BMC Set up in Strata Master

1) Configure > Association types | create a new Association type - Building Management Committee

2) Configure > Bank Accounts > enter a new Bank Account - Unless a General (single) Trust is operated the BMC should have a separate Bank Account

3) There is not usually a requirement for a Status Certificate however the S184 in NSW or S151 in Victoria may be adapted.

4) Go to Owners Corporation > Select New and enter an Owners Corporation for the BMC

5) Body Corporate Name is usually a DP number e.g. DP 7895612 with the name of the Property e.g. DP 7895612 George Towers

6) Create a BMC number e.g. BMC 1 and complete the General information

7) Go to Financial > enter the GST Status for the BMC (usually Registered for GST as levy income is greater than the threshold) ABN, Tax File number etc

8) Go to Bank Account – and attach the newly entered Bank Account

9) Go to Structure and select BMC from the drop down list.

If a strata lot in NSW is contained in a strata plan that is part of a BMC there is a requirement to report the annual levies that the strata plan must contribute to

the BMC. The details should be added under the Structure tab of the Owners Corporation: Where the Agency manages both the BMC and the Strata Plan and the correct information is included, the levy information will be populated when a S184 is created for a lot within the Strata plan.

10) Go to Insurance and enter details of the overall insurance policy. There will be an overall insurance policy which covers the whole of the BMC. The individual lots (including the Strata Plans) may be required to effect additional insurances.

11) Go to Lots and create the new lots. Identifying them as they appear in the Plan of Subdivision including the Lot number as allocated

12) Levy entitlements (refer later) - The Unit of Entitlement is created based on the proposed budget for the financial year and may need to be changed each year.

13) The BMC may appoint office bearers and these would be added under the Executive committee section of the corporation.

14) BMC meetings will be entered under the Meeting Register and by selecting MCM – Management Committee Meeting

Creating Chart of Accounts

The levies for the lots in the BMC development are based on the annual contribution of each shared facility. The best method for accounting for these levies is to create the cost for each lot using an Excel spreadsheet.

Each line item in the Shared Facility Statement will be represented by the percentage that each lot must contribute. An expected budget for that line item is then created and each lot’s contribution is determined.

Once all items on the Shared Facilities schedule have been entered on the budget, the total levy required by the BMC for the year is known. The individual lot contribution is determined by adding up the lot’s commitment for each line item. The total of the lots contributions will equal the total required by the BMC.

An example of a BMC Chart of Accounts is as follows:

Entering Budgets for BMC

Budgets for the Administrative Fund are created in the same manner as for other corporations other than the suggested Shared Facilities general ledger accounts are used rather than the standard Chart of Accounts. Amounts are entered exclusive of GST and the total for each line item is entered, not the individual lot contribution.

Entering Unit Entitlement on STRATA Master

Administrative Fund:

The suggested method for entering the Unit Entitlement on STRATA Master is to use the GST inclusive budget figure for the year as the Total Unit Entitlement value. The individual lots will then be entered with a Unit Entitlement that reflects their contribution to the budget.

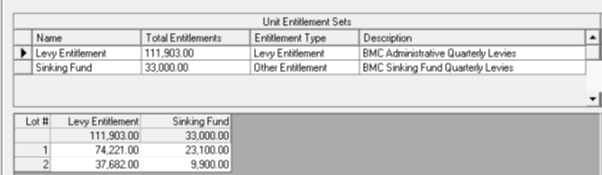

The following is an example where the total GST inclusive BMC budget for the financial year is $111,903 for the Administrative Fund and this has been divided between Lots 1 and 2 in accordance with the total of their contribution towards the shared costs.

Sinking Fund

Where Sinking Fund Contributions are required and are based on a different ratio this can best be achieved by the creation of a Financial Group named BMC Sinking Fund. A separate Unit of Entitlement set would be created and the Sinking Fund Budget applied to the BMC Sinking Fund Group and the Lot Entitlements created in the same manner as the Administrative Fund. For more details on setting up financial groups, please see our webinar found at http://kb.rockend.com/help/financial-group-reporting-on-demand-e-learning

Creating Levies

Following the approval of the Administrative and Sinking Fund levies at the Annual Meeting of the BMC it will be necessary to check if there is a change to the budget and the total levy contribution. If the budget is changed it will be necessary to update the unit entitlement. A separate levy process is required for the Administrative and the Sinking Fund levies.

Financial Year End Adjustments

Some Management Statements require year end adjustments to adjust each lot with either a charge for any under contribution or a credit for those lots that have over contributed. Following the completion of the Financial Year the actual spend for each line item will be compared with the contribution levied to each lot. A reconciliation will then be done to determine if the lot should contribute more levy income or be entitled to a refund.

Using the original spreadsheet which created the Administrative Fund Budget:

- Enter the total amount expended during the year for each shared facility item

- Calculate each lot’s difference between the budget and actual for each item

- Enter the amount of the actual against the budget amount as either a positive (budget is greater than expenditure) or negative (budget is less than expenditure) amount, where:

a. Positive = Budget > Actual

b. Negative = Budget < Actual

4. Total the positive and negative amounts to reach a consolidated figure for each lot.

Creating the Adjustments

To facilitate Financial Reporting, consideration should be given to creating new Revenue and Expense accounts. This will ensure that the total levy income for the

Financial Year agrees with the Budget.

o Revenue Account

Example: 143200 Levies Due - Annual Adjustment - Admin

o Expense Account

Example: 159800 Levy Refund – Annual Adjustment - Admin

Lots that have Under Contributed -

- Create a new entitlement set for the total amount that needs to be recovered. This could be named – Annual Adjustment Levy.

- Allocate the appropriate amount that the affected lots need to pay as the Lot entitlement

- Raise a one off levy for the amount required to be recovered

- Create a journal as follows:

Dr Levies Due – Admin

Cr Levies Due – Annual Adjustment – Admin

Lots that have Over Contributed -

- If the next Annual Levy has been raised create levy credits for the lots that have over contributed

- If the next levy has not been raised it will be necessary to create a payment from the BMC to each lot that requires a refund

- Receipt back into the lots as Unallocated Funds

- Select the following account when creating either the Levy Credits or the Payments:

159800 Levy Refund – Annual Adjustment