STRATA Master Version 7.0.4 Release Notes

| Creditor Invoice Screen Tab order |

After saving a creditor invoice the cursor/focus is returned to the Owners Corporation Selector. |

| Error during large levy notice run | Under certain circumstances Strata Master produced an error when printing a large amount of levy notices with the option to "Save to File" selected. This has been corrected. |

| Display Skipped Chq / Payment numbers | An option "Display skipped payments" has been added to the selection screen for the following reports (Cash Payments Report, Trust Payments Report, Cash Management Report, Cash Management Group Report) to allow the user to print missing payment details. The default is set to NOT print the details. |

|

Owner and Executive Portals not showing documents |

An issue has been addressed where published documents to the portals could not be retrieved when Name on Title and Contact name were different. |

STRATA Master Version 7.0.3 Release Notes

|

User Access Rights Report - User Meting Favourite |

Any user with access rights to the Configure Users screen can now export a list of users and their security settings. To create the report click on the Excel icon and save the report when prompted. When you open the report it will display a list of user names, status and access to each area of STRATA Master as configured. You may then sort and filter the results as required. |

| Other Changes |

The following issues have been rectified in this version: Resizing of Reminders Screen- The Reminders screen now accommodates a Windows screen display setting of 125%. This also applies to the Reminders Configuration screen. Reminders – Payment Plan - Lots will only be displayed where the payment plan is associated with the current debt recovery action. Auto-Reverse Journals - An error was being displayed and the auto-reverse journals could not be saved. Cash Management Report - The Cash Management Report could not be produced when there were fees created through the investment reconciliation screen. Note: This would also affect any fees posted to an investment account through the Macquarie Bank download processing. Validate levy interest rate - Validation has been added to the levy interest rate field in the Corp screen to ensure that only amount less than 100% can be recorded. Archive levy notices to fileSMART - When lots are recorded as linked in the Owners Corporation, with the use of ‘&’ in the lot or unit number the levy and debt recovery notices were not being archived successfully in the Individual Lots folder in fileSMART. Dairy Validation - Diary entries will only be saved where a valid date is recorded. |

STRATA Master Version 7.0.2 Release Notes

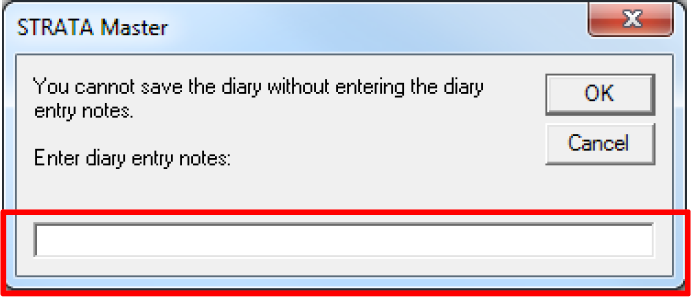

| Diary Message |

When saving a diary the details must be recorded.

This has been changed, and if a user attempts to save a diary record without entering details the following message will be displayed. Any text recorded on the screen will then be saved in the diary details tab. |

| Status Certificate – Exclude from debt recovery option |

When producing status certificates you now have the option to update the lot(s) to be excluded from debt recovery at the time of producing the certificate |

| Quick Pay and Levy Refund – NZ |

The screens have now been updated to all a bank account suffix to be recorded when making payments by direct entry. |

| ANZ BPAY levy notice slip2 |

A new levy notice has been added to the stationery configuration to allow users to issue an ANZ levy notice without a deposit slip, or BPAY details. The notice type is named ANZ BPAY levy notice slip2 and is available for printing and emailing notices. |

| Mailing Labels – Meeting Documentation |

When printing a mailing label for meeting notices and/or minutes the following changes have been made:

|

| Other Changes |

The following issues have been rectified in this version: Budget Screen

Work Order / Quote Request Reports Access instructions and quote/job details were not displayed in full where there where access instructions were too large. Status Certificate Merge Field The total instalment merge field will display the correct details where all lots are selected and one of those lots has a zero entitlement. Direct Entry by Email – update email subject line Where payments are made from a general trust account, the subject line now reads Remittance Advice. Owner & Executive Portals

