How to Setup Split Invoicing in REST Professional

Overview

Split Invoicing creates and prints the tenant invoices for services such as water rates, council rates, air conditioning etc. based on the percentage use of the tenants in a building. Up to five services with differing percentage uses may be set up for each owner so that if for example an air conditioning invoices split on a different ratio than a water rate invoice both percentages may be entered.

Before using split invoicing, you must set up the spit invoice descriptions on the owner and enter the percentages of use on the tenants. The tenants to be charged must all be attached to the one owner. The owner must own all the properties in the building.

You must have the Advanced Commercial Module to utilise this feature.

This document will cover:

- How to Setup the Split invoicing Allocation Descriptions on Owner Card

- How to Setup the Split Percentage on Tenant Card

- How to Invoice the Tenant for Split Invoiced Amounts

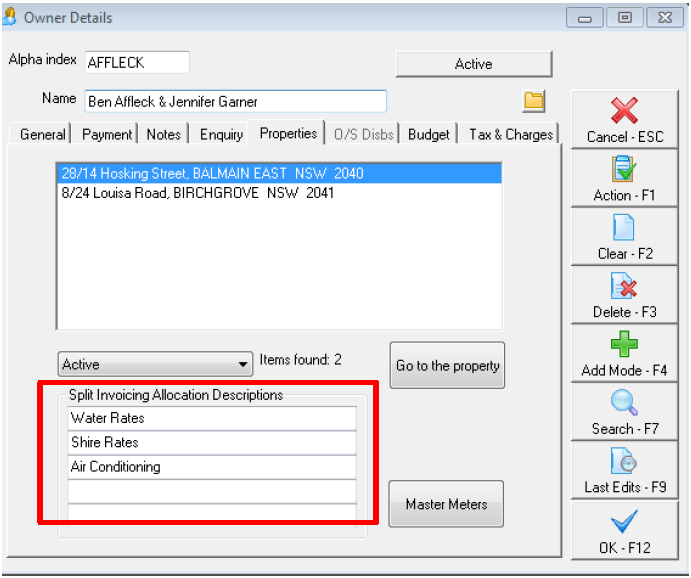

How to Setup the Split invoicing Allocation Descriptions on Owner Card

- Go to Files > Owner and click on Properties Tab

- Enter up to 5 descriptions for the different services to be charged for this owner/building. For example: Water Rates Council Rates or Air Conditioning. NOTE: The descriptions entered here are reflected on the Commercial Tab of the Tenant Details so that you can enter the percentage of use for each service for each tenant

- Click OK-F12

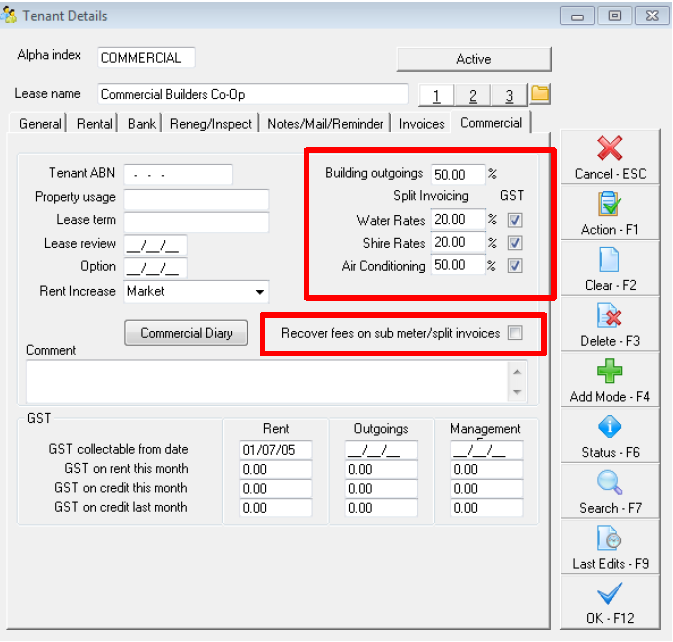

How to Setup the Split Percentage on Tenant Card

- Go to Files > Tenant and click on Commercial Tab

- Percentage of Use - Enter the percentage of use for each service.

- GST - If the tenant is liable for GST, tick the GST tick box

- Recover fees on sub-meter/split invoices - If you wish to automatically recover the management fee charged to the owner, from the tenant, check the check box on the Tenant Commercial Tab for ‘Recover fees on sub meter/split invoices’. Note: REST charges the owner the management fee and only recovers it from the tenant if you check this option.

