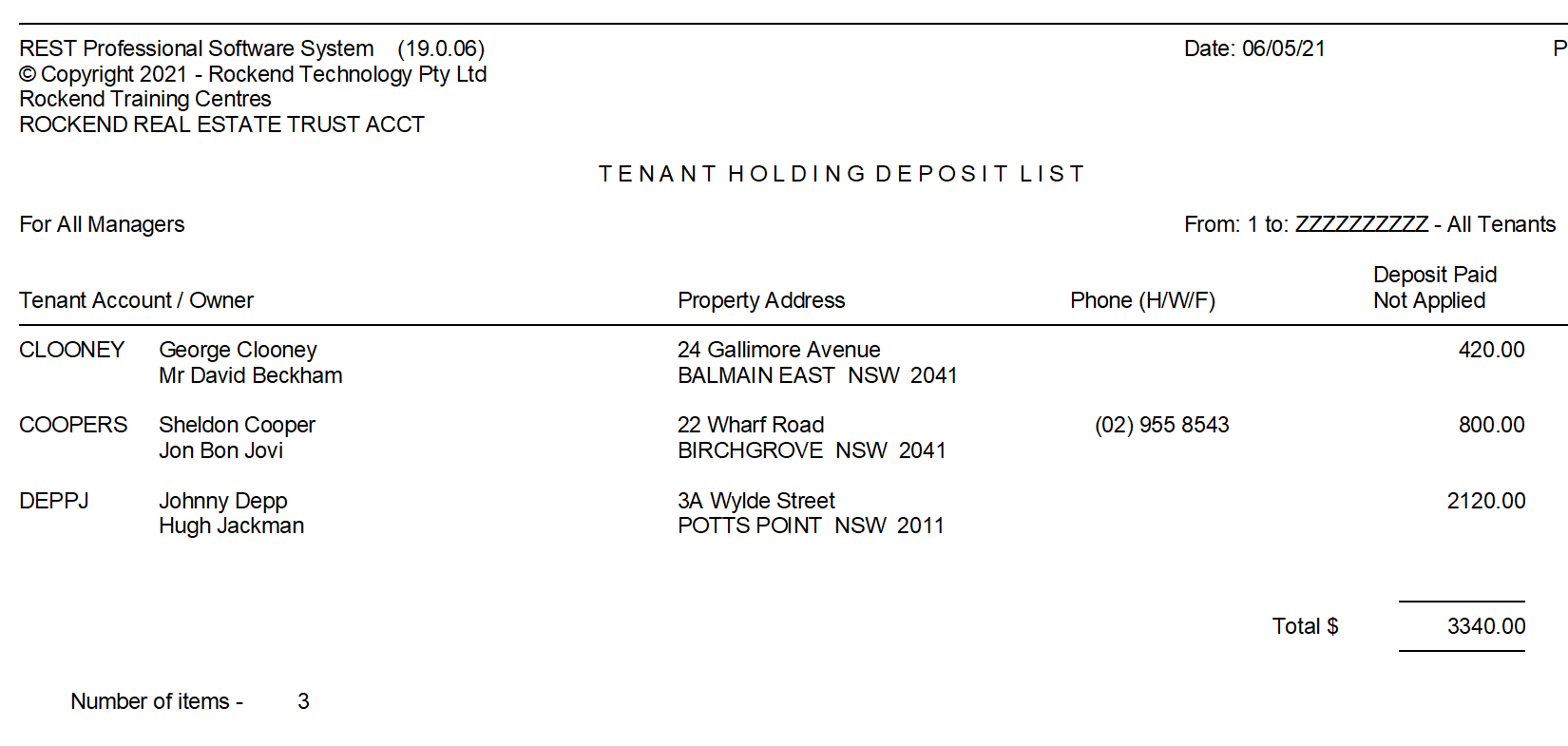

- Generate the Tenant Deposits Held report by going to Reports > Tenant > Deposit Report > Preview (no need to change any of the selections). Make note of the Total $ amount at the bottom of this report.