Print Levy Notices with fileSMART

Display UE Correctly when Deleting a Lot An issue has been resolved where the Corp | Entitlements tab was not being refreshed after a lot was deleted. User Security on Corp Screen An issue has been resolved where the function keys were still enabled in the Corp screen when the user has not been granted Write access. Removed Work Order Status An issue has been resolved where a diary could not be closed if the work order status was set to Removed. Corp Diary – Adding New Details An issue has been resolved where a diary entry would return an error when a user double clicked on the details section of the diary without first highlighting a row. Duplicate User or Login Name

|

STRATA Master Version 7.0.1 Beta Release Notes

|

Reminders Proxies |

An additional reminder has been added to the configuration screen to allow you to monitor valid proxies, based on the expiry date recorded in the Proxy / Nominee Register. Default settings The first reminder will be displayed 30 days prior to a proxy expiry date, and the second reminder will occur 7 days prior to expiry. Reminder Details Any proxy which meets the criteria in the reminders configuration will display the following details:

Link Screen When you click through from the reminder screen for a proxy reminder, STRATA Master will display the Proxy / Nominee register for the owners corporation. Note: This reminder will not continue to be displayed past the proxy expiry date. |

| Reminders – Report Toolbar |

The following options are now available for saving the Reminder Report.

|

| Other Changes |

The following issues have been rectified in this version: Reminders - Open Diary A change has been made to highlight the selected item in the diary when selected from the reminders screen. Reminders - Work orders or Quotes A change has been made to ensure that reminders will not be displayed for open work orders or quotes where the user has indicated that there is no further action required on the owners corporation diary. A change has been made to only display lots with a payment plan for the current owner. Reminders - Display Settings and Screen Resolution Changes have been made to ensure that the entire reminders screen can be viewed and utilised when display settings and screens resolutions are altered. Repairs & Maintenance An issue has been resolved where upon saving a quote or work order STRATA Master would revert to display the Job Details tab. Journal Entry Screen An issue has been resolved where an error is displayed if users scroll the account number selector in the journal screen, using a mouse or arrows on the keyboard. |

