When an Invoice has Been Paid from the Wrong Plan

When an invoice has been paid from the wrong plan, the plan that should have paid for the invoice needs to reimburse the plan that actually paid the invoice. Please note there are different instructions if you operate individual accounts or a general (pooled) trust.

![]() The original payment to the creditor does not need to be cancelled

The original payment to the creditor does not need to be cancelled

Individual Bank Account Configuration

From the plan that should have paid the invoice:

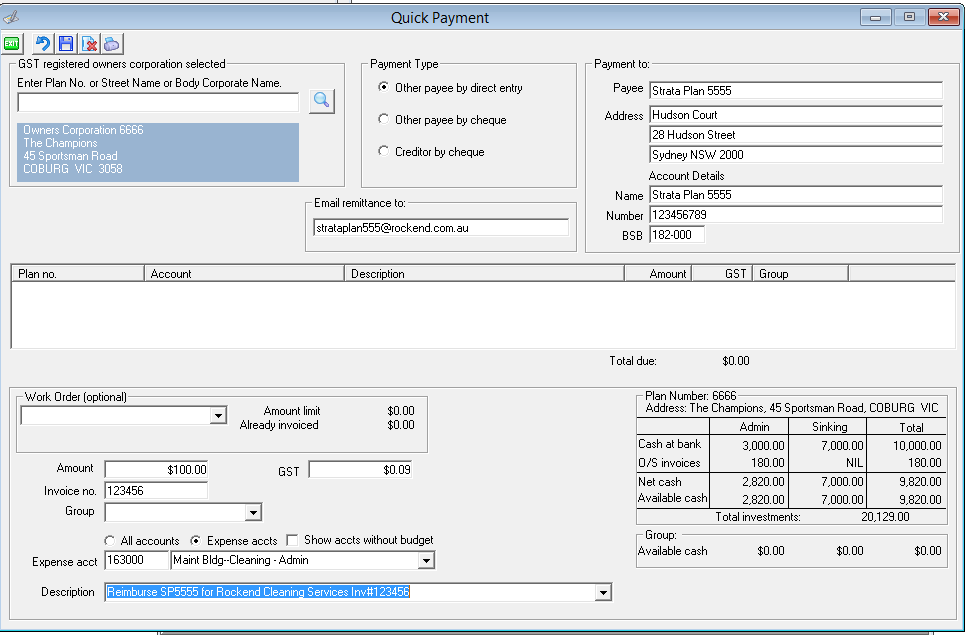

1) Process a Quick Pay transaction

- Payable to the Owners Corporation who paid the invoice

- From the expense account that the invoice should have been paid from

From the plan that should not have paid the invoice

2) When the quick payment from the other plan is shown on the bank statement; process a receipt

- Receipt Type: Other Receipt to Owners Corporation

- You can choose either to;

- Select the original expense code the incorrect invoice was paid from, as the receipt will offset the original payment OR

- A different account may be selected if required.

General / Pooled Trust Account Instructions

If General Trust Account, 2 journal entries need to be processed in the plans. No cash transfers are required at the bank, as the funds are paid from the general trust, only the record of the payment needs to be amended.

- For the plan that should not have paid for the invoice

DR Cash At Bank (select Admin or Sinking)

CR GL account to account for the expense (select Admin or Sinking)

- For the plan that should have paid for the invoice

DR GL account to account for the expense (select Admin or Sinking)

CR Cash At Bank (select Admin or Sinking)