How to Manually Adjust a Tenant Ledger

This document relates to Rest Professional Databases on Inclusive dates only.

How do I know if my system is on inclusive or exclusive dates?

Open a tenant Master File: Files > Tenant, insert Alpha Index of the tenant > Rental Tab

- Inclusive dates: “Paid to Last Month” will appear underneath “Period”

- Exclusive dates: “Paid from” will appear underneath “Period”

Problem

There may be times where a rent renegotiation has not been entered or it was entered incorrectly. In these situations you will need to make manual adjustments to the tenant Rental Tab, to reflect the correct paid to date and credit amounts on the tenant ledger.

This document will cover the following:

- How to Calculate what the Tenant Has Paid

- How to Calculate what the Tenant Should Have Paid

- How to Calculate the Tenant's Correct Paid to Date

- How to Adjust the Tenant Rental Tab

- How to Adjust Credits

NOTE: Changes made to the Tenant Rental Tab will only reflect on the ledger from this point onward. All previous history will remain unchanged; please ensure you use clear reasons when saving the changes.

Example

A property is rented at $440 per week and the tenant has been issued with a rent increase notice. The increase was to take effect on the 21/09/2019 at $450 per week, but was never entered. The tenant is now paid to 01/11/2019 according to Rest, however they have not been paying the new rate, instead paying the old rent rate of $440 per week.

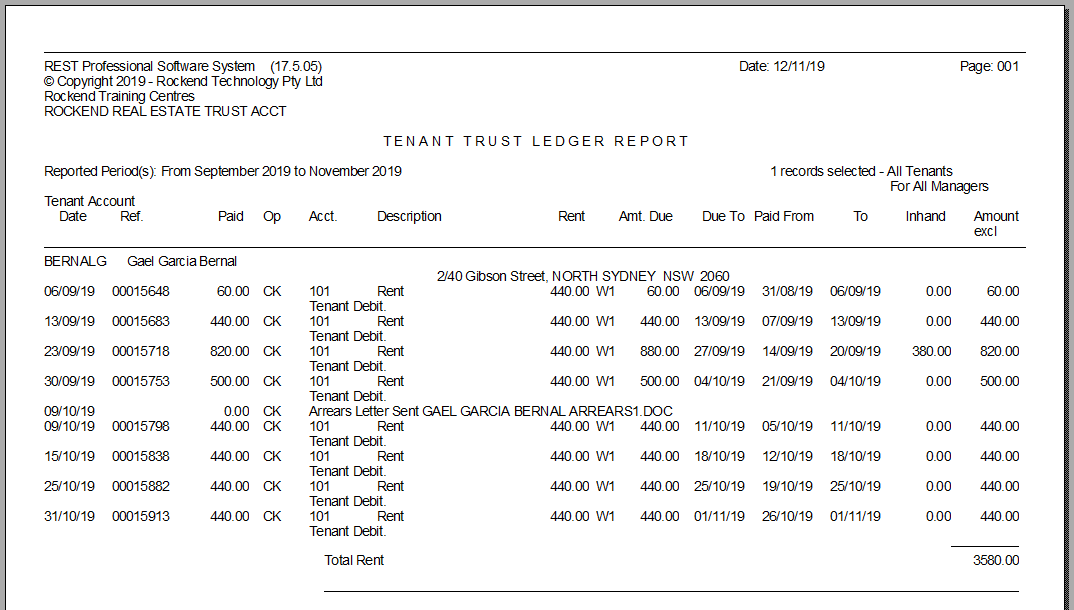

Tenant Ledger:

How to Calculate what the Tenant Has Paid

To calculate what the tenant has paid:

- Locate the last correct paid to date before the rent increase/decrease date and confirm whether or not there is an inhand amount at this point. (It will show on the last receipt prior to the change). Any inhand amount at this stage belongs to future rent

- Total all rent received from the day after the last correct Paid to Date including the Inhand amount if applicable, to the end of the ledger. Only calculate the rent receipts amounts, invoices are not to be included.

