Letting Fees in Rest Professional

Overview

There are a several ways to charge the owner for the Letting Fee in Rest. You can charge letting fees when receipting move in costs on the Tenant Receipts > Other Payments tab of the receipt or you can charge the letting fee by journal. Alternatively, you can now setup default agency fees and charge any new tenancy fees within this new feature. If you use Charge Agency Fees, refer to Agency Fee Configuration and Charges Setup and Use in REST Professional.

This document will cover:

- How to set up the default Letting Fee

- How to charge Letting Fee through the Rent Receipts screen

- How to charge Letting Fee via Journal

- How to refund a incorrectly charged Letting Fee

How to Setup the Default Letting fee

There are 3 ways to calculate letting fees in Rest; by number of weeks, a percentage of annual rent or set dollar amount. The default setting is located in System Options. If you wish to change the default option, this can changed in your System Options. You will need to contact Rockend prior to changing this System Option.

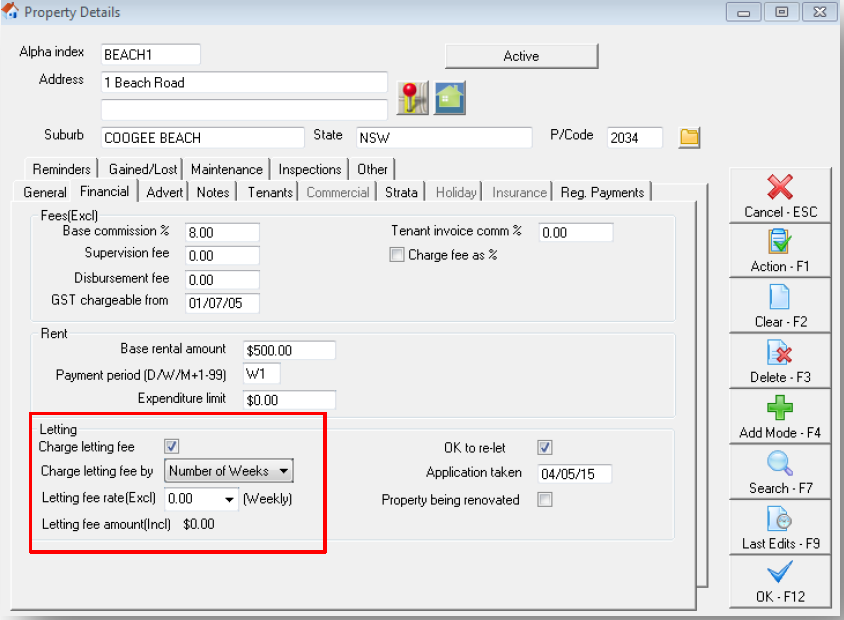

- Go to Files > Property > Financial Tab or click on the house icon

- Tick “Charge letting fee”

- Enter Letting Fee Rate:

- Letting Fee by Number of Weeks – Enter the rate by number of weeks (or part thereof) you wish to charge for the property. If you wish to charge half a week, you would select 0.50 from the drop down menu.

- Letting Fee by % of Annual Rent - Enter the percentage of annual rent to be charged for this property.

- Letting Fee by $ amount – Enter the fixed amount to be charged as a Letting Fee to this property. This amount is exclusive of GST.

- Click OK-F12

This process does not charge your letting fee automatically for you. This merely holds the information of the rate at which the fee is charged.

How to Charge Letting Fee through the Rent Receipts Screen

When you are receipting the tenants’ move in costs i.e. rent and or bond monies, you can charge the owner the letting Fee at this point.

NOTE: You cannot charge a letting fee through the rent receipts screen unless you are receipting monies at the time.

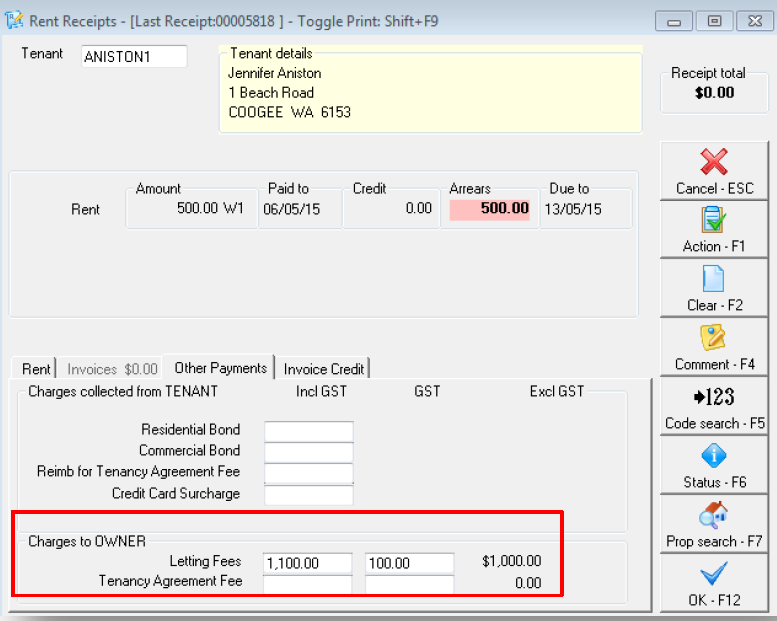

- Go to Transactions > Rent Receipts and enter the rent amount

- Select Other Payments tab, in the Charges to Owner, click into the Letting Fee field.

