Unable to Edit a Transaction in Search/Edit Transactions in Strata Master

Summary

Some transactions can be edited in the Search/Edit Transactions screen. When clicking on the transaction, a pop up box will show editable fields. This article will assist clarify when you cannot edit the fields you wish to edit.

If a required field is not editable in this screen, you can generally do so with Journals.

Overview

The editing of fields can be divided into 4 categories -

- Fields editable for all time.

- Fields editable up to Annual Rollover of a Plan.

- Fields are only editable with journals.

- Unpaid invoices.

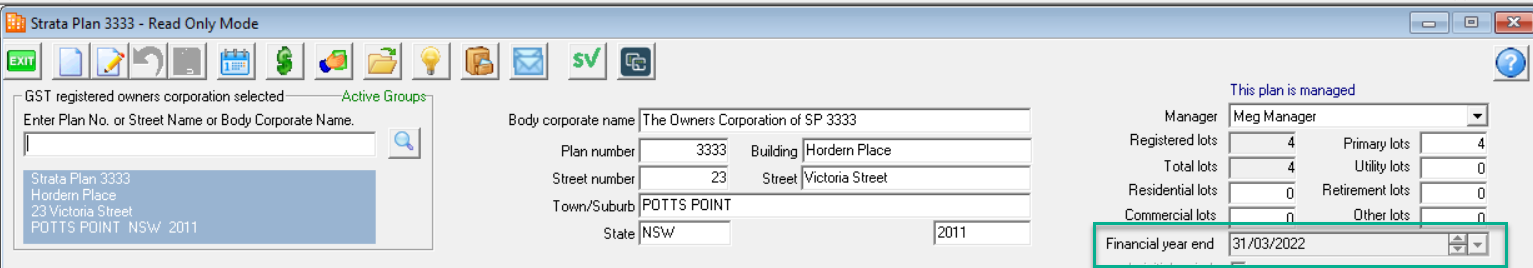

Once the Annual Rollover is processed, many fields are then locked in the search/edit transaction screen, and then require journals to adjust. Find the Financial Year End in the Corp screen.

Note that any changes made through the search/edit transactions screen will be reflected in the Audit Trail report.

Fields Editable for All Time

Fields that can be edited for all time are generally those listed below. Note there can be variations in this -

- Descriptions of invoices and payments

- Invoice numbers

- Descriptions of levies, levy receipts and owners corp receipts

- Descriptions of Journals

- Cancelled transactions

Fields Editable Up to Rollover of a Plan

The following fields are editable in this screen until a relevant Plan has been 'rolled over' to its new financial year. Once the financial year rolls over, the fields are in the read only values section. The transactions can be edited after rollover however, using journals.

- Expense accounts with the same gst code in Chart of Accounts

- Expense accounts with the same Fund eg Admin or Sinking Fund

- Income accounts for standard accounts such as status certificate fees and strata inspection fees.

Fields Only Editable With Journals

Some items are prohibited from being changed in this screen by legislation. The following changes require journal entries to edit anything but the basic details -

- Accounts where the 2 involved accounts have different gst codes in Chart of Accounts.

- Accounts where the 2 involved accounts are in different Funds eg Admin or Sinking.

- Dates of transactions.

Unpaid Invoices

Unpaid invoices are changed in the Creditor Invoices screen. There is a note to this effect in the Editable values section as below.

Related Articles

Journals to Correct GST on Payments

Journals to Correct GST on Receipts

Check Chart of Accounts for GST Codes

Move Transaction From One Fund to Another

Change the Date of a Transaction