Post or Process a Quarterly Levy for a Plan in Strata Master

The Strata Plan gains its income primarily from Levies charged to the Lot Owners. This income provides the funds to pay for insurance, maintenance, common area utilities and more.

In Strata Master, a Levy can be posted (processed) and then sent to the Lot Owners at a later date. Levies can also be posted for periods other than quarterly and can be posted as Standard or Special levies. Levies can also be posted to just one Lot through a different functionality.

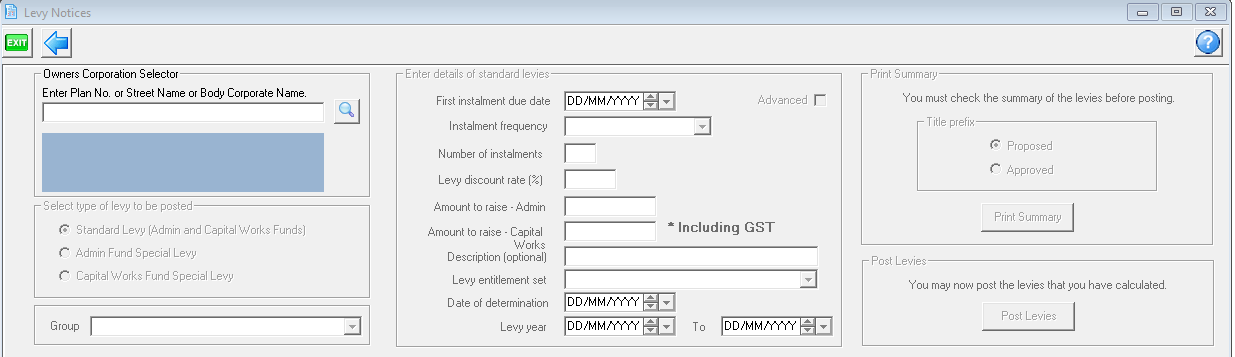

This article will provide the steps to processing a quarterly levy to all Lot Owners of a Plan.

Prior to Posting

Gather your information from meeting minutes, and from the Strata Manager, for example -

- are you to post 4 quarters or 1 quarter

- the total you need to raise from the levy

- what break up will be attributed to Admin Fund and Capital Works Fund

- what due date is the levy to have, as this will be the date of the levy.

- date of the meeting where the levies where approved

- Is a group involved, does this need to be posted to a group for this plan?

Also check a Lot Owners ledger to ensure the levy has not already been posted. If it shows on the ledger, it has already been processed.

Navigate to Levy Posting

1. Double click on the Levy icon in your toolbar

2. Click on 'Calculate Levies'

3. Your screen will open as below -

Entering the Levy Details

3. Enter the plan

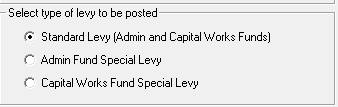

4. Select type of levy. In this example we are entering a Standard Levy with an Admin component and a Capital Works component.

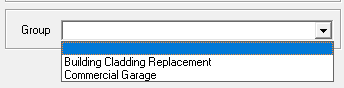

5. Enter a group if relevant, there would be a selection on the drop down if this Plan uses groups. We will not select a group for this example.

6. Next you will enter information as gathered regarding due date, how many instalments and the amount to raise. In this example the amount to raise for 4 quarters is to be $55,000 for Admin Fund and $20,000 for Capital Works for the year. However, we are only going to enter 2 quarters at this time, with the first due date being 1/4/2022.

So, our entries will look like this -

Notice that we have entered that we only want to post 2 of the 4 quarters now, beginning with 1/4/22 and then we have entered the amounts as only 2/4th (or half) of the total amount to be raised and we enter the inclusive of gst figure.

7. You can add further information to each instalment to clarify the period. Refer to this video instruction https://kb.rockend.com/help/adding-additional-information-to-levy-a-notice

8. Notice the date of determination entered relates to the meeting date, however this can be any reasonable date you wish to use. It could relate to a decision made other than in a meeting.

9. Notice that the instalments commence at or are within a levy year.

Checking the Figures and Finalising

10. Then you will be required to print a summary and check your entries to the individual Lots. A preview screen will show.

The summary shows the amount to be paid by each lot over those two instalments. Strata Master will post a levy on each Lot for 1/4/2022 and 1/7/2022 for $4687.50 in the above example, or half of the total figure against each Lot.

With $37,500 raised with these 2 instalments, it is half the amount to be raised in the year, being $75,000.

11. If the Plan is not gst registered, then the references to gst will not appear.

12. You then save the preview or you are able to exit, return to the Calculate levy screen and make edits as required. In some businesses, the Preview needs to be approved by another user at this stage.

13. When you are satisfied that the figures are correct, you change the radio button to 'Approved' and print that summary.

14. The final step is to click the button to post the levies

15. You have a final opportunity to exit if you are not sure that your details are correct. If satisfied the figures are correct, click ok.

16. The levies now show on the Lot Owners levies tabs

Other Notes

- If you are processing only one instalment, you still select quarterly, however you enter the number of instalments as one and the amount to raise is reduced to one quarter of the yearly amount to raise.

- If you process 4 quarterly instalments, Strata Master will add them on the owner ledger with different due dates, 3 months apart eg 1/4/2022, 1/7/2022, 1/10/2022 and 1/1/2023.

- If you need to raise different amounts for the instalments, you can add them 1 instalment at a time and enter the appropriate amounts to raise. If you do this the first would be entered manually as due date 1/4/2022, and the second would be entered manually as due date 1/7/2022 and so on.

- it is possible to enter levies across a levy year, however there are some variations to financials. It would be preferable to enter the levies in the current levy year, then change the levy year to enter the levies in that levy year.

- Special levies are entered in a similar manner except that they are entered for only one Fund.

Useful Links

https://kb.rockend.com/help/strata-master-top-tip-71---levy-periods-on-levy-notices

https://kb.rockend.com/help/post-a-levy-for-one-owner

https://kb.rockend.com/help/strata-master-top-tip-47---add-levy-messages

https://kb.rockend.com/help/adding-additional-information-to-levy-a-notice