Setup and Update Income and Expenditure Fees in REST Professional - Australia

Overview

Your owner Income and Expenditure fees can be setup up globally for all owners or for all owners currently being charged a specific amount. The fee can also be set up individually against each owner.

Report on Current Income and Expenditure Fees Set Against the Owners

In order to generate a report to ascertain what the owners are currently setup to be charged, go to Transactions > Owner One Off Charge > Print

This will only show any owners who have a fee set against them, any owners who have Income & Expenditure set to $0 will not show on this report.

Change Income and Expenditure Fee Globally

Backup your REST data and rename it i.e. before.global.change.dat.zip

Go to Other > Utilities > Global changes

Click OK to confirm you have a current backup

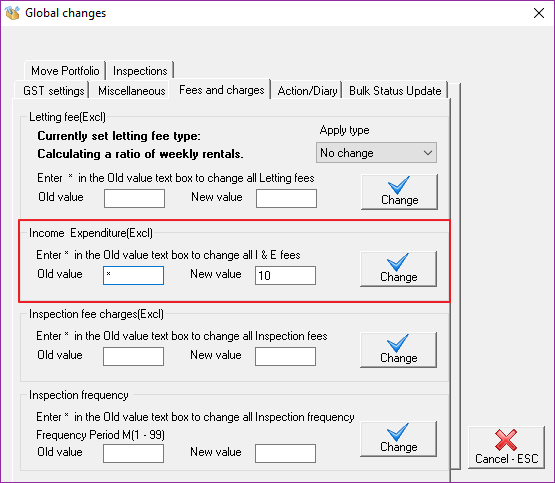

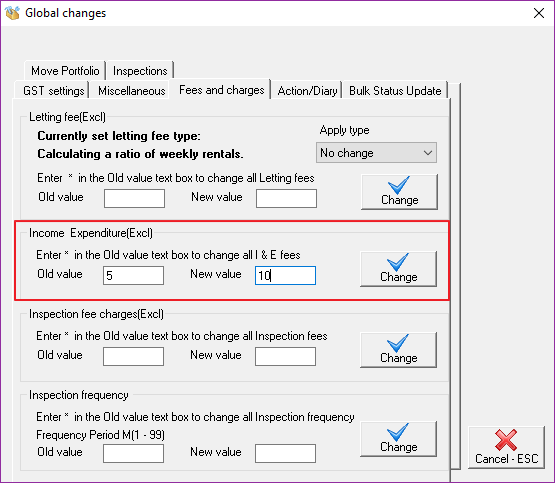

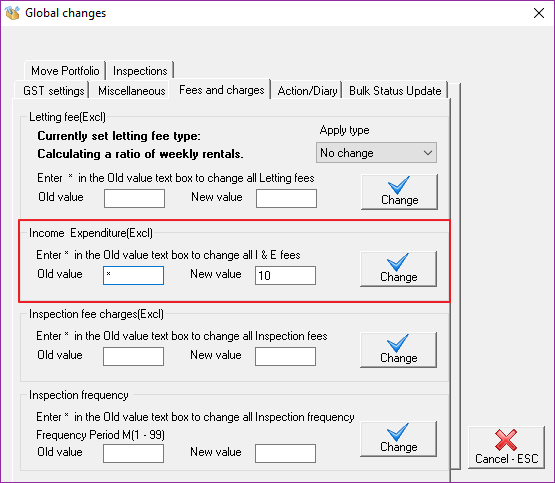

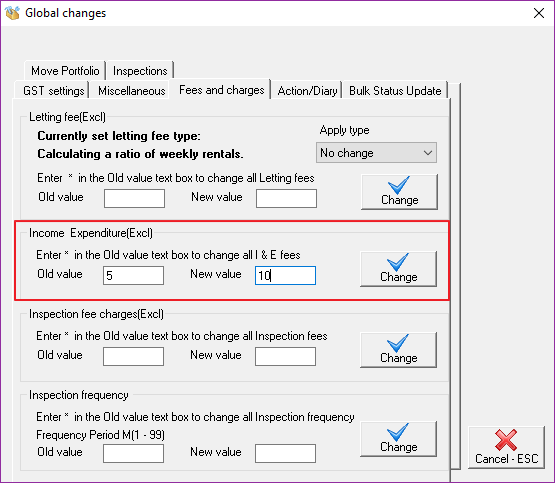

Click the Fees and Charges tab

In the Income and Expenditure charges section, you have the option to filter the owners for whom you want to set up or update the fee;

To update the charge for all owners, regardless of the existing fee to a common amount, enter an asterisk (*) in the Old Value field

To update the charge for all owners who are currently charged a specific amount, enter the amount in the Old Value field

Enter the amount to be charged in the New Value field

Click Change

Click OK to confirm your changes

NOTE: When the change has been made, check one or two owners to ensure that the correct fee is now set.

Setup or Update I & E Fee for Individual Owners

Go to Files > Owner > Enter appropriate owner alpha index and press Enter

Click on the Tax & Charges tab

Enter the Income & Expenditure Fee amount in the required field and click OK-F12

Setup an Internal Account for I & E Fees

If you do not have an internal account already set up for Income & Expenditure Charges, enter a new internal owner and property in Owner and Property Details making sure that:

The alpha code starts with AA (e.g. AAINCEXP).

Fees and charges should be 0.00 on the internal owner and property cards.

In the Taxes and Charges tab of Owners Details, the account has been marked as internal and Account attracts GST has been selected. It should also be selected for revenue recovery and selected for payment at the EOM.

Further instructions for setting up an Internal Account can be found here: How to Create an Internal Owner Account in Rest Professional

Setup an Account Code for I & E Fee

If you do not already have an account code set up for Income & Expenditure Fee you will need to create one before charging the fee:

Go to Files > Chart of Accounts

Click on Add Mode

Enter an account code in the range of 401-499.

Enter a Long and Short Description for example Income & Expenditure Fee & click OK-F12

Further instructions for setting up an Account Code can be found here: How to Add Chart of Account Codes in Rest Professional