How to Setup Tenant Brought Forward Balances in REST Professional

Overview

If you wish to use statement style 9, 12 or 13 the tenants belonging to the owner must have an opening balance created and entered in REST. Arrears or credits are based on the accounting month not on the system date. You may not use this format if the tenants pay weekly or fortnightly.

NOTE: If the opening balances are not correct, the owner statement will be incorrect.

This Document covers:

- Tenant Brought Forward Balances

- Calculating and Entering Brought Forward Balances

- Example of brought forward balance if Tenant in arrears

- Example of brought forward balance if Tenant paid up to date

- Example of brought forward balance if Tenant paid in advance

- Updating the Tenant Details

- Checking B/F Balances are entered correctly

Tenant Brought Forward Balances

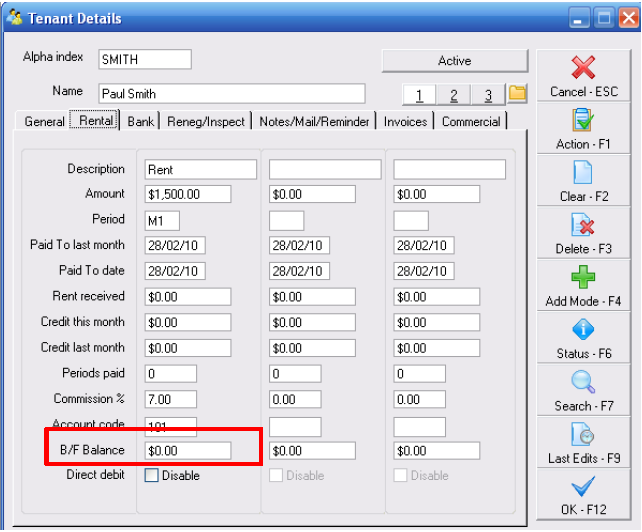

If you go to Files > Tenant Details > Rental Tab you will notice at the bottom of every column there is a B/F Balance Field. This field is used to reflect the amount of arrears or credit (exclusive of GST) for a Tenant from the previous period. This is so that the Commercial Owner’s statement shows the correct rent amount due for this month. The B/F Balance amount needs to be entered before the first statement is run for any Owner who has statement style 9, 12 or 13.

Also be aware that if any changes are made to Tenant paid to date or credit amounts the B/F Balance field for that column will also have to be adjusted accordingly.

Calculating and Entering Brought Forward Balances

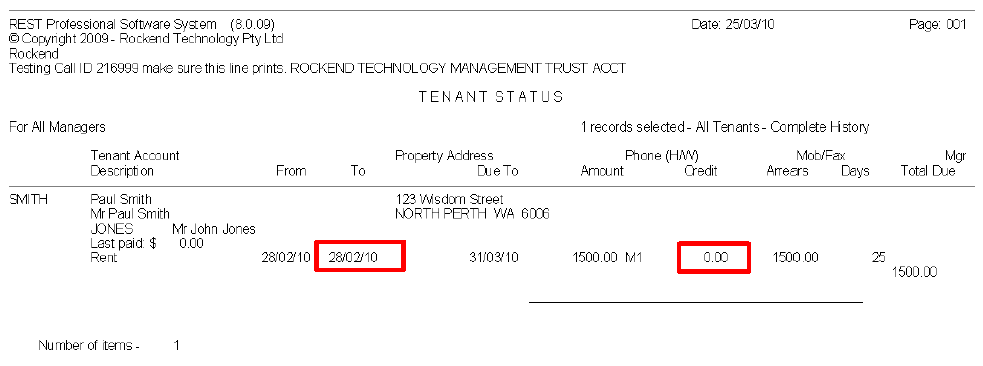

If you’re entering B/F Balances for multiple Tenants after just installing the Advanced Commercial Module or converting to REST Professional you’ll need to print out a Tenant Status Report. Go to Reports > Tenant > Status Report and select the previous month to print. You will reference the Tenant’s paid to date and credit amount to work out what figure to enter into the B/F Balance field.

If it is a new tenant open the Tenant Details > Rental Tab and view the paid to date and credit fields.

For this example the Tenant pays $1500 per month plus GST from the 1st of every month. The current accounting month is April so we’re calculating the Tenant’s arrears or credit to the last date of March – 31/03/10.

If the B/F Balance is in credit enter the amount with a minus sign e.g. $-200. This will then change to brackets once saved ($200). If the B/F Balance is in arrears enter the number normally e.g. $200.00

Example of brought forward balance if Tenant in arrears

If the Tenant’s paid to date is before the 31/03 – then the tenant is in arrears. You must calculate how much the arrears are, taking into account any credit.

