Cancelling Levy For One Lot Owner

This article will assist you to cancel a levy for one Lot Owner, or only a few of the Lot Owners in a Plan.

To cancel a Levy for the whole Plan refer to Accounting > Adjustments > Search/Cancel Levy Posting.

Note - If you cancel a Levy for one owner and then need to re-enter it, you will need to do so as levy frequency 'once-off' which may have effect on a future Section Status Report. The report may require some manual correction. Status Reports should always be checked prior to issue.

Please read through this article to determine if this article is right for your purpose and also to ensure you Plan your steps.

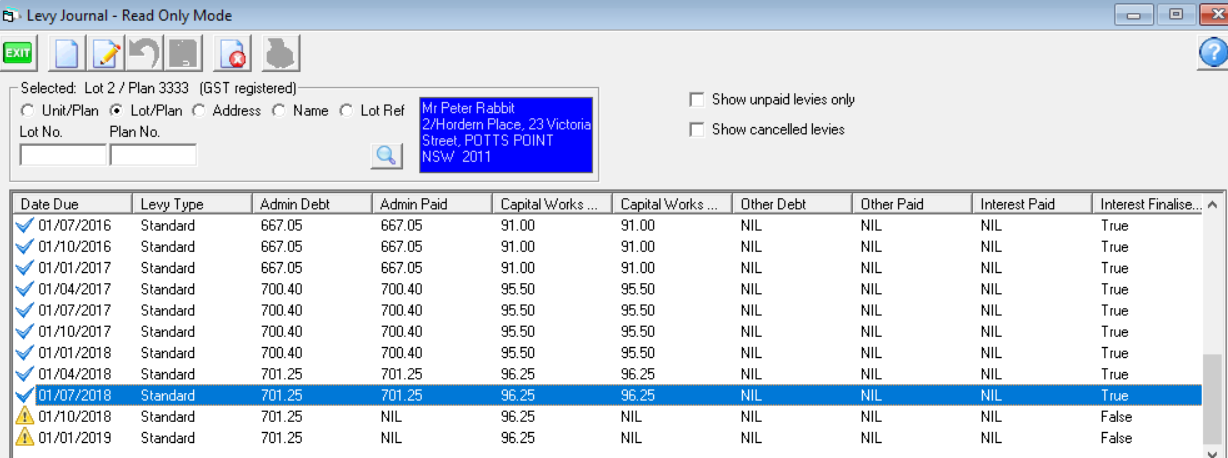

In the example below, the levy for 1/7/2018 is to be cancelled.

GST

Levy cancellation will affect GST in Plans who are gst registered, so be aware of implications if the levy is dated in a prior BAS period. If the levy is to be re-entered for the same period and the same amount, then the implication is negated/contra'd.

If the funds need to be returned to an owner, a better option would be to cancel the receipt. The funds can then be re-receipted to unallocated funds and a Refund Levy processed.

The Process

1. Check the owner ledger to clarify which levy is to be cancelled and why.

2. If owner funds have been applied to the levy, you may need to cancel the receipt prior to cancelling the levy. If there is an unpaid levy posted with a later due date, the funds of a cancelled levy will automatically apply to the later levy, which may not be a good result.

3. In the example below, the funds will auto allocate to the 1/10/2018 levy, if you don't cancel the receipt to the 1/7/2018 levy. For this reason, instead of cancelling the receipt as mentioned in step 2, you may wish to cancel the future levies, in the example below being 1/10/2018 and 1/1/2019, cancelling the 1/1/2019 levy first.

4. Select Accounting in the top toolbar, then Adjustments and Levy Journal.

4. In the Levy Journal, enter the Lot and Plan number or other selection to bring up required Lots Levy and invoice information. Locate the levy you wish to cancel and highlight it.

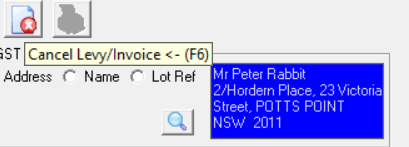

5. Click the cancel levy button.

6. If the levy was due in a previous financial year, you will receive warning before cancelling. Read the warnings and only cancel if you are prepared to manage the changes appropriately.

7. Check the owner ledger. In the example above, the funds will auto allocate to the 1/10/2018 levy. For this reason you may wish to cancel the future levies also, in the example above being 1/10/2018 and 1/1/2019, cancelling the 1/1/2019 levy first.

8. Funds paid against the cancelled levy would be moved to the Lot Owners unallocated funds if there are no other unpaid levies, for example if levies for 1/10/2018 and 1/1/2019 had not been posted, funds against 1/7/2018 would move to unallocated funds where they can be reallocated to where you choose.

9 If you have levies to cancel for another owner or Lot, you would follow through these steps for that Owner or Lot.

10. In some instances the Levy may need to be reprocessed to a different fund or for a different amount. You can also action the reprocessing of levy for one owner in the Levy Journal.

Useful Links

Cancel A Lot Owner Receipt | MRI Knowledgebase (rockend.com)

Receipt to Unallocated Funds | MRI Knowledgebase (rockend.com)