Interest on Arrears for Advanced Commercial

What is Interest on Arrears

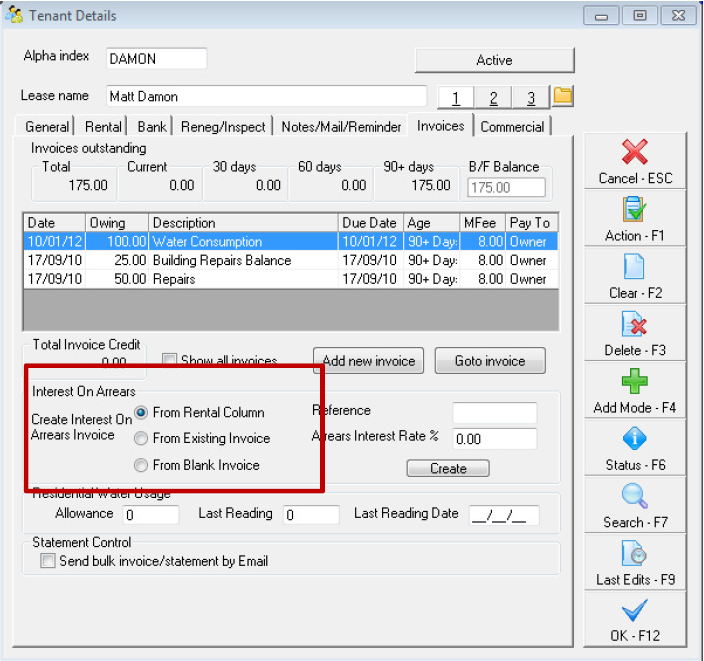

The Advanced Commercial Module is required to activate this feature. REST helps calculate the interest owed on overdue rents and invoices for commercial clients and creates a tenant invoice for the calculated amount.

What REST will Calculate Interest on

- The rental amount (on the rental tab of tenant details)

- On budgeted outgoings (on the rental tab of tenant details – 2nd column)

- An existing invoice

- You can create a blank invoice and enter your own information

How to Calculate Interest on Arrears

Select the rent or invoice on which the interest is to be charged

From Rental Column

Select this option to charge interest on the rent or outgoings in any of the tenant rental columns. When you click on CREATE, you will be able to choose the column (see next column up top right of screen which will allow you to choose the 2nd column or the outgoings column)

From Existing Invoice

Choose this option to charge interest on an outstanding invoice. When you click on CREATE, you will be asked to choose the invoice from a list.

From Blank Invoice

When you click on CREATE, you will be asked to enter paid from and to dates and a description.

Reference

Enter a reference such as INTEREST

Arrears Interest Rate%

Enter the interest rate to use for this calculation

Create

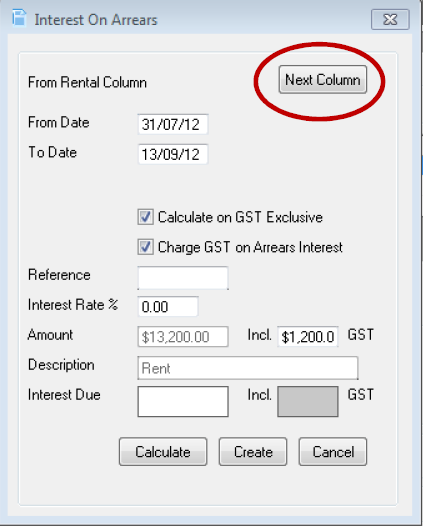

Click on Create to load the interest rate screen (as per the below screen shot)

From Date

Depending on whether you are calculating interest on rent, outgoings or an invoice, the paid from date is taken from the paid to date of the rent or outgoings or the due date of the tenant invoice. You may change this is you wish to calculate the interest for a different period.

To Date

This is defaults to today’s date and may be changed if required.

Calculate on GST Exclusive is ticked

- If you select this option, REST calculates the interest on the GST exclusive rent.

- If you don’t select his option, REST calculates the interest on the GST inclusive rent.

Charge GST on Arrears Interest

- If you select this option, REST charges GST on the calculated interest.

- If you do not select this option, REST does not charge GST on the calculated interest.

![]() The above two options to calculate on GST exclusive and charge GST on arrears interest defaults to being selected or deselected. This default can be found in your system options ie/ other > utilities > system options > miscellaneous tab (a response code from ROCKEND will be required to change this)

The above two options to calculate on GST exclusive and charge GST on arrears interest defaults to being selected or deselected. This default can be found in your system options ie/ other > utilities > system options > miscellaneous tab (a response code from ROCKEND will be required to change this)

Reference

This is taken from the value entered in the tenant details screen if this field default amount

Interest Rate

The Interest rate is taken from the tenant details screen if this field defaults amount otherwise this can be manually updated.

Calculate

Click on Calculate to calculate the interest.

Create

Click on Create to load the information into a tenant invoice. REST will display the tenant invoice screen and you may change any of the information. Click on OK to save and optionally print/email the invoice.

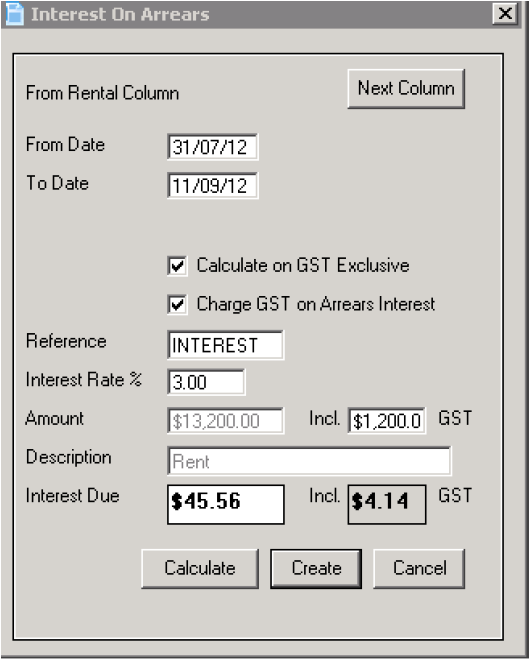

How REST calculates this amount

In the above example, the amount of rent is $6000.00 + GST = $6600.00

The tenant is in arrears 2 months.

Example

In this example, the the interest is being calculated on the base rent amount (GST excusive) ie/ $6000 x 2 months

The amount of arrears is then multiplied by the daily rate of 3% and then divided by 365 days to get a daily rate. I.e.

$12000 x 3% = 396 ÷ 365 (days in the year) = 0.9863013

0.9863013 x 42 days (arrears) = $41.42 + 10% GST = $45.56

![]() The amount in the Interest on Arrears shows as the GST inclusive amount, however if you have selected to calculate on the GST exclusive amount it will still calculate it on the base amount, even though the inclusive amount is shown on the screen.

The amount in the Interest on Arrears shows as the GST inclusive amount, however if you have selected to calculate on the GST exclusive amount it will still calculate it on the base amount, even though the inclusive amount is shown on the screen.