STRATA Master Version 7.0.0 Beta Release Notes

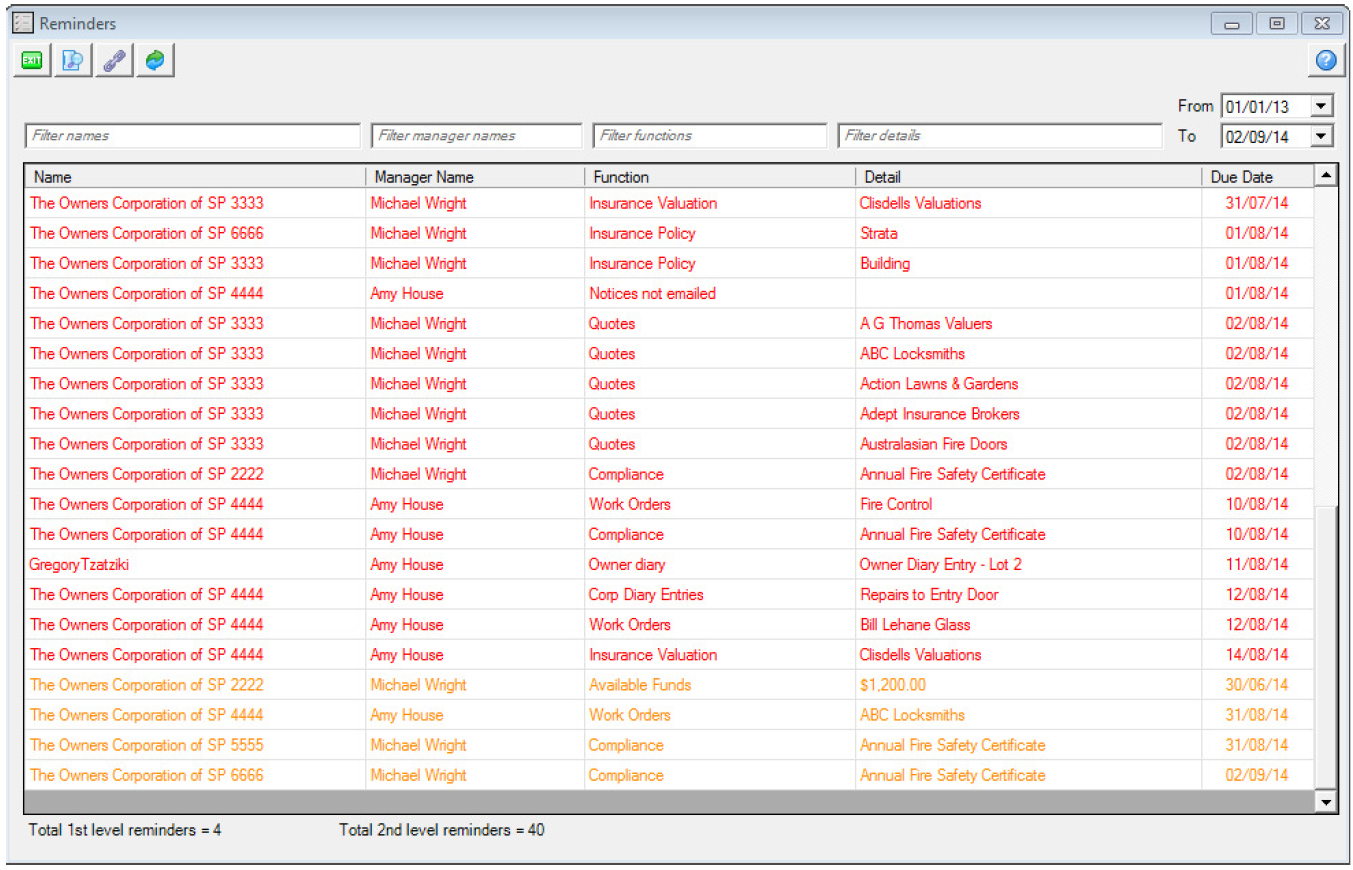

| Reminders |

Each user is now able to configure alerts to remind them of important tasks to be completed. Firstly, you can select which Manager(s) you wish to follow. This determines the buildings which will be included in your alerts. Then, you can set the number of days before or after an event occurs for the reminder to be displayed. This includes diary items. Finally, you can select which functions are monitored - for example; if you only want to see insurance related items you only select those from the configuration screen. Your tasks are then displayed in a list of the most important items at the top of the list, based on your criteria. You can filter the results on screen, by:

If you wish you can then print the list of action items and click through from the list to the see further details relating to the task. Please review the Setup and Use Guide for further details. |

|

Help – Sensitive Help |

A help icon is now located on the main toolbar. To access the Help file you can now click the icon on the toolbar, click F1 to launch the in-system help. STRATA Master includes over 120 screens where users are able to launch help which is specific to the screen which is being viewed. To indicate to users where there are specific articles to explain how the screen works, there is now a small Help icon on the right hand side of the screen. Click the Help icon on the selected screen, or F1 to launch the help for the chosen function. |

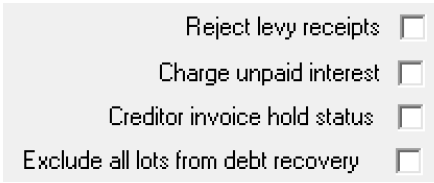

| Reject levy receipts for a lot |

When processing your daily bank download file, if you do a not want a levy receipt to be automatically created, you are able to tick the Reject levy receipts checkbox in the Levies tab of the Owner screen.