Example:

- Last Paid to Date: 20/09/2019

- Inhand Amount: $380.00

- Total of all Rent Received: $380.00 (Inhand Amount) + $2,260.00 (Rent Paid) = $2,640.00

How to Calculate What the Tenant Should Have Paid

To calculate what the tenant should have paid a formula is used:

- To calculate the number of weeks paid at the new amount, divide the total amount of rent paid since the Last Paid to Date, by the new rent amount

- If the calculation for the number of weeks has a decimal, this indicates there is a credit/inhand amount

- To calculate the total amount paid by the tenant at the new rate, multiply the new rent rate by the number of weeks

- To calculate the credit/inhand amount, minus the total amount paid at the new rate from the total amount of rent paid at the old rate

Example:

- Number of weeks paid at the new amount: $2,640.00 ÷ $450.00 = 5.8666 (5 weeks)

- Total amount paid at the new rate: $450.00 x 5 = $2,250.00

- To calculate the credit/inhand amount: $2,640.00 - $2,250.00 = $390.00

How to Calculate the Tenant's Correct Paid to Date

To calculate the paid to date:

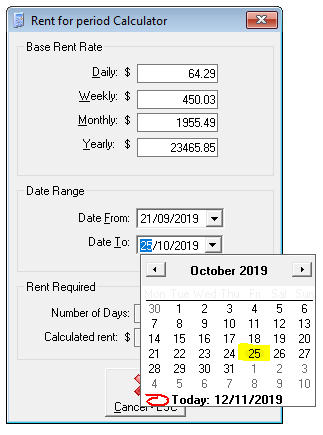

- Use the Rest Calculator calendar to obtain the correct Paid to Date, according to the number of weeks paid at the new amount

- On the Tenant Rental Tab, adjust the Paid to Date to reflect the correct Paid to Date

Example:

- Select the Date From as the date the renegotiation was supposed to take effect = 21/09/2019

- Move forward 5 weeks to calculate the new Paid to Date = 25/10/2019

- You can use the Number of Days field on the Rest Calculator to confirm the correct number of days (I.e. 5 weeks = 35 days)

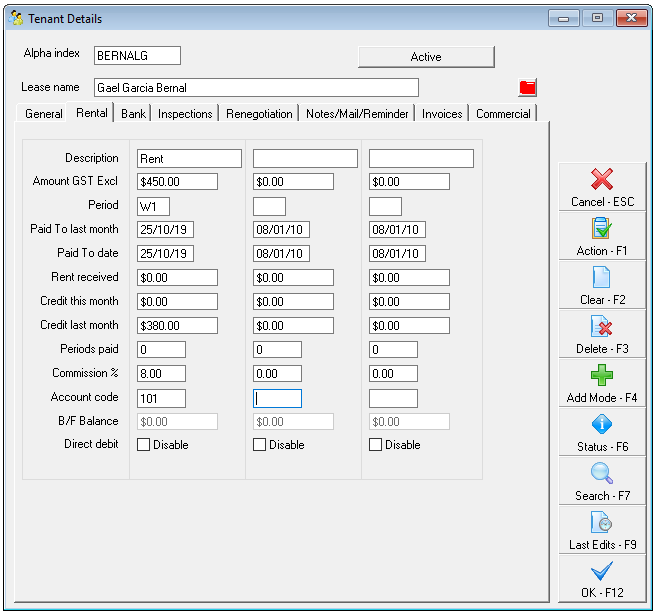

How to Adjust the Tenant Rental Tab

Once you have done all the calculations you can proceed with adjusting the rental tab:

- Adjust the Paid to Date to reflect the correct date

- Adjust the Rent Received, Credit this Month and Credit Last month to reflect the correct Credit/Inhand amount

Example:

- Remove the old Paid to Date and Enter the new Paid to date = 25/10/2019

- In this case, as Rent Received, Credit this Month and Credit Last Month are all currently $0.00, adjust the Credit Last month to $380.00, (if your situation is not as noted, please refer to 'How to Adjust Credits' below)

