How to Receipt Owner Funds in REST Professional

Overview

Owner funds may be received into your trust account from a Landlord to assist with the payment of a disbursement where there would be insufficient funds from the rental funds alone.

Steps

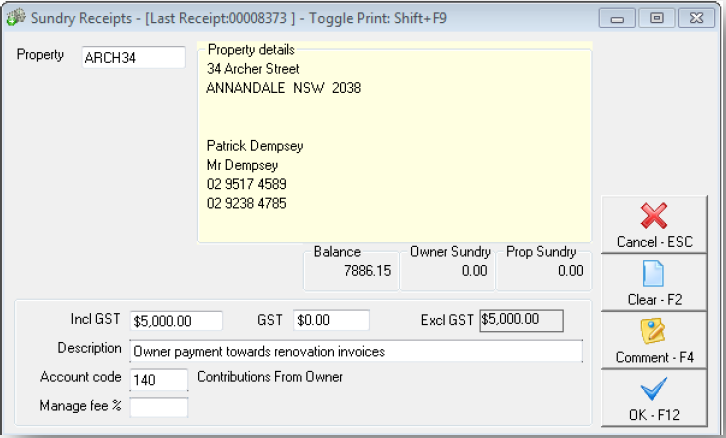

- Go to Transactions > Sundry Receipts

- Enter the details for the disbursement:-

- Property - Enter the alpha index of the property

- Incl GST - Amount to be credited. Zero out the GST field

- Description - Owner payment towards o/s invoice etc.

- Account code - If the owner sends contributions to cover outstanding or future invoices, use account code 140 owner contribution. If it is any other funds i.e. returning overpaid or dishonoured monies, ensure you use account code N/A

- Management Fee % - this field should be left blank

- Click OK-F12

- Enter the Banking details:

- Payment Method – Select the relevant method

- Received from – Owners name

Funds are now available for invoices to be disbursed from the property.

NOTE: If you are not disbursing these funds straight away you may want to withhold this amount from the owner to avoid releasing the funds back to them prior to the creditor payment being made. This can be done by going to Owner Card and clicking on the Payments tab and entering the withheld amount.