You are still able to Reject levy receipts for an entire owners corporation, by ticking the checkbox in the Corp screen, on the Financial tab. You can view the status of this checkbox in Quick Reports | Lots for current owners. |

| Executive Committee – Unlimited members |

The number of executive committee members which can be linked to an owners corporation is now unlimited. To add a new member, select the |

| Investment Account Bank Reconciliations |

The Bulk Bank Reconciliation Wizard has been enhanced to allow you to produce and/or save bank reconciliation reports for your linked investment accounts as well as your working accounts.

Note: Where you have the rights to publish the document (in the fileSMART User Configuration) on the Owner & Executive Portals you will be prompted at the beginning of the process to make your selection.

Note: Where there are multiple investment accounts linked to a plan the description of the report will be followed by _1, _2 and so on. |

|

Management Fee Save to file |

When invoicing or reprinting management fee invoices you have the option to save a copy of the invoice.

Note: Where you have the rights to publish the document (in the fileSMART User Configuration) on the Owner & Executive Portals you will be prompted at the beginning of the process to make your selection.

Note: If you are configured for running split management fees, when saving the second management fee invoice for the month the description of the second invoice will be followed by _1. |

| GST Frequency |

STRATA Master will use the GST frequency and the Tax year end for each plan to determine if transactions are being created in the current, or a previous GST period. For example: Today is 11/06/2014, the GST frequency is quarterly and the tax year end is 30 June 2014, the current GST reporting period is therefore 1 April to 30 June 2014. Warnings will be displayed, and Audit trail records created in the database when any transaction is created in a prior GST period to ensure that GST transactions are created as required. The audit trail records are displayed in a new GST audit trail report outlined in the release notes below. Note: All GST registered plans are set with a quarterly GST frequency during the upgrade to version 7, and can be edited as required. |

| GST Warnings |

To assist users to review GST transactions prior to lodgement with the Australian Taxation Office (or similar), when any of the following occur a warning will be displayed on screen.

Note: Following the warning, upon completing any of these actions a record will be made in the audit trail, and reported as detailed below. |

| GST reports – Change to calculation |

|

| GST Details reports – New Details |

The following additions have been made to the report to help you determine if the transaction was entered correctly:

Note: The additions are included on the reports when they are run from Formatted reports, or the Reports | GST Report menu. |

|

GST Audit Trail Report |

A GST Audit Trail Report can now be generated which will lists details saved following a warning which may impact the GST calculation from a previous GST period. The new report is found in Reports | Audit trail reports menu option, and is generated by selecting the GST checkbox. The GST Audit Trail Report is based on the original transaction date recorded in STRATA Master, not the date the transaction was changed by the user. Note: The report layout is different from the other audit trail reports so when the GST checkbox is selected, the other checkboxes are unselected automatically. Each entry in the Audit Trail Report includes the Plan number (where appropriate), Original transaction date and the date the record was altered, known as Change date. In addition the following details are also displayed for each action listed below: Changing the GST status of a creditor

Posting journals to the GST clearing account(s)

Saving an invoice where the transaction date is in a prior GST period

Cancelling of levies due in a prior GST period

Cancelling a payment made in a prior GST period

Search/Edit transactions; where the fund is changed and the original transaction is in a prior GST period

Cancelling a levy receipt dated in a prior GST period

Cancelling an owners corp. receipt dated in a prior GST period

Deleting an invoice saved in a prior GST period

|

|

Creditor Invoice Entry |

Creditor Invoices

Creditor Invoices – Multiple Dissection

|

|

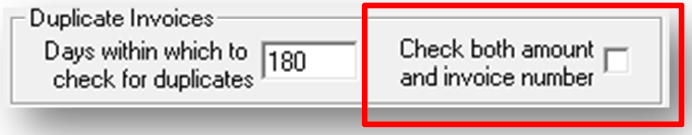

Duplicate Invoice |

Agency configuration (Options # 2) displays a new checkbox called Check both amount and invoice number. When the checkbox is ticked STRATA Master will prompt for duplicate invoices within the specified number of days and only when both the amount and invoice number are recorded against the selected plan and creditor. Where the checkbox remains unticked, the duplicate invoice prompt will continue to be displayed when the amount has already been recorded against the selected plan and creditor. The invoice duplicate checking method is used when saving / validating invoices in the following screens:

Notes: During the upgrade, this checkbox is unticked which means that the duplicate invoice checking method is unchanged. |

| Manage| Creditor Check ABN |

A new button has been added to the Creditor screen called Check ABN which will launch your default browser and search the Australian Business Registry (www.abr.business.gov.au) for the creditor recorded.

