Tenant Refund – Apply Part to Invoices and Balance to Tenant

Overview

Tenant is vacating and requires a refund; however, there are still outstanding invoices that need to be paid before the refund is given.

This document will cover the two ways that this process can be done in REST Professional:

- Create two tenant refund amounts – pay one to outstanding invoices and balance to tenant

- Reversing the latest receipt and re-applying to rent and invoices

Create two tenant refunds – Pay one to outstanding invoices and balance to tenant

Below are an example of outstanding invoices due and then the balance of the tenant refund

Outstanding Invoices $ 450.00

Tenant Refund $1550.00

Total Refund $ 2000.00

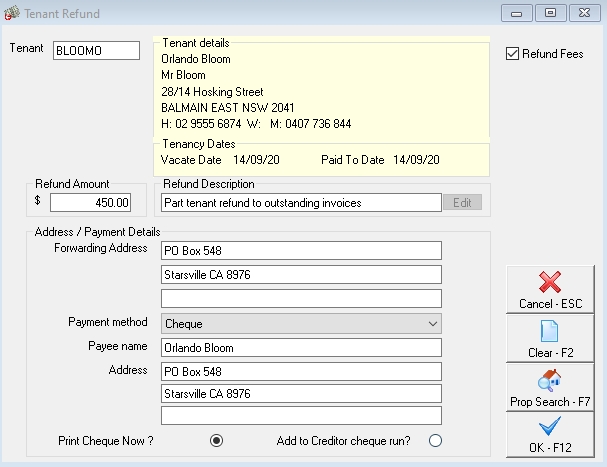

- Go to Transactions > Tenant Refund and enter the tenant alpha and press enter

- REST will calculate the refund amount automatically. Change the Refund Amount to the total of your outstanding invoices i.e. $450.00

- Ensure that Refund Fees is ticked (this should default to being ticked)

- Change the default description to “part rent refund to outstanding invoices

- Add in a forwarding address

- Select the Payment method as Cheque

- Click on Print Cheque Now

- Click on OK-F12

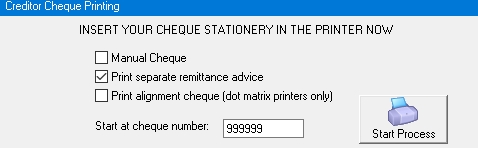

- Start at cheque number 999999

- Click on Start Process

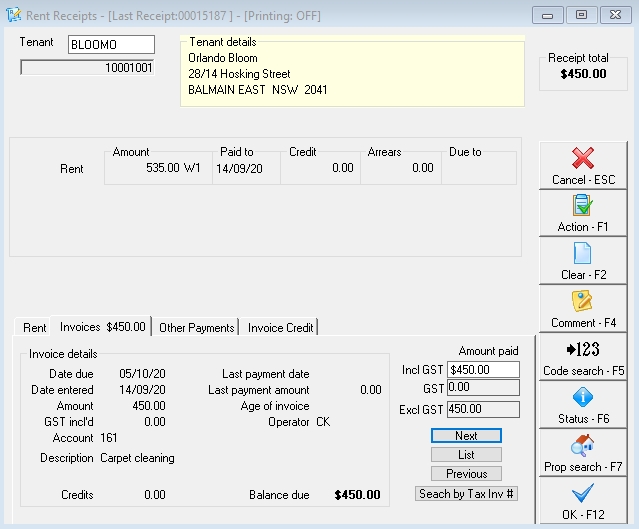

2. Go to Transactions > Rent Receipts and put in the tenants alpha index and press enter

3. Click on the Invoices tab and enter the invoices and ensure they total the amount of the refund you have just done i.e. $450.00

4. Click OK-F12

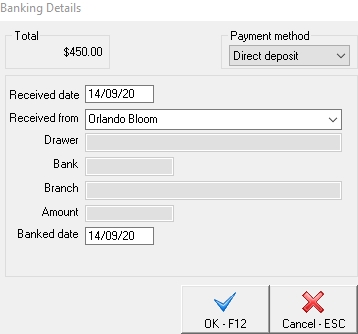

5. Choose payment method direct deposit and click OK-F12

NOTE: When you create a tenant refund, regardless of the amount (whether it is the full amount or a part amount) REST will show the tenant being paid up to the vacate date with no credits.

In order for REST to identify that there are remaining funds that still need to be refunded, you will need to update the credit amount to the remaining amount to be paid out.

6. Go to Files > Tenant and enter the tenant alpha index and press enter

7. Go to the Rental tab and enter the remaining balance of refund due into Credit last month i.e. $1550.00

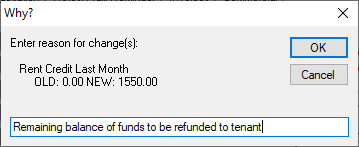

8. Click OK-F12

9. Enter the reason for change and make reference to the remaining balance of funds to be refunded to the tenant

10. Go to Transactions > Tenant Refund and enter the tenant alpha index and press enter

- REST will calculate the refund amount automatically. i.e. $1550.00

- Ensure that Refund Fees is ticked (this should default to being ticked)

- Enter your tenant’s payment details, select Print Cheque/EFT now to process the Remittance & Payment straight away or Add to Creditor Run to process the payment with your next creditor run

- Click OK - F12

Follow the prompts through to payout your tenant (setup as a temporary creditor) if you have chosen to pay now by going to Reports > Creditor > Remittance and Payment, select your tenant and click on NEXT and follow the prompts through to payout.

Reversing receipt and re-applying to Rent and Invoices

An alternative way of allocating the overpaid rent to invoices is by simply reversing the last rent receipt and re-entering it so it pays the invoices outstanding and then the balance to rent.

You can do this only if owner has sufficient funds to reverse the receipt.

NOTE: If receipt is from a previous period, it must be a straight rent receipt i.e. you cannot reverse receipt for rent plus outgoings/sundries/invoices.

- Go to Transactions > Cancel transactions > Receipt reversal / Reverse Rent from Previous Period

- Re-receipt rent to the outstanding invoices and any balance to rent

- Use payment method Direct Deposit

- Proceed to do tenant refund through Transactions > Tenant refund and payout the tenant as a creditor (set up as a temporary creditor) If this was receipted to tenant invoice credit, refund by going to Transactions > Allocate Tenant Invoice Credit and refunding to the tenant as a creditor payment