How to Create a Water Rebate in REST Professional

Overview

Some government authorities offer a rebate to owners of residential property that are recorded as being connected to mains supplied water.

The rebate is generally based on the water usage recorded within the calendar year.

The rebate will be automatically applied to your water bill. Landlords must pass on all or part of the benefit of the rebate to any tenant who pays any amount for water. This may include the water supply charge.

This document will cover:

- Creating the Rebate

- Receipting the Rebate to Tenant Invoice Credit

- Creating the Water Consumption Invoice

- Allocating the Rebate

NOTE: These instructions require “Tenant Invoice Credit” to be activated in REST. You will require all users to be logged out of REST to set this up in your system options. Go to Other > Utilities > System Options. On The Transactions Tab tick Allow Tenant Invoice Credit and click OK-F12.

Creating the Rebate

Note: the owner will need to have sufficient funds to proceed with the following steps.

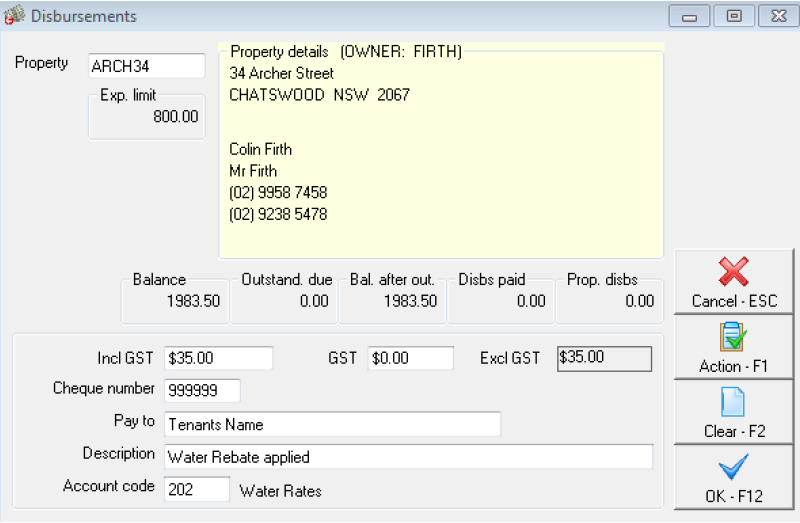

- Go to Transactions > Quick disbursements and select the property alpha index

- Amount - Enter the rebate amount, zero out the GST

- Cheque number - 999999

- Pay to – Put in the name of your tenant

- Description - Water rebate applied

- Enter expense account code i.e. 202

- Click OK-F12

Receipting the Rebate to the tenant

- Go into Transactions > Rent Receipts and enter the tenants alpha index

- Select Invoice Credit tab and enter the amount and enter description SA Water rebate applied from Owner (Owners name)

- Click OK-F12 and choose the payment method as direct deposit

- Enter Received from the owners name

- Click OK-F12

NOTE: The invoice amount will have reduced by the amount of the invoice credit i.e. rebate amount

Creating the Water Consumption Invoice

- Go into Transactions > Invoice Entry and enter the tenants alpha index

- Enter the amount for the full amount of the invoice total of the usage

- Enter description i.e. Water usage for the period that is due

- Enter Expense code i.e. 202

- Make to invoice payable to the owner

- Click OK-F12

- REST will detect that a tenant invoice credit exists, say yes to allocate the invoice credit to the invoice

Allocating the Rebate

If the invoice credit was not allocated at the time of the creating the invoice, this can be allocated as follows:

- Go into Transactions > Allocate Tenant Invoice Credit and enter the alpha index of the tenant

- Select the Invoices tab (REST should default to this tab)

- Allocate the amount of invoice credit to the invoice

- Click OK-F12