- Click OK-F12 and add a reason = "To reflect rent increase from 21/09/19 at $450.00 per week"

How to Adjust Credits

There are three important fields to take note of when altering credits under the rental tab of a tenant card and they are:

- Rent Received

- Credit this month

- Credit last month

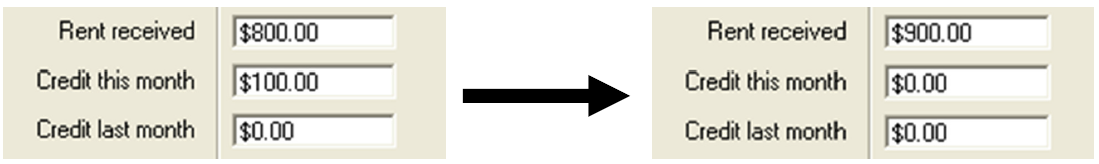

Credit last month can be altered or deleted as required. Any change to Credit this month field will affect the rent received field. The credit this month and the rent received fields must always equal the funds received for the current accounting period.

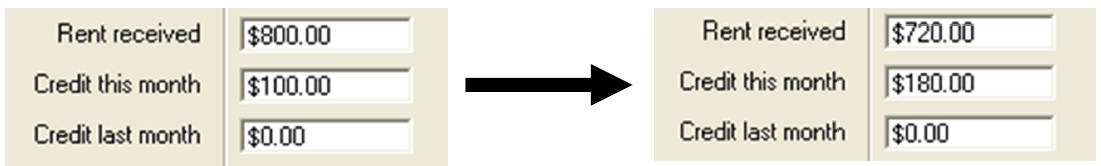

1. $800 in rent received and $100 in credit this month and you want to clear credit this month so the tenant shows no credit.

2. You would like to credit the tenant $180 and they had $800 in rent received, $100 in credit this month, zero in credit last month.

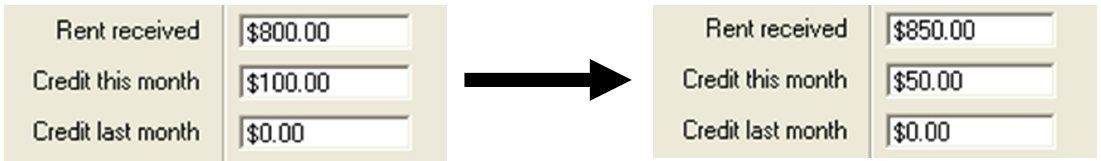

3. You would like to credit the tenant $50 and they had $800 in rent received, $100 in credit this month, zero in credit last month.

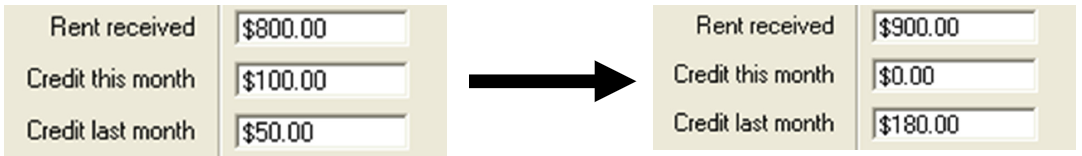

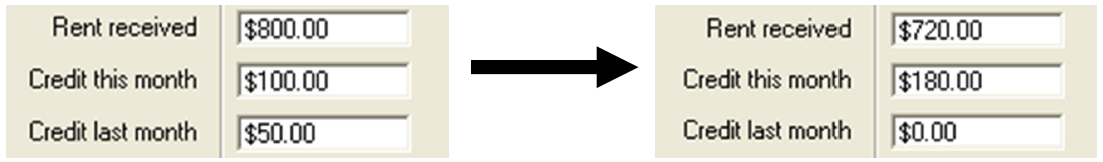

4. You would like to credit the tenant $180 and there is $800 in rent received, $100 in credit this month and $50 in credit last month.

- Option A

- Option B

Finally, remember to check your “Periods paid” field and ensure it corresponds with the changes made.