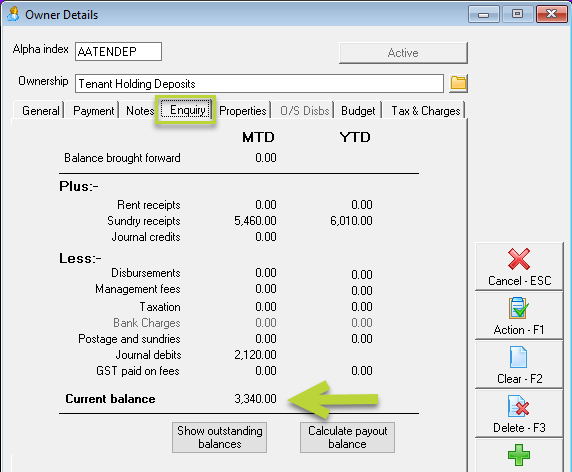

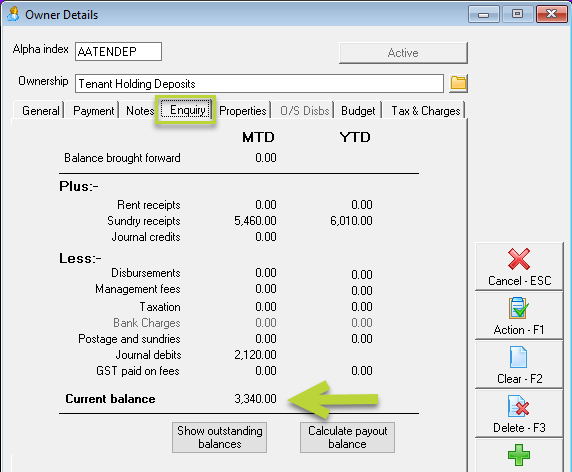

- Compare this amount with the balance of the Tenant Holding Deposits owner ledger by going to Files > Owner > AATENDEP and select the Enquiry Tab and refer to the Current balance.

If these amounts balance, congratulations - your tenant holding deposits are reconciled!

If they are not reconciled, you will need to investigate this further to determine what has caused the Tenant Deposits to be unreconciled.

Troubleshooting

Compare the Tenant Deposits Held report against the AATENDEP internal owner ledger.

If this is the first time you are reconciling this internal account, you will need to view the complete history of the AATENDEP ledger.

If you reconciled last month but the opening balance was not at $0, you may still need to view previous months to see the holding deposit transactions that make up the brought forward balance.

Refer to the tenants listed on the Deposits Held report, and locate the corresponding credit transactions for those tenants in the AATENDEP ledger and circle these as these should still be held in the AATENDEP account.

All other tenant deposits would have already been either reversed, applied to rent or refunded/confiscated. Therefore, for every credit receipt going in for a tenant, you should see a debit transaction that may say "Applied as Rent: Tenant Name" going out. You need to find the matching pairs and cross these out. Alternatively, you may see a credit receipt and then a reversal receipt which would be a match to cross out as well, or you may see that the credit receipt was disbursed out via a quick disbursement or creditor disbursement either back to the tenant or to the owner. These should all be matched up and crossed out. (some instances the deposit may be paid in installments, and similarly may have multiple disbursements making up the total deposit amount too.

Once you complete matching everything, any orphaned transactions will give you clues about what any additional funds may relate too so that you can disburse the funds back to where they belong.

On the flipside, if you there is a transaction has been disbursed/reversed too many times, you might find that you need to get some funds back in order to balance.

Tips to avoid an Unbalanced Holding Deposit

- Ensure there are no transactions made directly to or from the AATENDEP ledger, all transactions should be receipted via the tenant.

- When receipting a holding deposit, create the tenant card and go to Transactions > Deposit Receipts and receipt against the tenant, this will ensure the funds show on the deposit held report and can later be applied accordingly, correctly.

- If the tenant application has fallen through and you need to refund the deposit, allocate the funds to Tenant Invoice Credit and then refund to the tenant through "Allocate Tenant Invoice Credit"

- Should the tenant forfeit their holding deposit and the funds need to be applied to the owner, create a tenant invoice against the tenant card and allocate the tenant holding deposit to this invoice.

- Further instructions on the above tips can be found here:

For further assistance, please access our Customer Lounge where you will find our Live Chat in the bottom right hand corner, or you can register/login to the myMRI Portal to log a support case instead.