- Click OK-F12

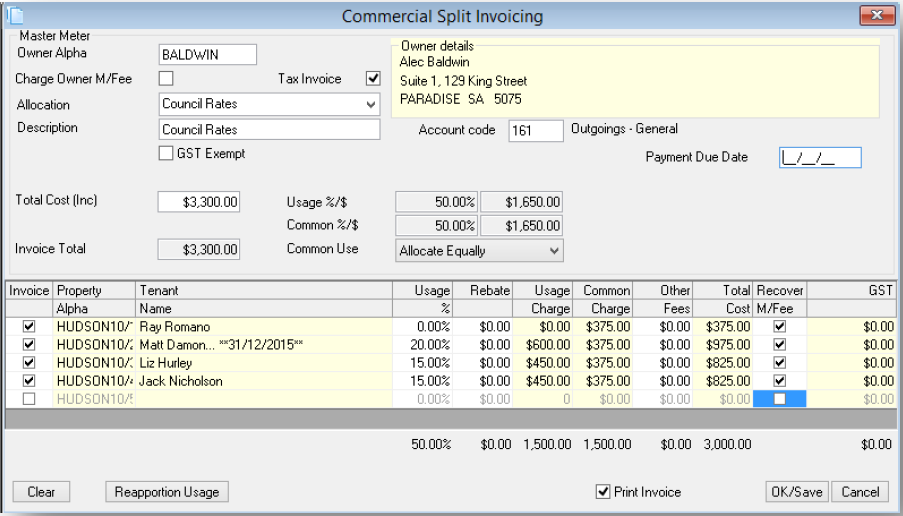

How to Invoice the Tenant for Split Invoiced Amounts

The tenants must all be attached to properties belonging to the one owner and the split amounts should equal 100%. If the owner has more than one building, you must set up a separate owner for each building. Up to five services with differing percentage uses may be set up for each owner so that if for example an air conditioning invoice is split on a different ratio than a water rate invoices both percentages may be entered. The owner stores the split descriptions and the tenant commercial tab stores the percentage used.

- Go to Transactions > Split Invoicing

- Owner Alpha – Put in the Owners alpha index and press enter

- Charge Owner M/Fee - Tick if you are charging Management Fees (this will default to the base commission % saved on the property details > financial tab)

- Allocation – Using the drop down menu, select the split invoice to be charged. The tenants that have this allocated split invoicing against them will now appear in the grid at the bottom of this invoicing screen

- Description – enter the description for the invoice. This will be printed on the tenant invoice

- Account Code – enter the account code for the invoices

- GST Exempt – This tick box is to be ticked if the tenant is GST exempt and will affect the way the total cost shows i.e. as a total inclusive amount or a total exclusive amount – which will ultimately populate the grid at the bottom of the split invoice screen

- Common Units - Enter any common units to be shared amongst the tenants

- Common Use - If the total usage percentage does not equal 100%, for instance there is a common charge or one of the properties is vacant, you may want to either recover only part of the bill (i.e. the owner pays the difference) or you may want to split all or part of the common usage amongst the tenants. You may choose between:

- Allocating Equally- REST will divide up the unallocated usage equally amongst the tenants and update the ‘Common Charge’ column in the grid with the amounts to be recovered.

- Allocating Manually- REST changes the ‘Common Charge’ column to “Column %’. You may enter the percentage of the common charge to be allocated to each tenant.

- Reapportion Usage - If one of the properties is vacant and you want to spread the cost over the other properties, click ‘Reapportion Usage’ on the bottom of the screen and REST will divide the bill between the remaining tenants.

- Payment Due Date - Enter due date for the payment it cannot be in the past. The invoices will be created with this date as the due date for payment.

- Tenant Grid – Enter details as follows:

- Invoice - Uncheck the ‘Invoice’ checkbox if you do not want to charge a tenant any part of the cost.

- Usage % - This displays the percentage usage that you have entered against the tenant in the tenant commercial tab. You may overwrite the percentage here.

- Rebate – this can be manually entered for any rebates that apply

- Usage Charge - The cost is arrived at by calculating the percentage of the total cost for each tenant, For example. Total Cost = 2200.00, Tenant a pays 15%. REST calculates 15% or $2200.00 = $330.00.

- Common Charge/Common% - If the total percentages of the tenants in the building do not equal 100% then the difference is considered common usage and will be allocated as a common charge. By default, REST allocates this equally between all the tenants but you may change the Common Use dropdown list to ‘Allocate Manually’ and enter any combination of the common charge against each tenant. If you select ‘Allocate Manually’, then the heading of this column changes to ‘Common %’ and you must enter the % of the common charge to be allocated to each tenant.

- Other Fees - Enter any other fee that you wish to charge the tenant.

- Total Cost - This is the total charge to the tenant.

- Recover M/Fee - If you have checked the ’Recover fees on sub-meter/split invoices’ on the Commercial Tab of the tenant Screen, this check box will automatically be checked and any management fee on the invoice charged to the owner, will be recovered from the tenant. You may check or unchecked this option for any tenant.

NOTE: When you print the invoices now, REST prints the split invoice details on each invoice. If you choose to not print them now, and reprint them through Tenant Invoices, only the description line will be printed and not the split information.

- OK/Save - Click OK to save and optionally print the invoices. If you do not print them immediately they may be reprinted as follows:

- Go to Tenant Details > Invoice Tab

- Go to Reports > Tenant > Statement/Invoice Printing

- Go to Reports > Tenant > Commercial Reports > Commercial Invoice

NOTE: Re-printing of the invoice as above will not show details of the split invoicing