Examples

Paid to date is 30/03 Credit = $0 B/F Balance = $1500.00

Paid to date is 15/03 Credit = $0 B/F Balance = $1500.00

Paid to date is 15/03 Credit = $200 B/F Balance = $1300.00

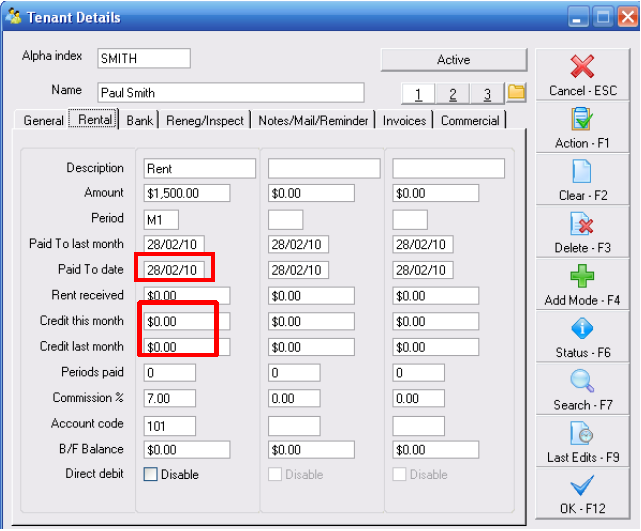

Example of brought forward balance if Tenant paid up to date

The Tenant has paid their rent/outgoings for March so doesn’t have any arrears.

Examples

Paid to date is 31/03 Credit = $0 B/F Balance = $0

Paid to date is 01/04 Credit = $0 B/F Balance = $0

Paid to date is 18/04 Credit = $0 B/F Balance = $0

Paid to date is 18/04 Credit = $200 B/F Balance = $-200.00

Example of brought forward balance if Tenant paid in advance

The Tenant has paid rent/outgoings not due until April or later.

Examples

Paid to date is 30/04 Credit = 0 B/F Balance = $-1500.00

Paid to date is 01/05 Credit = 0 B/F Balance = $-3000.00

Paid to date is 30/04 Credit = $200 B/F Balance = $-1700.00

Updating the Tenant Details

- Go to File > Tenant Details > Rental Tab

- Enter the B/F Balance for each rental column. See the calculation examples below for details on how to determine the balance. NOTE: The amounts must be entered as GST exclusive.

- If the B/F balance is arrears enter the amount without a sign.

- If the B/F balance is a credit enter the amount with a minus sign.

- Click OK-F12

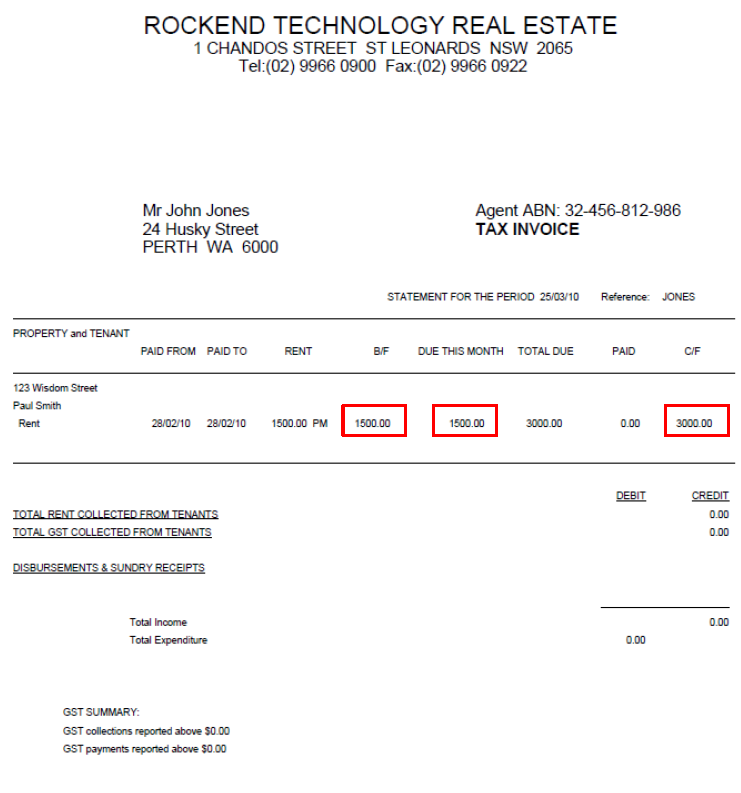

Checking B/F Balances are entered correctly

The way to check that a B/F Balance has been entered correctly on the Tenant Details is to preview the Owner’s statement and make sure it calculates. Go to Reports > Owner > Statement Printing > select the Owner and preview the statement.

You will see where it shows the B/F Balance you entered on the Tenant Details, it will then show the Rent Due This Month and the Total Due should be what the Tenant is in arrears or in credit at the beginning of this month.