Holding Deposits in REST Professional

Holding Deposits can be receipted into REST against a prospective tenant who has paid a deposit or holding fee on a property. The funds receipted as holding deposit are held into an internal owner account called AATENDEP until they are applied to a rent receipt or refunded back to the tenant.

This document will cover:

- Creating the New Tenant Card

- Receipting the Holding Deposit

- Refunding the Deposit to the Tenant

- Applying the Holding Deposit to Rent

- Transferring the Forfeited Holding Deposit to the Owner

Creating the New Tenant Card

- Go to Files > Tenant or click on the tenant icon

- Click on ADD MODE

- Enter an alpha index for the tenant

- Enter the details of the tenant as required

- Enter the property alpha index and press ENTER

- Click OK-F12

Receipting the Holding Deposit

- Go to Transactions > Deposit Receipts or click on the Key icon

- Enter the Tenant alpha index and press ENTER

- Enter the amount of the holding deposit

- Click OK-F12

- Enter the banking details and click OK-F12

Refunding the Deposit to the Tenant

- Go to Transactions > Rent Receipt or click on the rent receipt icon, put in the alpha index of the tenant and press ENTER

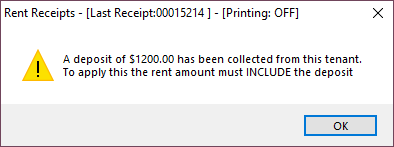

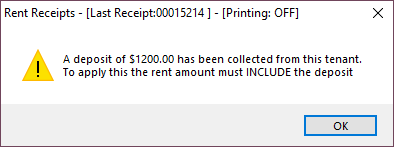

- You will now get a message about the holding deposit that has been collected from this tenant > Click OK

- Enter the amount of the deposit into the Tenant Invoice Credit field with a Description i.e. Refund of holding deposit and click OK-F12

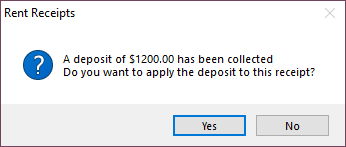

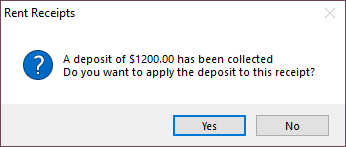

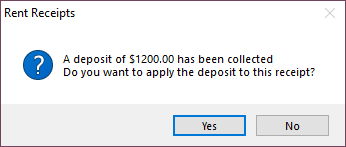

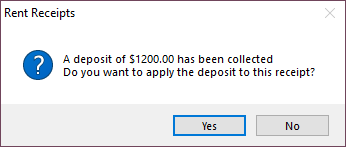

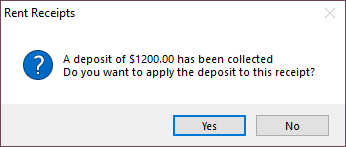

- A prompt will appear asking if you would like to apply the holding deposit to this receipt, click YES.

- These funds will now be in your tenant's invoice credit balance to be able to refund to them

- To refund the deposit that is now in your tenant invoice credit go to Transactions > Allocate Tenant Invoice Credit

- Click the Refund tab

- Complete the Refund Amount for the tenant, Description i.e. Refund of holding deposit and Account Code field (N/A)

- Select the Contact to refund

- Select the Payment Method for this refund

- Enter the Payee or Account Name

- Enter the Address or Bank Account Details

- Enter the Forwarding Address, if not required you can just enter the refund description in this field

- Click OK to process the allocation

The tenants refund payment will now be added to your creditor run. If you wish to pay this now you can go to Reports > Creditor > Remittance and Payments > Select the tenant and process their payment only from there. Once processed, if paid by EFT you can create your ABA file next by going to Transaction> Create file for upload to the bank > EFT (ABA) Payments > Print. You must immediately upload that to the bank.

NOTE: You will not be able to archive/delete this tenant card until after your next end of month/files update has been processed.