- Click on + symbol on your keyboard. Rest will default the amount from the property card

- If the amount of 0.00 is displayed, this has not been set up on your Property Details. You can manually enter the amount of the Letting Fee including GST if this doesn’t default.

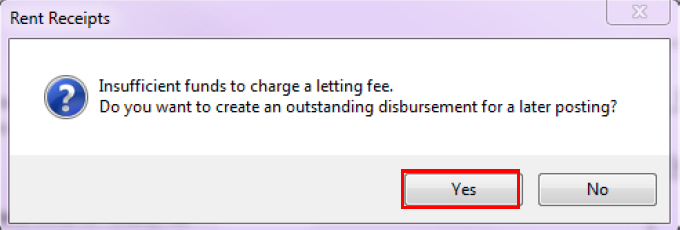

NOTE: If there are insufficient funds for this owner, a warning message will appear asking if you would like to create an outstanding disbursement for a later posting. Click yes. This will create this fee as an outstanding disbursement.

How to Charge Letting Fee via Journal

You can manually charge a letting fee in the event that the fee was not charged at the time of the original receipting, or at any time.

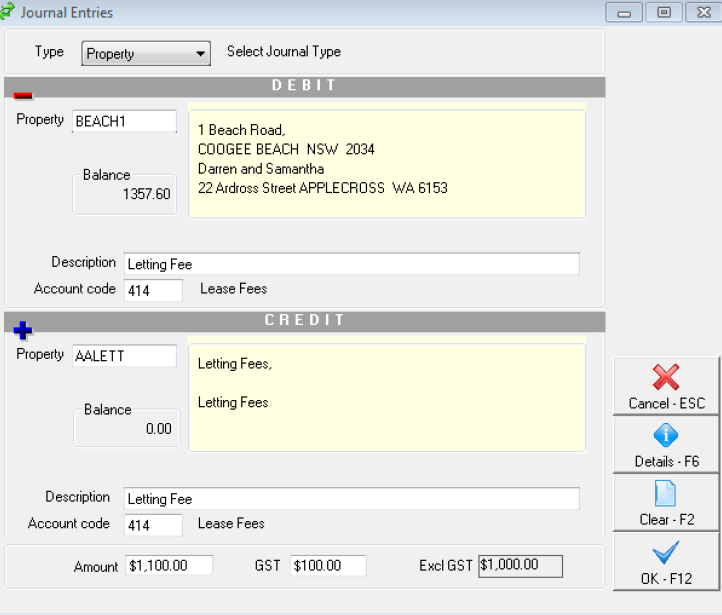

- Go to Transactions > Journals

- Type – select Property

- In the DEBIT section, enter the alpha index for the Property and press ENTER

- Enter a description such as ‘Letting Fee: The property address’

- Enter Account Code 414

- In the CREDIT section enter the alpha index AALETT and press ENTER. NOTE: The description & account code will automatically populate in this section

- Enter the amount including GST; REST will automatically populate the GST amount

- Click OK-F12

NOTE: If the owner has insufficient funds in their account, you will get a warning message asking if you would like to create an outstanding disbursement for a later posting. Click yes. This will create this fee as an outstanding disbursement.

You can check the outstanding disbursement against the owner by going to Files > Owner > O/S Disb tab. Once funds become available in the owners account, you can process the outstanding disbursements in Rest or this will happening automatically during end of month process.

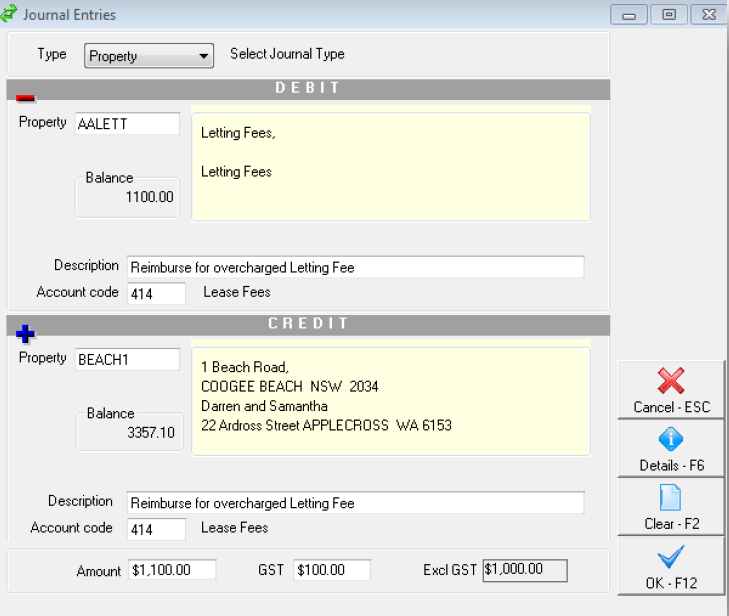

How to Refund an Incorrectly Charged Letting Fee

Should you accidentally charge an owner, or charge an owner twice for the letting fee, a journal can be done to reimburse the owner for the letting fee.

- Go to Transactions > Journals

- Type - Leave as Property

- In the Debit section, enter AALETT and press ENTER

- Enter a description, i.e. Reimburse for Overcharged Letting Fee

- Enter account code 414

- In the Credit section, enter the property alpha index of the property you wish to reimburse and press ENTER. NOTE: The description & account code will automatically populate in this section

- Enter the amount including GST; REST will automatically populate the GST amount

- Click OK-F12