How to Refund a Sales Deposit in REST Professional

Overview

In the event that a sale does not proceed, there may be a requirement to refund the sales deposit paid to the Purchaser.

This document will cover:

- How to Ascertain the Deposit Amount

- How to Refund the Sales Deposit to the Purchaser

How to Ascertain the Deposit Amount

- Go to go to Files > Sales > Sale or click on the

on the sales toolbar

- Select the alpha index of the Property and press ENTER or simply press enter and select from the list of properties

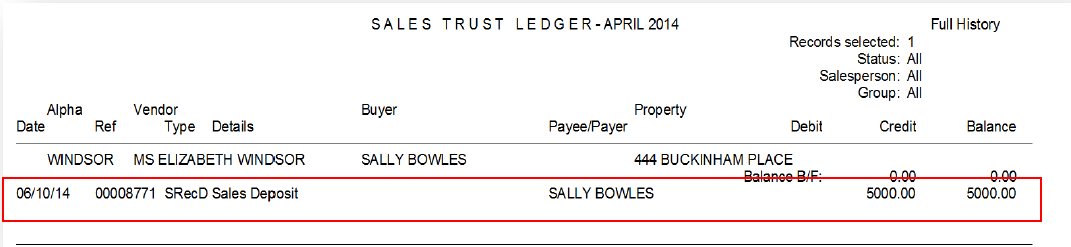

- Click on the Enquiry tab – the deposit collected will appear in the dep/sundry column

- To check the ledger for further details, click on the Printer Icon at the top right of the page

- Click on Preview-F11

How to Refund the Sales Deposit to the Purchaser

- Go to Transactions > Sales > Disbursement or click on the

icon on the sales toolbar

- Select the alpha index of the Property and press ENTER or simply press enter and select from the list of properties

- Select the criteria for the transaction:

From - Select Trust Account

To - Buyer

NOTE: This will prompt a payment details box to populate where the clients cheque or EFT details can be entered. REST will prompt a message asking if you would like to update the Buyer Details.

Amount – Enter the amount of the sale deposit to be refunded

Description – Enter in a description i.e. Refund of Sale Deposit

Ref./Invoice No. – enter a reference i.e. refund of deposit on xxxxxx (property address)

- Click OK – F12

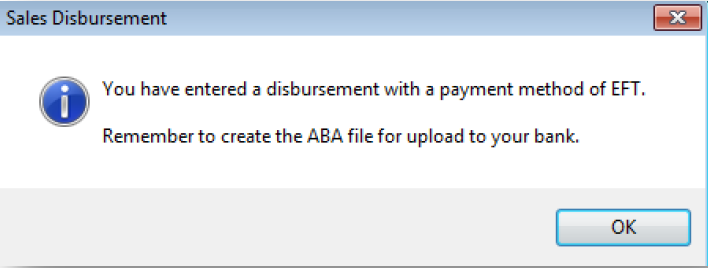

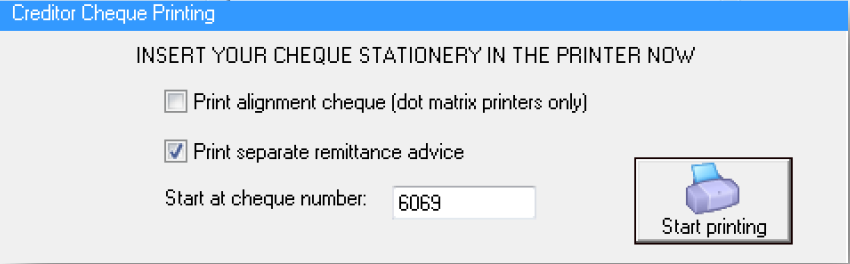

- You will then be prompted depending on the payment method:-

For EFT – You will see a message that a disbursement has been created and to remember to create your aba file

For CHEQUE – You will be prompted to select to print an alignment or separate remittance and to confirm the cheque number. Click on Start Printing.

- If paid by EFT ensure you create your ABA file for upload to Bank through Transactions > Create File for Upload to Bank > EFT (ABA) Payments and click Print

NOTE: The account sales (report) will still record the deposit paid and does not record the refunded amount. For this reason it is important that this card be marked as fallen over or completed. Any subsequent sales for this property will require a fresh sale card to be created.

on the sales toolbar

on the sales toolbar

icon on the sales toolbar

icon on the sales toolbar