Set up a GST Creditor and Paying GST

Summary

This article guides you to setting up a GST creditor and then making cheque or electronic payments of GST and income tax.

The articles covers -

- Linking the Creditor

- Checking and Updating the GST Creditor Details

- Creating the GST Invoice

- Creating Dissections

- View Creditor Invoices Entry Screen

- Paying GST

- Upload EFT Direct Entry and BPay payments to the Bank

Overview

Payments to the Taxation Office are made by firstly creating an invoice in Accounting > GST. Do not use the Creditor Invoicing screen to enter these invoices. The GST screen enables dissections. Dissections enable a mixture of payments and refunds to multiple funds, groups and taxation accounts, as is often required.

Linking the Creditor

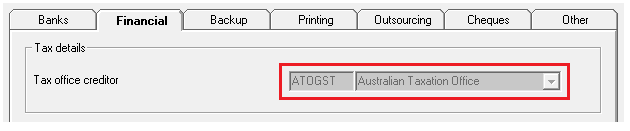

1. Go to Configure > Display & Set Config Values > Financial tab

Here you can link an existing creditor for the purposes of paying GST. This is usually set up for you in implementation. However if you do not have a GST Creditor already recorded in your database, you will need to create one.

Checking and Updating the GST Creditor details

Check the default creditor card in your database to see whether it is set to pay as cheque or BPay, has the relevant bank details and is compliant.

1. Go to Manage > Creditor – Select creditor code ATOGST.

If this creditor already existed in your database prior to Version 8, the creditor code will be ATOGST1.

2. To change the payment method if required, click edit. Where the payment method is set to BPAY, enter the ATO GST Biller Code as on your documentation from the Taxation Office. You may enter the CRN for each GST registered owners corporation on the CRN tab, or allow STRATA Master to update the CRN for each plan once the first invoice has been entered.

2. To change the payment method if required, click edit. Where the payment method is set to BPAY, enter the ATO GST Biller Code as on your documentation from the Taxation Office. You may enter the CRN for each GST registered owners corporation on the CRN tab, or allow STRATA Master to update the CRN for each plan once the first invoice has been entered. 3. Ensure the Creditor Compliance Status and WHS is set to Compliant before creating any entries against this creditor. Click edit and update as required. If you have an external compliance company and the compliance needs to be updated, liaise with them in this regard.

3. Ensure the Creditor Compliance Status and WHS is set to Compliant before creating any entries against this creditor. Click edit and update as required. If you have an external compliance company and the compliance needs to be updated, liaise with them in this regard.

Creating the GST Invoice

The invoice is not created through Creditor Invoicing.

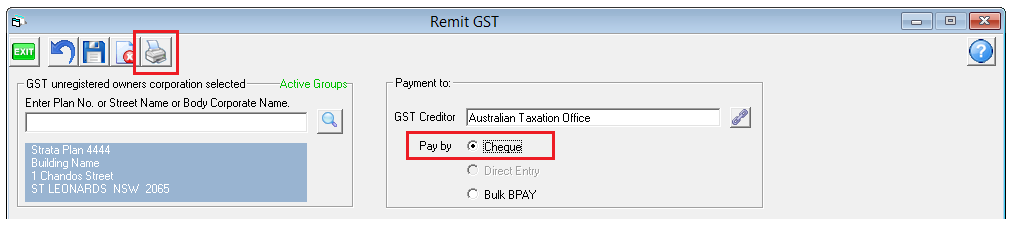

1. Go to Accounting > GST > Payment screen

This displays the default GST creditor and the default payment method set for the creditor in the creditor card.

- Where the payment method is Direct Entry or BPAY you are able to change the payment method on screen for one off cheque payments.

- The default payment method on screen will determine which icons are displayed on screen. Where payment is by cheque, the Printer icon will be displayed (instead of a process icon) as a quick cheque is produced after the printer icon is clicked.

- Where payment method is Direct Entry or Bulk BPAY the Process icon is displayed (instead of a print icon) as the dissections are saved as creditor invoices from the Remit GST screen.

2. Continue to enter your dissections.

Creating Dissections

Continuing in the Remit Screen.

1. Enter the first payment amount to be made, select the GST Payable account and the correct Fund (Admin or Sinking) that is to make a payment. Then click Save button.

2. Add the other dissections required, including any income tax to be paid or refunded.

3. The Final result will be the amount that is to be remitted/paid.

4. Click the Process button to complete this screen.

4. Click the Process button to complete this screen.

Note - Where payment method is Bulk BPAY after the first invoice dissection amount has been saved the CRN is locked for the remaining GST entries. This field is unlocked when a new owners corporation is selected. If you are paying for different CRN's you must process in a new screen.

Note - Where payment method is Bulk BPAY after the first invoice dissection amount has been saved the CRN is locked for the remaining GST entries. This field is unlocked when a new owners corporation is selected. If you are paying for different CRN's you must process in a new screen.

View Creditor Invoices Entry Screen

The invoice will now be in the Creditor Invoicing screen waiting to be paid.

1. Go to Accounting > Enter Creditor Invoices > Creditor Invoice screen.

You can view unpaid creditor invoices created from the Remit GST screen.

2. Enter the relevant Strata Plan.

3. Check that the invoice is in the screen and the values are as required.

Note - New creditor invoices can be entered from this screen against the GST creditor.

To enable the selection of the GST creditor accounts, you must tick Show accounts without budget.

The accounts are displayed in alphabetical order, and the GST accounts are named (by default) Creditor—GST—Admin and Creditor—GST—Sinking.

Paying GST

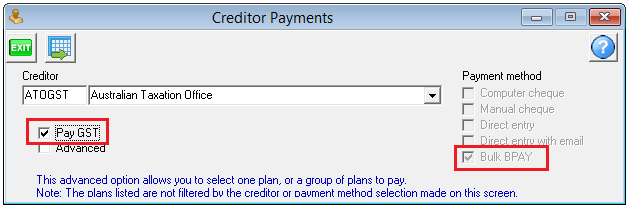

1. When ready to push the invoice through for payment select Accounting > Pay Creditor Invoices or select the Pay Icon.

2. All other payments for GST will be made from the Creditor Payments (Pay) screen.

2. All other payments for GST will be made from the Creditor Payments (Pay) screen.

3. Tick Pay GST and the GST creditor is automatically populated on screen, including the payment method. Alternatively, enter the ATOGST creditor alpha and tick all of the payment method boxes, the result will be the same.

Note - Cheques were printed in step 4 of Creating Dissections

4. Click Process

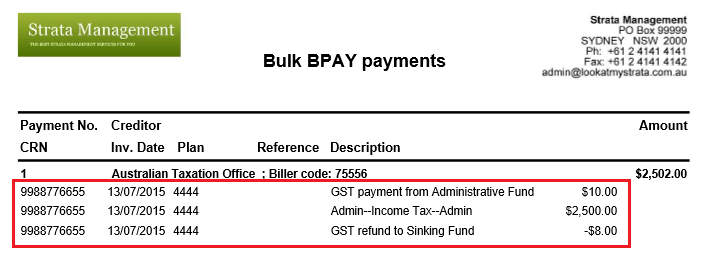

5. Only the net remittance is paid, however the Bulk BPAY payments summary will display all invoice dissections included in the net payment.

Upload EFT Direct Entry and BPay payments to the Bank

The final step to making electronic payments is to create a file for uploading to the Bank.

- Go to Accounting > Process Direct Entry Payments or Process Bulk BPay Payments

- Click ok