A change has been made which will require users to select the appropriate GST status when adding a new creditor. Previously all new creditors would default to GST Unregistered. |

| Manage | Creditor – Suppress creditor remittance advices |

When payment method for a creditor is Direct entry, you now have the option to suppress issuing remittance advices. Where creditors are set to receive a printed remittance, ticking the Suppress remittance checkbox will stop the remittance being printed when the Pay function is completed for Direct Entry. Where creditors are set to receive an emailed remittance, ticking the Suppress remittance checkbox will stop the remittance being emailed when the Pay function is completed for Direct entry with email. In addition, the payment will not be listed on the Remittances to be emailed report printed during the Pay function. To confirm which invoices are being included in a specified Pay run, you should continue to run a Quick Report from the Cr. Invoices tab, and select Invoice status of Unpaid approved. Note: Where the remittance has been suppressed if you wish to create a remittance at a later time, you are able to print a remittance using Search/Cancel payments, and select the Preview or Print option. |

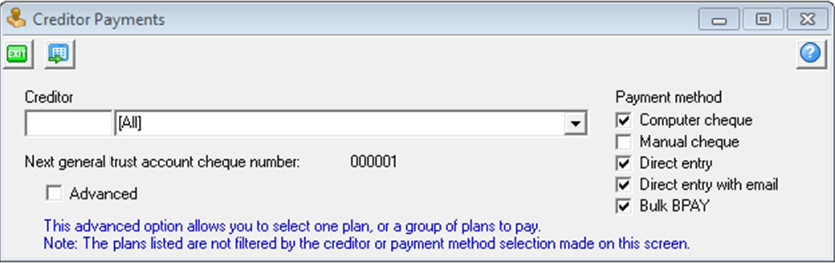

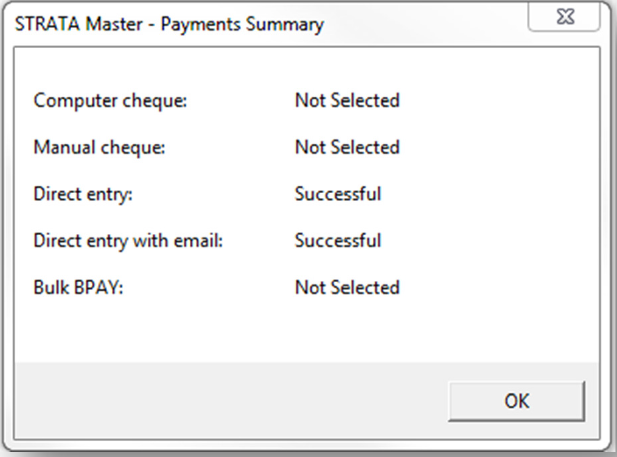

| Creditor Payments – Multi Select payment methods |

The Pay screen has been updated to allow multiple payment types to be processed in a single pay run.

In addition, a summary of each selected payment method when all payments have been completed. |

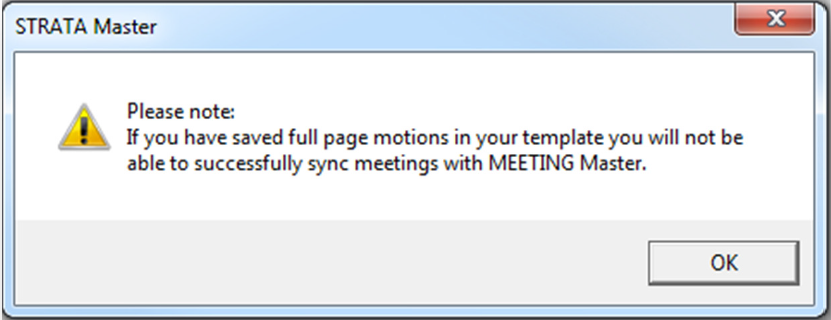

| Meeting template validation message |

When saving changes to meeting agenda and minute templates the following message will always be displayed to confirm the correct setup required to ensure successful synchronisation with MEETING Master. |