Applying the Holding Deposit to Rent

- Ensure that all lease details are completed against the tenant card i.e. lease commencement/start dates and paid to dates etc. NOTE: If the details of the lease start date were not entered at the time of creating the tenant card, the Paid to Date on the Rental Tab should be updated to reflect the day before the lease start date

- Go to Transactions > Rent Receipt or click on the rent receipt icon, put in the alpha index of the tenant and press ENTER

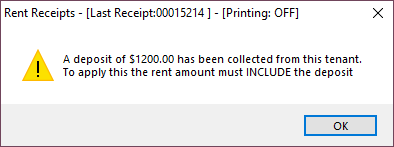

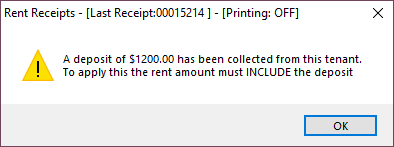

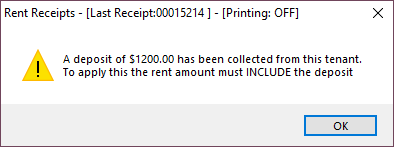

- You will now get a message about the holding deposit that has been collected from this tenant

- Enter the rent amount and bond monies as required remembering to include the holding deposit in the total amount receipted.

- A prompt will appear asking if you would like to apply the holding deposit to this receipt, click YES

Example

Mr Clarke has paid a $1200.00 holding deposit and is now paying the balance of monies owing being $7200.00 which is for 2 weeks rent and 4 weeks bond. In REST enter the rent of $2400.00 (the $1200.00 paid now plus the $1200.00 paid as a deposit) and $4800.00 for bond.

The RECEIPT TOTAL should be $7,200.00 (monies received and deposit). On the payment banking details screen, this should reflect the amount actual received now (i.e. not including the deposit)

Transferring the forfeited Holding Deposit to the Owner

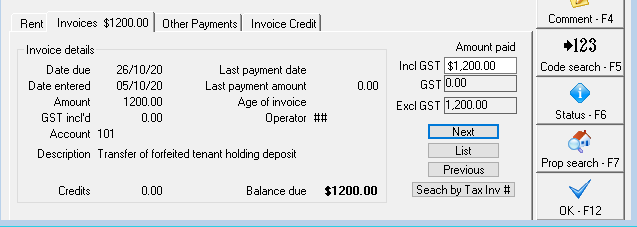

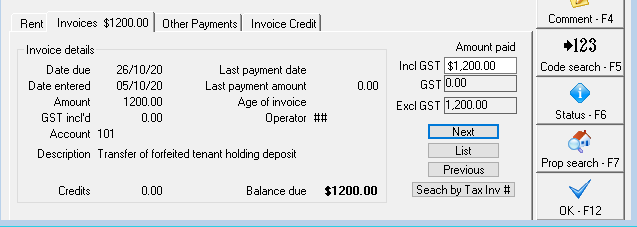

- Firstly you will need to create a tenant invoice against the tenant who has forfeited their tenant deposit. Go to Transactions > Invoice Entry

- Select the tenant

- Enter the amount of the tenant deposit you will be transferring to the owner (No GST)

- Enter Description, i.e. Transfer of forfeited tenant holding deposit

- Account Code (101) for Rent

- Enter a Management Fee % if applicable

- Pay to: Owner must be selected

- Click OK-F12

- Go to Transactions > Rent Receipt or click on the rent receipt icon, put in the alpha index of the tenant and press ENTER

- You will now get a message about the holding deposit that has been collected from this tenant > Click OK

- Click on the Invoices Tab and you will see the tenant invoice for the transfer of holding deposit

- Enter the amount of the invoice and click OK-F12

- A prompt will appear asking if you would like to apply the holding deposit to this receipt, click YES.

- These funds will now have been transferred to the owners ledger for the forfeited tenant holding deposit

NOTE: You will not be able to archive/delete this tenant card until after your next end of month/files update has been processed.