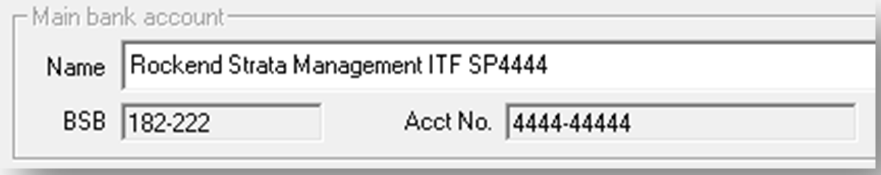

| Corp screen – Bank Account number |

The main bank account linked to each plan is displayed in the Bank Acct tab in the Corp screen. The BSB and Account number for the Main bank account are now also displayed. Note: Where a suffix is recorded for New Zealand bank accounts, this is displayed after the account number field. |

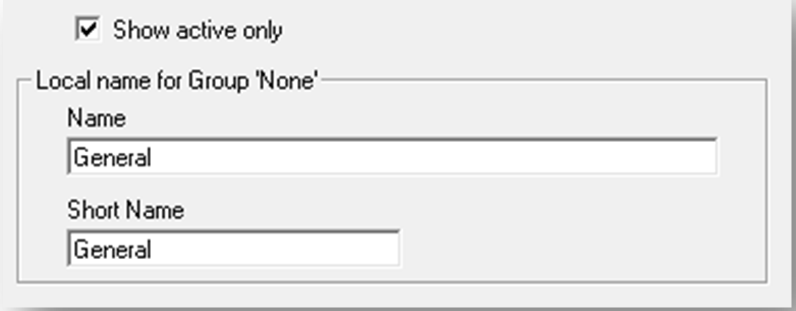

| Financial Group Reporting - Rename group ‘None’ by plan |

Where plans are set-up for financial group reporting any transactions not assigned to a group are displayed in reports as group ‘General’ or ‘None’. At a plan level users can now change the name displayed on the reports in the Manage | Group Reporting screen.

Victorian users who configure group reporting for managing multiple owners corporations, are able to rename ‘None’ to Owners Corporation 1. Note: STRATA Master will allow the fields to be blanked which will result in no group name being displayed where the transactions are not associated with a specific group. |

| User Meeting Favourites |

Quick Reports – Lots – Owners The following details are now available for both Show current owners and Show previous owners:

Quick Reports – Lots – Debt Recovery The Last receipt date is available for Show current debt recovery output. Journal report The formatted report has been improved with the addition of the general ledger account number prefixed to the account name for both the debit and credit accounts. Audit Trail Report – Transaction The general ledger account number is now displayed to the left of the account name, and the group name displayed to the right. Annual levy notice – Display in chronological order The annual levy notice will now display all standard levies due within the levy year in chronological order. Budget Screen – GST status and Row highlight

Preview Management Fees Report before Processing You must now preview the report detailing all charges which will be posted to the general ledger, before running the management fees for the month. Proposed / Approved Levy Posting Report The entitlement set associated with the levy posting is displayed on the report, directly under the group name. Utility - Un-present a BPAY payment The existing utility which allows cheques and direct entry payments to be unpresented has been expanded to include BPAY payments. |

| Other Changes |

Creditor Invoice – Multiple Dissection screen - ‘On Hold Status’

Manage | Creditor

Accounting | Adjustments | Journal entry

fileSMART login

Replace Compression Program for Backing up Documents

Include skipped payment numbers on selected reports

|